In this methodology, an index member will receive a weight in the index based upon the current market value of its common stock as a percentage of the combined market value of all index members. However, a major problem with this market-cap weighting methodology is that it concentrates the risk and return of the index to the largest names in the index, diminishing any value to be added by the smallest index members. The dependence on the performance of the largest names reveals the S&P 500 Index as an extremely unbalanced index.

For example, according to Lipper, Apple makes up 10 percent or more of assets in 117 out of the 1,119 funds that own its shares. As you well know, Apple stock has dropped more than 37 percent since its high in September 2012 (as of March 31, 2013). That weighting has hurt the S&P 500 and many funds as Apple was one of the largest holdings.

In addition, the top 10 components in the SPDR, the largest ETF tracking the S&P 500 Index, comprise 18.92 percent of the portfolio versus CEMP US Large Cap 500 Volatility Weighted Index whose top 10 holdings are a mere 4.1 percent of the portfolio. The Compass EMP US 500 Volatility Weighted Fund tracks the performance of the CEMP US Large Cap 500 Volatility Weighted Index. Which do you think offers a more balanced representation of the broad market?

Returns

Stephen Hammers is a Managing Partner, Co-Founder and Chief Investment Officer of Compass Efficient Model Portfolios, LLC and the Compass EMP Funds. The Compass EMP Funds provides global multi-asset alternative portfolios with a focus on risk management. As Compass’ Chief Investment Officer, Mr. Hammers directs all of the Company’s investment activities, asset allocation and portfolio management. In addition, he oversees all internal strategies and research. Cap-Weighting Bias

Cap-Weighting Bias

The S&P 500 is one of the most widely-followed market indexes across the globe with over 1 trillion U.S. dollars in assets tracking its performance. Despite its widespread acceptance, it contains some inefficiencies. One of the chief inefficiencies, and the main focus of this commentary, is in how weights are assigned to members in the index as a market capitalization-weighted index.

The Volatility Weighted Solution

The CEMP indexing methodology emphasizes a target weighting of different securities or assets by their riskiness and not by their market cap or by their fundamentals. There are many different types of risks affecting all asset classes from stocks to commodities. These risks include economic risk, liquidity risk and interest rate risk to name a few. As these different risks fluctuate over time, it can be difficult to gauge what impact on performance they may have. However, price volatility is a clear and observable variable that tracks these risks in the aggregate. The core principal of CEMP Enhanced Indexing methodology is consistent earnings and each index member receives an equal weighting on the basis of volatility. The net result is an index that faces the same amount of future uncertainty as a traditional market cap-weighted index or even a fundamental weighted index, but controls and distributes that uncertainty equally across the entire index rather than concentrating it to a smaller subset of the index.

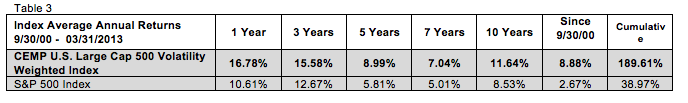

Analysis of the historical performance of the CEMP volatility weighted indexing methodology shows the strength of these indices relative to the most popular market indices and benchmarks used today. The average annual returns and cumulative returns have significantly outperformed traditional cap weighted indexes over the short-term as well as the long-term. It is important to note that Compass Efficient Model Portfolios, LLC has weighted securities and asset classes based on their volatility since June 2003. The Index performance represents the application of CEMP Index methodology dating back to the Index inception of June 30, 2003. Prior to June 30, 2003 the Index performance was calculated and back tested by Bloomberg analytics based on the criteria listed above. The CEMP Indexes are published by Dow Jones Indexes and are patent pending (Serial No. 61/645,370).

S&P 500 Index - Is It Really A Broad Market Index?

May 1, 2013

« Previous Article

| Next Article »

Login in order to post a comment