Investing Requires Resolve And Discipline

Stocks have taken a pounding and investor sentiment has cratered with uncertainty surrounding U.S. growth, global growth (especially in China), currencies, commodities, and Fed policy. There are many comparisons being made to the financial crisis which erupted in 2008, but we think there’s more different than similar. The financial system isn’t crumbling, and actually businesses are still relatively upbeat. Leverage in the financial system is a fraction of what it was in 2008; and while consumers—the major drivers of the U.S. economy—were heavily exposed to the financial crisis via housing; today they are on the “right side” of one of the causes of volatility by being oil consumers. Even if it gets worse from here before it gets better, remember that panic is not an investment strategy. It’s never fun to live through turbulent market times, but it can flush out some of the excesses in the market and set up the next move higher. As always, patience, diversification, discipline, and a long-term perspective are required.

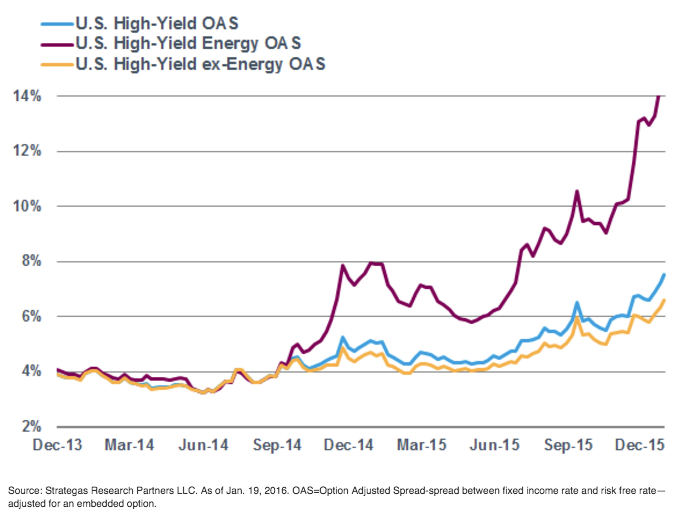

In that longer-term context, the recent move isn’t all that rare. According to FactSet, since 1928, on average a 10% correction has occurred every 1.58 years; while during this bull run that began in 2009, we have only experienced three. But what was the impetus behind the recent selling and is it foretelling something more ominous? Global growth worries, centered in China, seem to be part of the reason, expressed most readily by the continuing drop in a broad selection of commodity prices, with oil being at the top of radar screens. As the drop in oil has decimated the energy market, worries have escalated that the drop is foretelling a serious economic problem, while also raising the risks of a financial accident due to increasing defaults on energy company debt—illustrated by a spike in US high yield energy rates.

Perceived Energy Risks Have Risen

And there’s no doubt defaults will rise as revenues have cratered, but we point out again that the financial system is in much better shape than it was in 2008, with much larger capital cushions; while major bank exposure to energy companies appears at this point relatively limited. Some regional banks may feel some pain, but there doesn’t currently appear to be a large systemic problem in the cards.

Unquestionably, the speed at which the headwinds associated with plunging oil prices are blowing (i.e., the hit to the energy sector and earnings) is presently sharply faster than the speed at which the tailwinds are blowing (i.e., the benefit to the consumer and energy-consuming companies). So for now, the race is being won by the negative effect.

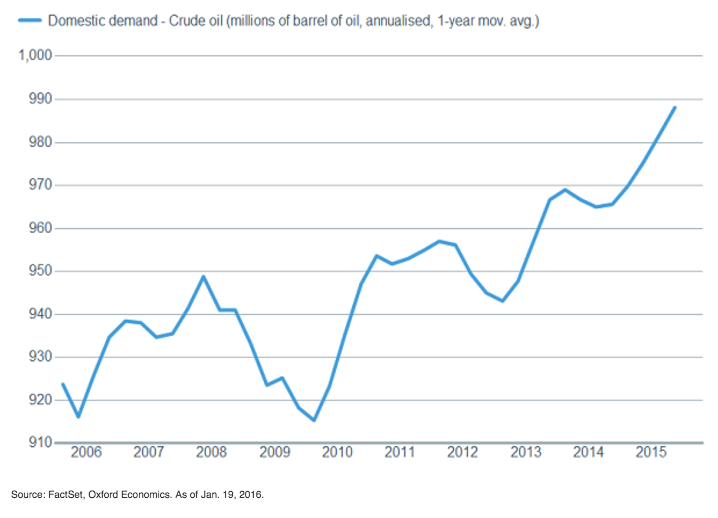

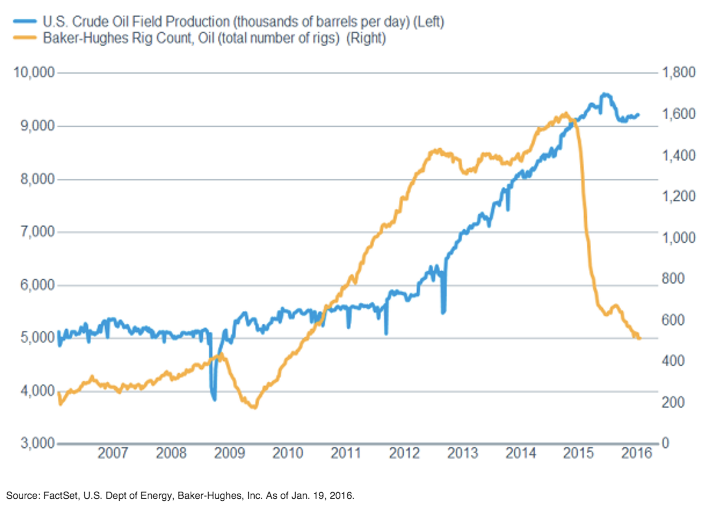

While we aren’t going to hazard a guess at where the bottom in oil may be, we do likely need to see some stabilization before market volatility can ease. This stabilization could be aided by a continued drop in the rig count, U.S. production growth decreasing, and global demand picking up. As is often said, the cure for low oil prices is low oil prices, as it typically stimulates higher demand and lower supply.

Rigs Have Fallen And Production Is Starting To Follow

While U.S. Demand For Oil Is Rising