Key Points

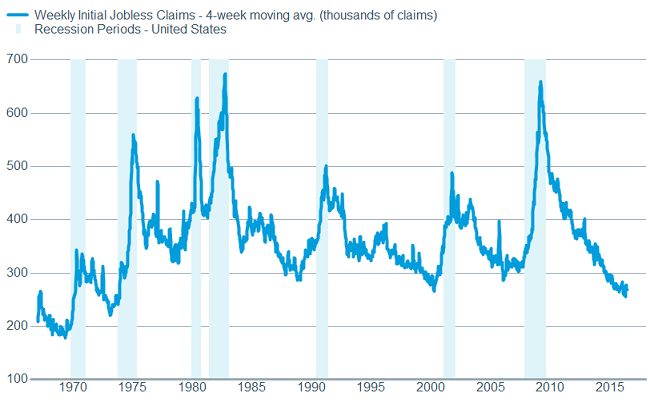

Source: FactSet, U.S. Dept. of Labor. As of June 22, 2016.

Helping to support retail sales

The corporate side of the U.S. private sector continues to struggle to gain momentum, and manufacturing continues to flirt with contraction. The uncertainty associated with Brexit has caused the U.S. dollar to surge again and could exacerbate the manufacturing sector’s problems at least in the short-term.

• Britain shocked the financial community by voting to leave the European Union (EU). Global equity markets plunged as traders searched for perceived safety in the midst of uncertainty. Short-term traders should be prepared for more downside, and the risk of a global recession has risen.

• The U.S. economy is fairly healthy and should manage to stay out of recession territory in the near term, although risks have risen. Long-term investors should stay patient and disciplined.

• The Federal Reserve seems highly unlikely to raise rates in foreseeable future and further economic stimulus cannot be ruled out. Across the pond, the Bank of England has made 250 billion pounds of liquidity available, with more action possible.

Brexit shock

Britain voted to leave the EU on June 23, referred to as “Brexit.” We would term this development a market and economic shock. International developed and emerging market (EM) stocks were up through yesterday in June, and over the 90 days leading up to the referendum, suggesting they were not pricing in a Brexit outcome. The initial shock of the unexpected outcome prompted a sharp decline in stock markets around the world and we believe it may take some time for the shock to fully work through the economic, financial, and political systems in the United Kingdom and Europe. With no visible catalyst to halt the slide, the decline in global stocks may continue, as the risk of a global recession increases.

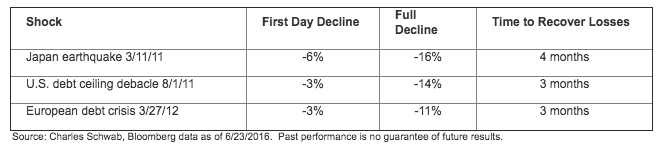

Since the end of the financial-crisis induced global recession in 2009, a series of shocks have helped to keep growth, inflation and stock market performance subdued. The shocks that have taken place in Japan, United States, and Europe may offer us some insight as to the potential duration of the market impact of Brexit.

After the shock of the devastating earthquake and related nuclear accident in Japan on March 11, 2011, the Nikkei fell 16% during the next two trading days, but fully recovered those losses by July 8—a period of four months. It is worth noting that the lingering recession caused this initial rebound to fade into two back-to-back double-digit declines and rebounds until stocks finally recovered their losses by the end of 2012.

After the congressional standoff over the U.S. debt ceiling saw the S&P 500 slide 3% on August 1, 2011, members of the House cut a deal to end it the following day, prompting U.S. stocks to have a one day rebound on August 3. But they fell another 12% over the next two months on fears of economic fallout, finally bottoming on October 3. The S&P 500 recouped these losses by the end of October, a period of three months.

The European debt crisis forced Spain to unveil an austere budget and prompted labor strikes in “too big to bail” Spain from March 27 to March 29, 2012, and effected a shock that drove the STOXX 600 down 3%. It fell another 10% from March 29 to June 4 as the Eurozone slid into a recession. By the end of July stocks had recovered their losses, a period of three months.

Although the Brexit is not a perfect parallel with any of the above shocks, the delayed recognition of widening impacts from shock events could prompt a further slide in the stock markets after the initial reaction, as we have seen in the past.

While past performance is no guarantee of future results, it is important for long-term investors to note that in each of these instances stocks rebounded to their pre-shock level in three-to-four months, even when a recession took place.

The widening impacts of Brexit may include:

• Other countries calling for their own referendums on EU membership. This could put the European Central Bank (ECB) in a difficult position to continue its quantitative easing (QE) program of buying the bonds of countries that may chose to leave the Eurozone. It's not hard to see France’s Marine Le Pen taking the same path as Britain’s, should she win the election in less than a year from now. A “Frexit” could be even bigger than Brexit in its impact on markets with an ECB that may be unable to effectively intervene.

• With U.K. Prime Minister Cameron stepping down, a battle may begin among those who want to replace him, with each candidate arguing they will be most aggressive in negotiations with the EU. In response, EU leaders in Brussels will make it clear they intend to be tough on the U.K., to make them an example. As the rhetoric heats up, the markets may become increasingly pessimistic regarding a trade deal that isn't mutually damaging. Negotiations could drag out for years.

• As investors seek safe havens, the rise in the U.S. dollar (if sustained) will likely contribute to declines in commodity prices. This may renew cuts to earnings estimates and prompt an eventual devaluation of the Chinese yuan versus the U.S. dollar. These factors, combined with slower export growth to Europe (China's biggest customer), may renew economic hard landing concerns for China. In addition, a rise in the dollar adds pressure on EM stocks due to concerns about dollar-denominated debts and tighter financial conditions.

• A return to recession in Europe as fears of a breakup begin to slowly impact capital investment, hiring, and consumption.

Signs to watch for that may indicate the impact of the Brexit shock:

1. Economic: If the Bank of England (BoE) and ECB stabilize financial conditions, and the U.K. and Eurozone economies capitalize on the weakness in their currencies to ease the slowdown/recession, the economic data may be near an inflection point.

2. Political: When the surge in political upheaval in Europe catalyzed by Brexit settles down. Events to watch include referendum announcements in other countries and the results of the vote on a new government in Spain over the weekend, along with an Italian constitutional reform referendum in October, and the polling on the upcoming 2017 French and German elections.

3. Currency: When we see an end to the flight-to-quality in the U.S. dollar and yen. The yen has been the best-performing currency recently during periods of heightened uncertainty. The lack of action from the Bank of Japan (BoJ) at the June policy meeting is allowing yen appreciation pressure to continue to build. While the yen’s move higher is negative for Japanese stocks—which have been in inverse lock step with the yen for five years now—an end to the rise in the yen may signal the worst is over.

Short-term focused traders should be prepared for further stock market declines over the next three-to-six months, similar to past shocks. We continue to believe volatility will remain a major characteristic of markets in 2016. However, longer-term investors may want to maintain their diversified asset allocations intended to weather volatility on the way to longer-term goals.

Back in the United States

We remain neutral on U.S. equities and believe that the market will ultimately recover, but near-term uncertainty will likely contribute to more volatility and the possibility of additional sharp pullbacks. However, with recession odds still fairly low—although higher than they were a week ago—we still don’t envision a prolonged bear market.

The great unknown

Bumpy…but not bearish

The U.S. economy is hanging in there. However, should the impact from the British vote become harsher than currently expected, we may be forced to downgrade our longer-term view of both the U.S. economy and equities.

The weak May jobs report concerned investors (and the Fed), but other employment-related data released since then—like unemployment claims as seen below—support the idea that it may have been an outlier, not the beginning of a significant deterioration in job growth. We do believe that job growth is naturally slowing given the maturity of the economic expansion and the fact that there are fewer available and/or appropriately skilled workers.

Leading job indicator looks healthy

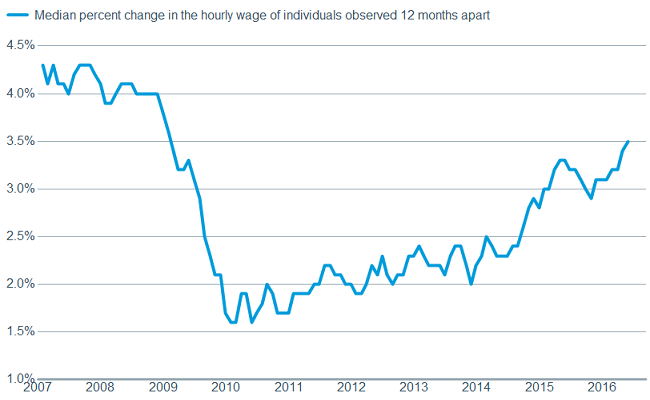

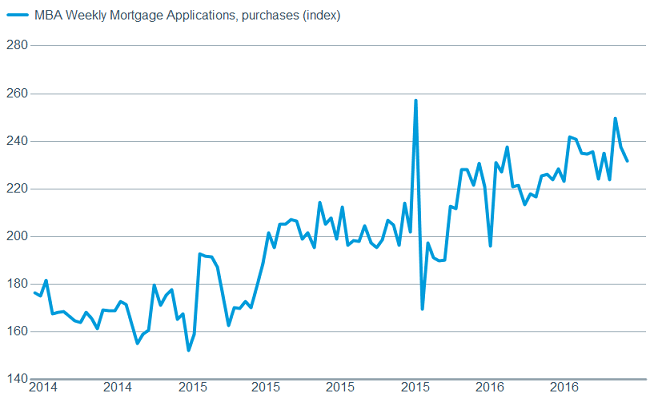

The apparent tightening of the labor market, with the standard measure of unemployment now at 4.7%, is helping to boost wages. This is bolstering the U.S. consumer as the strong April retail sales report was followed by another solid report for May. Additionally, the housing market appears to be strengthening as elevated rental costs, aging Millennials, improved consumer confidence, and exceptionally low mortgage rates move more folks into home purchases.

Wages appear to strengthening

Source: FactSet, Federal Reserve Bank of Atlanta. As of June 22, 2016.

Source: FactSet, US Census Bureau. As of June 22, 2016.

And housing purchases

Source: FactSet, Mortgage Bankers Association. As of June 22, 2016.

Although a couple of regional manufacturing surveys inched back into expansion territory, according to the Federal Reserve industrial production fell again in May by 0.4%, while capacity utilization moved lower to 74.9 from 75.4—more than five percentage points below its longer-term average. And the continued extreme interest rate environment seems to us to be influencing corporate decision making—although likely not in the way policy makers were hoping. Stock buybacks and increased dividend payments seems to be the choice of many companies, while they remain reluctant to invest substantially in equipment and material that has longer-term potential benefits.

Fed stands ready to help

The Fed is unlikely to raise rates in the foreseeable future, and could look to add some sort of support to the economy or financial institutions if needed. Global central bankers are meeting today in a previously-schedule meeting in Basel, Switzerland. They are likely to discuss, synchronize and possibly announce short-term actions to address global financial market stresses and we will keep investors informed.

So what?

The next several weeks could be a tumultuous time in global markets, and investors need to keep a longer-term view in mind. Global stock markets have tended to ultimately rebound from other sharp declines—often fairly quickly. It can be tough to get back on track once things reverse, so we recommend investors use volatility to tactically keep allocations in line with their long-term strategic targets.

Schwab Market Perspective: British Shock—What's Next

June 24, 2016

Liz Ann Sonders is senior vice president and chief investment strategist at Charles Schwab & Co.

Brad Sorensen is managing director of market and sector analysis at the Schwab Center for Financial Research.

Jeffrey Kleintop is senior vice president and chief global investment strategist at Charles Schwab & Co.

« Previous Article

| Next Article »

Login in order to post a comment