Now that the Fed has begun raising rates, there is much discussion regarding how these decisions might affect stock returns. The commonly held belief is that increasing rates hurt stocks. And there is a grain of truth behind this, since rates used for discounting future cashflows are also going up and, in turn, current stock values are going down based on this single variable view of stocks.

The Power Of Growth

What many do not appreciate is that the reason rates are increasing is a strengthening economy, which drives up the cost of money for everyone. But the silver lining of an accelerating economy is faster growth in corporate earnings and cashflows, a positive driver for stock values. So stock returns are the result of a tradeoff between the downside of higher rates and the upside of faster growth. It turns out that the impact of the difficult to envision higher future growth rates far outpaces the in-your-face rate rise.

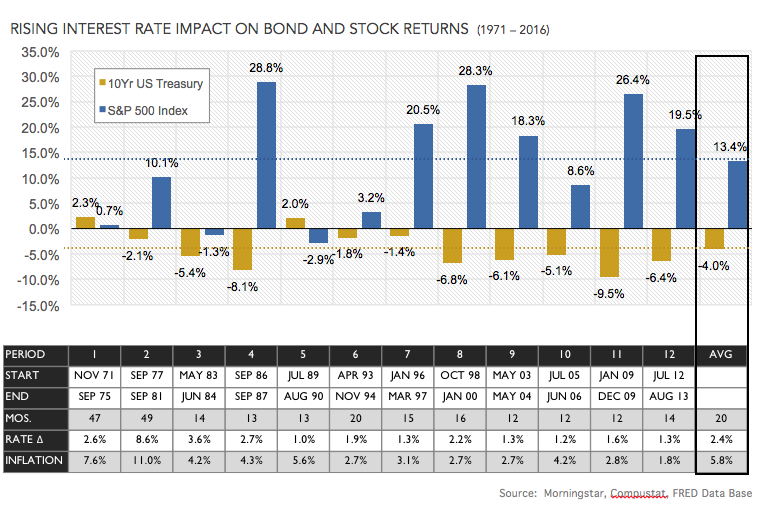

The chart below shows equity returns as represented by the S&P 500 for the dozen times during which the 10-year U.S. Treasury Bond rate increased by more than 1 percent over the last 45 years. The annual S&P 500 return averaged 13.4 percent over these 12 periods, higher than the long-term average of 10 percent, and was positive in nine of the 12 periods.

It makes sense that the 10-year U.S. Treasury Bond lost an average of 4.0 percent annualized as the 10-year rate increased due to the mathematical inverse relationship of bond prices to yield. On the contrary, stocks most often perform well during these periods, which is evidence that the growth positive far outweighs the rate negative. Strikingly, stocks outperform bonds by an average of 17.4 percent during these 12 rate increase periods. This means rising interest rates should be a cause of great excitement rather than foreboding among equity investors.

Since last November, the 10-year U.S. Treasury Bond rate has jumped by 0.60 percent (through March), the Aggregate Bond index lost 2.40 percent, while the S&P 500 raced ahead by 10.2 percent. The market’s increased growth expectations overwhelmed the negative impact of higher rates. This current return pattern mirrors that of the historical relationship among rates, bond returns and stock returns, providing further reassurance for equity investors in today’s market environment.

Hedging Inflation

One downside of a strengthening economy is rising inflation. So it is no surprise that keeping up with inflation becomes a hot discussion topic during such periods. But here the news is also good for equity investors. The bottom row in the table above reports the CPI inflation rate during each of the 12 rising interest rate periods. The stock market outpaced inflation in 75 percent of these periods (8 of 12) and on average bested inflation by an impressive 7.6 percent annually, well above the long-term average of 6.5 percent.

In contrast, bonds failed to outpace inflation in any of the 12 periods and, on average, underperformed inflation by a disastrous 9.8 percent. Ouch!

A Behavioral Point Of View

The evidence is compelling that rising rates are good for stocks and bad for bonds. So why is there a general sense of anxiety pervading discussions of recent Fed announcements and how stocks will perform as rates increase? As is so often the case, investor emotions and resulting cognitive errors underpin this misperception.

Here are a few cognitive errors contributing to this investor misunderstanding:

-

The Fed and what they will do with interest rates is an example of an availability cascade, when a topic is so prevalent in the media that it dominates our decision-making. The conventional wisdom, repeated over and over again, is that rising interest rates will hurt stock returns as the Fed “takes away the punch bowl”. However, the evidence provided shows just the opposite, because the improving economic environment is what triggers the rate increase in the first place. In other words, rising rates are the result and not the cause.

-

Another popular notion is that “all things being equal” rising rates make fixed income more attractive on a relative basis and therefore money should flow out of equity and into fixed income. This is an example of a heuristic where we over-simplify things, applying simple rules to complex problems. As such, all things are not equal with rates that are historically low and changes that are likely to be gradual.

-

Most fixed income assets are hurt by rising interest rates and so it is not surprising that some people may think stocks will be hurt as well. This is a representativeness bias, based on the incorrect assumption that interest rate changes are the main drivers of stock returns as they are for bond returns.

A Reason To Be Cheerful Not Gloomy

The equity investor cheer: Hip, hip, hooray, rates are rising!

Now you may not get quite this excited about the forthcoming higher rates, but the evidence reveals that such a reaction is closer to how you should feel rather than being anxious in the face of a strengthening economy. Higher rates, the residual of stronger growth, create an environment in which selling bonds and buying stocks makes eminent sense. These moves upgrade your future portfolio return along with providing greater protection against rising inflation.

Equity investors have every reason to be cheerful not gloomy as the Fed raises rates in 2017 and beyond.

So, sit back and enjoy the ride!

C. Thomas Howard, Ph.D. is the chief investment officer for AthenaInvest Inc.