In the face of a continued stream of positive economic data, resilient equity markets, massive Treasury bond auctions, and the passage of $1 trillion health-care reform legislation, bond yields have been pressured higher in recent weeks, setting off alarm bells among the investing public. After all, interest rates are at 50-year lows, so it seems inevitable that the only direction yields can go is up, and thus the only direction bond prices can go is down.

With Morgan Stanley calling for a 5.50% 10-year Treasury bond yield at year's end, and Bill Gross saying bonds have seen their best days, there is an understandable impulse to push the sell button on your clients' bond holdings.

Resist that urge, and consider for a moment just some of the reasons why rising rates do not necessarily spell doom for bond portfolios.

Rising Rates, Increasing Income

For one thing, when interest rates rise, income increases.

Income represents 70% of a bond portfolio's total return over the course of its lifetime, and income generation is perhaps the biggest advantage bonds have over other asset classes. When interest rates rise, the income increases as long as the portfolio is actively managed to maintain its duration (or interest-rate sensitivity measure) over time. An active manager can bring higher-interest-paying bonds into the portfolio, and thus take more income.

The caveat is that very long-term bonds will see the smallest income benefit from rising rates, since they will fall so much that fewer new income-producing bonds can be bought to replace older ones. Thus, to prepare for the rising rate environment, it may be wise to ensure that the average maturity and duration of your client's bond portfolio has a short or intermediate term-say, less than five years. Otherwise, principal losses will curb your ability to increase income and the total return.

No Straight Line

Another reason not to panic is that interest rates do not move in a straight line and do not go up indefinitely.

Like the economy, interest rates move in cycles. They rise for a few years, stabilize for a certain time and then fall at some point when the economic cycle matures. For this reason, an investor who liquidates his bond portfolio in a rising rate environment can miss a recovery, and that means selling in a panic may be a poor idea.

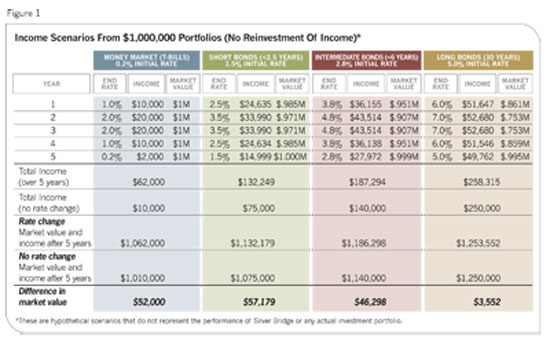

Consider the example in the first chart-four bond portfolios of varying maturity structures in which the manager does nothing more than maintain the portfolio duration over the course of an interest rate cycle. In each case, interest rates rise by 1% for two years, stabilize for one year, and then fall by 1% for two years, essentially round-tripping back to the original portfolio yield. As these hypothetical scenarios illustrate, regardless of the maturity structure of the bond portfolio, the total return (the combination of principal and income return) is higher for a portfolio held over the course of an interest rate cycle than it would be if there were no change in interest rates, even if you don't take into account the benefit of compounding reinvested income.

These are hypothetical scenarios that do not represent the performance of Silver Bridge or any actual investment portfolio.

Furthermore, an examination of just the ending market values at year five demonstrates that the short and intermediate bond portfolios are almost fully restored to their initial level after an interest rate cycle, and even the long bond portfolio comes back (save for $5,000). Considering how difficult it is to perfectly predict interest rate cycles, the best strategy would seem to be one in which an investor holds bonds in appropriate allocations permanently, but with tweaks at the margins to position the portfolio for downside protection or upside momentum as his or her judgment warrants.

On the subject of those tweaks, it is important to remember that the term structure of interest rates does not move up and down in perfect parallel shifts, and all bonds are not correlated one-to-one with Treasurys. The shape of the yield curve is dynamic, and can invert, steepen, flatten or shift by varying amounts depending on the economic environment, the interest rate policy and inflation expectations.

An active bond manager attempts to anticipate these movements of the yield curve and position portfolio maturities accordingly to protect against or limit negative price movements. Furthermore, Treasury bonds, as the rawest expression of interest rate risk, can be minimized as a holding in rising interest rate environments in favor of spread sector securities such as corporate bonds, whose incremental income advantage helps diminish losses, particularly if spread compression opportunities exist.

Also, bonds nowadays come in many different varieties, with fixed, floating or step-up coupon rate structures; with one-time or multiple call and put features; or with inflation protection, if that is a concern. These options allow professional bond managers to soften the pain of interest rate risk, and help bonds deliver long-term value within an investor's asset scheme.

Less Volatile

Bonds still have the lowest historical volatility of any asset class other than cash-the historical volatility of fixed income is 3.5% or less, which cannot be said of domestic equities, international equities (or bonds), commodities, real estate or even hedge funds. Despite the rising popularity of absolute return hedge fund strategies touted for their combination of equity-like returns and bond-like stability, there was never a better demonstration than the one in 2008 that bonds are sleep-at-night money.

Furthermore, bonds are the go-to investment when investors flee to quality. They were an excellent investment from 2000 to 2002 when the equity markets fell both before and after the September 11 attacks, and again more recently at the height of the credit crisis. For most clients, bonds play an important role stabilizing their portfolio structures, and clients appreciate them for their low volatility, their liquidity and the better income advantage they have over other asset classes.

Interim Price Less Concerning

Bonds held to maturity are unaffected by interim price swings.

If appropriate diversification can be achieved, clients may want to consider using a portfolio of individual bonds for their fixed-income allocation, given the advantage they have over bond mutual funds in a rising-rate environment. While there are many excellent fund offerings run by dynamic and skillful investment managers in the fixed-income space, the fact remains that bond mutual funds do not have a specified maturity date with a guaranteed return of principal. They trade at net asset value, and are subject to the whims of their shareholders-and unfortunately, these investors have shown in the past they are willing to head for the door when rates start rising, forcing even the most skillful manager to sell holdings and lock in losses at the most inopportune times.

Meanwhile, 60% to 80% of the holdings in an individual bond portfolio are likely to be held to maturity, which means an investor recovers principal in full (assuming there are no defaults). No matter what kind of roller-coaster ride interest rates take during the life of a bond, its value will always be par when it is redeemed.

Harvesting Loss

Finally, bond losses can spell tax savings. In rising interest rate environments, investors seeking tax efficiencies may book a capital loss to offset capital gains in other parts of their portfolios by selling their bonds. The investors may then reinvest those proceeds into bonds with higher yields, creating a win-win tax and investment situation. Consider the hypothetical scenario in the second chart, which demonstrates a tax-loss swap strategy that ultimately yields a net benefit of $1,071.44 to an investor with $100,000 in municipal bonds.

This is a hypothetical scenario. It does not represent the performance of Silver Bridge or any actual investment portfolio.

Ultimately, it is best to take a long-term view when you consider fixed income, just as you do with equity or alternative investments, and maintain your commitment to the asset class at appropriate levels, even when interest rates are rising.

Michelle Knight is the director of fixed income at Silver Bridge (www.silverbridgeadvisors.com), an independent wealth management boutique. All investment advisory services are provided by Silver Bridge Capital Management LLC, a registered investment advisor affiliated with Silver Bridge Advisors LLC. None of the information contained in this piece is intended as investment advice or securities recommendations to any person.