Failure no. 3. I have $5 million in savings, have just retired at age 65, expect to live for 25 more years, and require an annual income of $275,000 (adjusted for inflation with the passage of time). My risk tolerance questionnaire provides a score of “6” on a ten-point scale. Therefore I am placed in a moderate portfolio with an allocation of 55 percent stocks and 45 percent bonds. But now “life happens,” perhaps I experience a poor -30 percent return on my portfolio or a child of mine is diagnosed with cancer and I spend $1 million of my savings on his/her treatment and care. Nevertheless, when I retake my risk tolerance questionnaire, I again score a “6” and therefore maintain my prior 55/45 asset mix. Unfortunately, this results in me running out of money prior to passing away. Sadly, I could have made adjustments to my spending and/or portfolio mix and mitigated this problem, but instead I failed to take appropriate corrective action because I relied on a risk tolerance questionnaire that failed to take into account my more important life events because it focused narrowly and myopically on my psychological reaction to risk.

Why is the use of risk tolerance questionnaires resulting in failure? The answer should be immediately obvious. Risk tolerance questionnaires fail to address any of my specific needs or circumstances. They ignore goals. The ignore objectives. They fail to adjust to an adequate degree and in a timely fashion as “life happens.” So what’s to do?

Moving Beyond One-Dimensional Risk Tolerance Questionnaires

Finra Rule 2111 requires “customer-specific suitability.” In other words, that the investment solution provided by the advisor fit well with the relevant attributes that define the retail client’s needs, objectives, and circumstances. This is a worthy goal and raises the question as to “What attributes define the criteria that are to be used for the selection of an investment solution?” There are three key attributes:

- Relevance: The criteria are relevant to both the client and to the investment solution under consideration,

- Understanding: The criteria are adequately understood by the client,

- Control: The client is actually in control and is in a position to decide something material about the criteria.

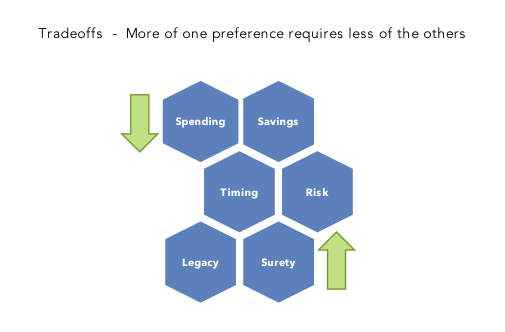

By applying these three attributes, we are able to identify six factors that define a retail client’s financial journey. Obverse how they are both well-understood and fully within the control of the client:

- Spending: How much is needed for consumption (what is the client’s lifestyle and spending level),

- Savings: How much to set aside for investment (how much to save),

- Timing: When does the client want savings and spending to occur,

- Risk: How risky or volatile an investment portfolio does the client want to maintain (where does the client want to be positioned on the efficient frontier),

- Legacy: What assets does the client want to transfer to heirs (or charities),

- Surety: Because future investment returns are uncertain, the sixth factor becomes the question of “certainty.” In other words, how certain does the client want to be that the choices made with respect to the prior five competing factors add up or work together?

It is important to observe that these six factors are at odds or in conflict. Generally speaking, more of one requires less of another. Thus the client must make decisions about the tradeoffs between these six competing factors. For example, if the client accepts a lower level of spending, then their surety will increase (holding the other four factors constant), i.e., the probability that their plan will be successful increases.

By using software tools such as eMoneyAdvisor, MoneyGuidePro, or Financeware, the advisor is able to interactively and collaboratively engage the client in a robust discussion of these six factors and to explore the tradeoffs that the client seeks to make, e.g., increased spending in exchange for increased savings or reduced spending in exchange for a more conservative portfolio. The result of such an exercise is a robust understanding on the part of the client as to his/her own personal objectives, the potentially harsh realities that exist, and the tradeoffs that must be made. The discussion and collaborative exchange produces two follow-on outputs:

- The Normal Policy Asset Allocation (the efficient frontier portfolio in a Modern Portfolio Theory world) and

- A set of follow-on issues for regular, periodic examination by the client and advisor.

Observe that nowhere in this process was the client ever asked to score or rank their risk tolerance through some sort of questionnaire process. In full compliance with FINRA Rule 2111, both the client and advisor are developing a deep understanding of the client’s perspective on risk and comfort with it. This understanding results from the interactive process of exploring the tradeoffs between the six competing factors identified above -- more of one means less of another, e.g., if the client desires greater surety, then they must accept lower spending. This approach avoids the artificial, unstable, path-dependent, one-dimensional nature of risk tolerance questionnaires. But its real benefits are significantly greater.