Room For Improvement - By Hannah Shaw Grove , Russ Alan Prince - 12/1/2007

This is the final article in a four-part series based on proprietary research conducted by Prince & Associates Inc.

Our research has clearly demonstrated that wealthy individuals turn to the professionals with whom they have established relationships, such as accountants or small business bankers, for referrals to other professionals that provide other products and services they need, such as financial advisors or insurance agents. In a study with 164 individuals with more than $20 million in net worth, 54% turned to a financial professional and 16% turned to a non-financial intermediary to find their current advisor. Perhaps most important, these types of referrals almost always are followed, which means another professional can be the key to a growing and profitable advisory business.

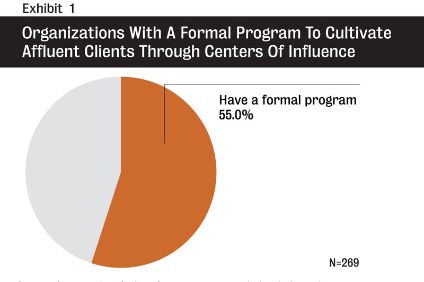

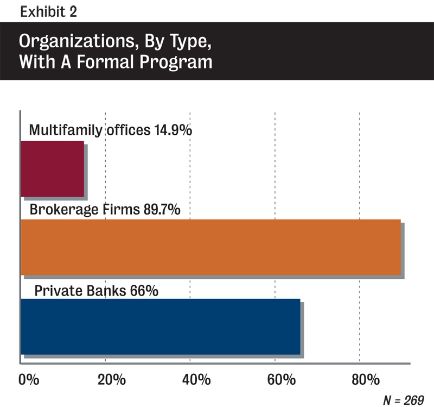

Most of the brokerage firms, or 90%, had such a program in place, as did two-thirds of the private banks. Multifamily offices were least likely to have done so, with only 15% indicating the presence of a client acquisition program in their organization (Exhibit 2).

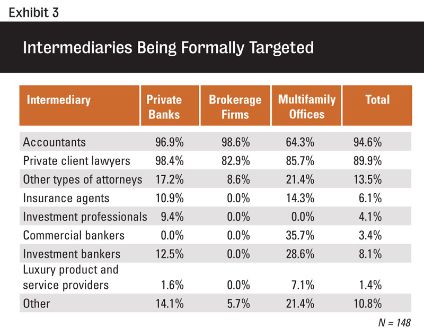

A wide variety of professionals and intermediaries could be excellent sources of new affluent clients, so we wanted to understand where private wealth providers were targeting their efforts and how effective the efforts were. Far and away, accountants were the number one focus for 95% of the firms surveyed (Exhibit 3). Private client lawyers, those attorneys that specialize in the issues of wealthy individuals and families, also received their fair share of attention as indicated by 90% of firms. Other attorneys, such as trusts and estates or family law practitioners, insurance agents, bankers and lifestyle providers were cited but to a lesser degree. Interestingly, multifamily offices were more inclined to spread their efforts across a range of professionals than either private banks or brokerages. For instance, 29% of multifamily offices formally target investment bankers as a source of new business, while just 13% of private bankers and none of the brokerages are doing so. In fact, brokerages have concentrated all their client acquisition efforts on accountants and attorneys, overlooking other potentially fruitful partnerships.

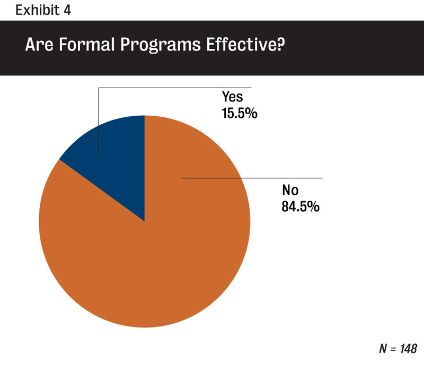

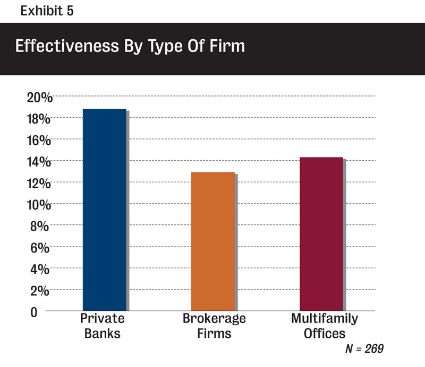

Despite the array of efforts underway, very few seem to have delivered the desired results, as just 16% of firms felt their programs were effective (Exhibit 4). Moreover, when segmented by firm, there is very little difference in the degree of perceived effectiveness (Exhibit 5). These responses indicate ample room for improvement in the client acquisition training programs at today's leading private wealth firms.

In our experience, not enough advisors and advisory firms consider their referral sources important enough to cultivate in much the same way they cultivate wealthy clients. Any professional with private wealth experience knows that it takes upstanding character, strong personal chemistry, a degree of caring and empathy, the technical skills and competencies, and a consultative nature to work effectively with high-net-worth clients. Such a professional will use preliminary interactions with potential partners to evaluate their ability to operate at the high-touch level required by her best clients. If you don't exhibit these qualities in your meetings, it is unlikely you will receive a referral from any professional that has the type of clientele you want.

In short, client acquisition programs must be retooled to incorporate interpersonal and relationship development skills so that they will yield productive and profitable partnerships between financial professionals that meet their wealthy clients' comprehensive needs.