In the July 2012 Regulatory Notice 12-25, Finra provides additional guidance on the issue of “suitability.” Specifically, Finra states “a broker must have a reasonable basis to believe that a . . . investment strategy . . . is suitable for the particular customer based on the customer’s investment profile.” They go on to specify “The new rule broadens the explicit list of customer-specific factors that firms . . . must attempt to obtain and analyze when making recommendations to customers. The new rule adds a customer’s . . . risk tolerance to the explicit list of customer-specific factors . . .”

In response to this rule and its predecessors, the investment industry developed the so-called “risk tolerance questionnaire” -- a short set of multiple-choice questions that the retail investor is required to answer. The results are then numerically scored and generally summarized as a single number, which the advisor or financial planner uses as the client’s specific risk tolerance. For example, you have a risk tolerance of “2” therefore you are conservative, while I have a risk tolerance of “8,” therefore I am aggressive. Advisors who rely on such an approach then select the portfolio lying on the efficient frontier that corresponds to their risk tolerance number. Simple, straightforward, and fully documented. Unfortunately, there are a few problems with this approach.

Failings Of Risk Tolerance Questionnaires

Academic economists have a long history of building abstract, simplified models of consumer and investment markets and their associated behaviors. In such theoretical models, academics assume that consumers (investors) base their individual decisions on simple utility functions (these are short algebraic equations that are then maximized in order to determine what specific decision a consumer will make with respect to each choice). Utility functions have a single variable sometimes referred to as the function’s risk tolerance. Such simple academic models are extremely powerful when applied in university research settings designed to grow our theoretical understandings. Unfortunately, when applied incorrectly to the wrong situations, i.e., when applied to complex real world settings, they frequently misguide and deliver poor solutions. FINRA’s mandate to identify a client’s risk tolerance is effectively based upon this academic, over-simplification of the real world. Several significant problems exist.

Today, it is widely appreciated that risk tolerance is not a clean, crisp economic factor, unique to each rational economic-person. Instead, it is understood to be a fundamental psychological trait as observed by Dr. Geoff Davey in the October 2012 Investments & Wealth Monitor. As a psychological trait, it is inconstant, nondurable, and ever-changing. Worse yet, it has proven to be highly path-dependent. In other words, how one scores on a risk tolerance questionnaire will depend heavily on the recent investment market returns and volatility experienced by the investor. In essence, risk tolerance questionnaires are heavily emotion-driven. As one set of academic researchers (Drs. Lucarelli, Brighetti, and Uberti) observed “Emotions are confirmed to drive the financial risk-taking process, enhancing the accuracy of the individual risk tolerance forecasting activity.”

Worse yet, research by the London office of Barclays Wealth Management on decision-making processes used by consumers and investors recognizes that risk is not a one-dimensional attribute (as assumed by risk tolerance questionnaires), but instead entails a complex and unstable multi-dimensional array of factors. This multi-dimensional attribute all but dooms risk tolerance questionnaires to the irrelevant (at best) or the misleading (at worst).

Consider for a moment one of the most carefully developed tests of the last century. The Scholastic Aptitude Test (SAT) has been given to high school students since its first introduction in 1926. Over the last 87 years its veracity has improved significantly. Each year, refinements have been made to the test. Major advances in psychometric test construction and test scoring and the results of many tens of millions of test taker results have been used to refine the SAT exam. Nevertheless, despite its extensive four-hour length and its near-century of refinement, it remains a terrible predictor of college success. SAT scores and college grades correlate at around 0.4 -- a terrible outcome, observed Dr. Geoff Davey. Consider then, what chance a simple risk tolerance questionnaire, to be completed within three or four minutes, has in identifying a fundamentally multi-dimensional psychological attribute that has been intentionally misspecified as one-dimensional. Risk tolerance questionnaires are a direct and immediate disservice to our very genuine need to best meet our client investor needs.

As one team of researchers (Drs. Lucarelli, Brighetti, and Uberti) examining risk tolerance questionnaires observed “Our findings show that misclassifications resulting from the questionnaire are massive: individuals asked to self-assess their risk tolerance reveal a high probability of failing their judgment, i.e., they behave as if they were risk takers, while defining themselves as risk-averse (and vice versa).” But the instability and over-simplification of risk tolerance questionnaires is only the tip of the iceberg. Worse yet, they serve little purpose other than meeting regulatory mandates. Consider three simple examples where reliance on risk tolerance questionnaires for the setting of asset mix results in failed financial journeys.

Failure no. 1. I have $1 million in savings, have just retired at age 65, expect to live for 25 more years, and require an annual income of $80,000 (adjusted for inflation with the passage of time). My risk tolerance questionnaire provides a score of “2” on a ten-point scale. Therefore I am placed in a conservative portfolio with an allocation of 10 percent stocks and 90 percent bonds. This portfolio is expected to provide a 1 percent real return over the next 25 years. Obviously, I will run out of money well before I pass away. Moreover, I could have prudently and safely taken on considerably more risk. If I had taken on more risk, my initial $1 million of savings should, with a very high probability of success, more than adequately meet my annual income requirements -- resulting in a far more satisfying financial journey during my retirement years. But reliance on risk tolerance prevented me.

Failure no. 2. I have $10 million in savings, have just retired at age 65, expect to live for 25 more years, require an annual income of $150,000 (adjusted for inflation with the passage of time), and strongly prefer no end-of-life legacy. My risk tolerance questionnaire provides a score of “7” on a ten-point scale. Therefore, I am placed in a moderately-aggressive portfolio with an allocation of 70 percent stocks and 30 percent bonds. This portfolio is expected to provide a 5 percent real return over the next 25 years. Clearly, I will end up with a huge, undesired surplus at the end of my life (recall that I had a strong preference to leave no legacy). I would have experienced a far more satisfying and rewarding financial journey if I had adopted a higher spending rate and/or a significantly more conservative portfolio (allowing for increased surety). Once again, reliance on the results of a risk tolerance questionnaire prevented me from following the more satisfying and rewarding path.

Failure no. 3. I have $5 million in savings, have just retired at age 65, expect to live for 25 more years, and require an annual income of $275,000 (adjusted for inflation with the passage of time). My risk tolerance questionnaire provides a score of “6” on a ten-point scale. Therefore I am placed in a moderate portfolio with an allocation of 55 percent stocks and 45 percent bonds. But now “life happens,” perhaps I experience a poor -30 percent return on my portfolio or a child of mine is diagnosed with cancer and I spend $1 million of my savings on his/her treatment and care. Nevertheless, when I retake my risk tolerance questionnaire, I again score a “6” and therefore maintain my prior 55/45 asset mix. Unfortunately, this results in me running out of money prior to passing away. Sadly, I could have made adjustments to my spending and/or portfolio mix and mitigated this problem, but instead I failed to take appropriate corrective action because I relied on a risk tolerance questionnaire that failed to take into account my more important life events because it focused narrowly and myopically on my psychological reaction to risk.

Why is the use of risk tolerance questionnaires resulting in failure? The answer should be immediately obvious. Risk tolerance questionnaires fail to address any of my specific needs or circumstances. They ignore goals. The ignore objectives. They fail to adjust to an adequate degree and in a timely fashion as “life happens.” So what’s to do?

Moving Beyond One-Dimensional Risk Tolerance Questionnaires

Finra Rule 2111 requires “customer-specific suitability.” In other words, that the investment solution provided by the advisor fit well with the relevant attributes that define the retail client’s needs, objectives, and circumstances. This is a worthy goal and raises the question as to “What attributes define the criteria that are to be used for the selection of an investment solution?” There are three key attributes:

- Relevance: The criteria are relevant to both the client and to the investment solution under consideration,

- Understanding: The criteria are adequately understood by the client,

- Control: The client is actually in control and is in a position to decide something material about the criteria.

By applying these three attributes, we are able to identify six factors that define a retail client’s financial journey. Obverse how they are both well-understood and fully within the control of the client:

- Spending: How much is needed for consumption (what is the client’s lifestyle and spending level),

- Savings: How much to set aside for investment (how much to save),

- Timing: When does the client want savings and spending to occur,

- Risk: How risky or volatile an investment portfolio does the client want to maintain (where does the client want to be positioned on the efficient frontier),

- Legacy: What assets does the client want to transfer to heirs (or charities),

- Surety: Because future investment returns are uncertain, the sixth factor becomes the question of “certainty.” In other words, how certain does the client want to be that the choices made with respect to the prior five competing factors add up or work together?

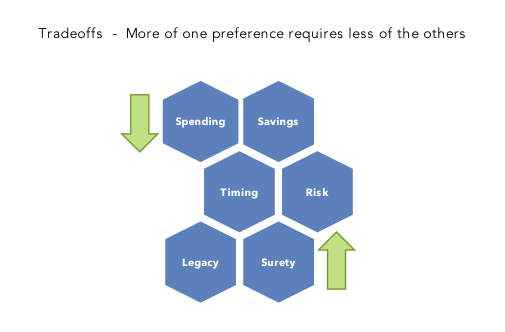

It is important to observe that these six factors are at odds or in conflict. Generally speaking, more of one requires less of another. Thus the client must make decisions about the tradeoffs between these six competing factors. For example, if the client accepts a lower level of spending, then their surety will increase (holding the other four factors constant), i.e., the probability that their plan will be successful increases.

By using software tools such as eMoneyAdvisor, MoneyGuidePro, or Financeware, the advisor is able to interactively and collaboratively engage the client in a robust discussion of these six factors and to explore the tradeoffs that the client seeks to make, e.g., increased spending in exchange for increased savings or reduced spending in exchange for a more conservative portfolio. The result of such an exercise is a robust understanding on the part of the client as to his/her own personal objectives, the potentially harsh realities that exist, and the tradeoffs that must be made. The discussion and collaborative exchange produces two follow-on outputs:

- The Normal Policy Asset Allocation (the efficient frontier portfolio in a Modern Portfolio Theory world) and

- A set of follow-on issues for regular, periodic examination by the client and advisor.

Observe that nowhere in this process was the client ever asked to score or rank their risk tolerance through some sort of questionnaire process. In full compliance with FINRA Rule 2111, both the client and advisor are developing a deep understanding of the client’s perspective on risk and comfort with it. This understanding results from the interactive process of exploring the tradeoffs between the six competing factors identified above -- more of one means less of another, e.g., if the client desires greater surety, then they must accept lower spending. This approach avoids the artificial, unstable, path-dependent, one-dimensional nature of risk tolerance questionnaires. But its real benefits are significantly greater.

The Need For A Dynamic Process

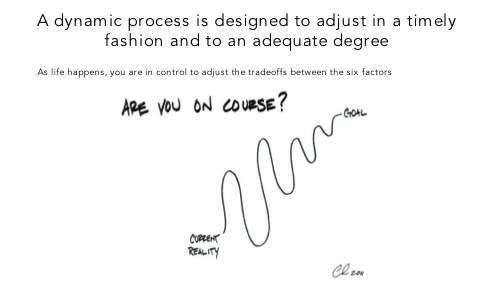

The process outlined above, focusing on the six factors that are understandable, controllable, and relevant to the client’s financial journey, provides a dynamic framework for dealing with life’s ever-changing nature - unlike the risk tolerance questionnaire. Let’s be honest, the world changes over time and therefore the nature of the six factors under the client’s control must also change at an equal pace. The world surprises, so no matter how solid a client’s financial plan, no matter how competent its initial implementation, the instant that it has been inked or implemented, it has also become stale and outdated. A “Financial Plan” is the ultimate in irrelevance. Life happens, so what is needed is a dynamic process that provides a “Continuous Planning Process.”

Such a process allows the client to reset the tradeoffs previously made between the six competing factors -- and at a pace and to a degree that matches life’s surprises. Now we can more confidently manage the unexpected and unplanned arrival of tomorrow’s new and different reality. Under such a framework, returns are not the objective. Outperformance is not the objective, and the scoring on a risk tolerance questionnaire is not the objective. The first two may contribute to a best-possible journey, but they are never the objective -- and in fact seriously distract from what is important, i.e., obtaining a best possible decision with respect to the six factors.

Through the use of software tools such as eMoneyAdviso or MoneyGuidePro, the advisor and client can reengage on a regular periodic basis (or whenever life happens) to ask the questions “How am I doing?” and “How is my funded status? (i.e., Surety level)” Competing decisions between the six factors can be reevaluated and incremental adjustments made. For example, perhaps returns were higher than projected. This would allow for a larger legacy, greater spending, lower savings, or higher surety. But now the client is in control and must make a decision between these opposing preferences. It is important to observe how changes in this simple example result from an externally imposed surprise (higher returns than had been projected) and as a result of a tradeoff decision made by the client -- and not as a result of some new score drawn from a foundationless and unstable risk tolerance questionnaire.

Finally, such an approach, focused on the six factors that actually matter, provides a significant opportunity for the advisor to build a more substantive, value-added, and ongoing relationship with his client. This benefit moves the relationship away from all too common return-chasing, questionnaire-based, one-time financial plans.

Rob Brown, PhD, CFA, is chief investment strategist and senior vice president of United Capital Financial Advisers LLC.