Economy Not Falling Off A Cliff

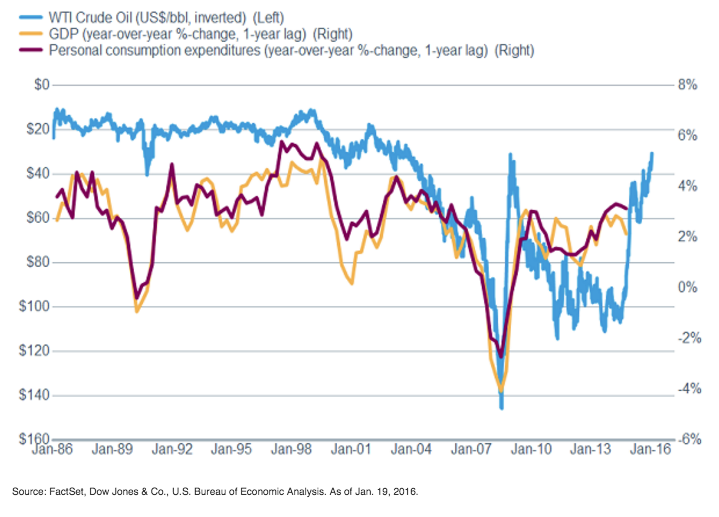

As noted, lower energy costs are ostensibly a boost to the consumption-oriented U.S. economy. To get an idea of the scale of the energy sector, Cornerstone Macro reports that in last year’s third quarter, oil and gas capital expenditures (capex) made up about 4% of total capex—not nothing, but relatively small as a share of the economy. And as the chart below shows, oil prices have led economic growth and personal consumption by about a year, with a negative correlation, meaning lower prices have led to higher growth a year later, something we could start to see this year.

Foretelling A Surge In Growth?

Company commentaries during reporting season have taken a back seat to macro concerns, but have contained little in the way of panic or dire predictions. There have been some business specific problems to be sure, but outside of the energy and materials groups, most companies have been noting fairly solid demand and are meeting or beating profit estimates. December 2015’s National Federation for Independent Business (NFIB) report showed that small business confidence rose slightly, as did hiring plans; while the plans to raise compensations stayed at a solid 20%. And the job market continues to be quite healthy, with unemployment remaining low at 5%, and forward-looking initial jobless claims continuing to be near historic lows.

Jobless Claims Not Flashing A Warning Sign

And a number not highly followed but mentioned as important by Fed Chair Yellen, the JOLTS (Job Openings and Labor Turnover Survey) “quit rate” rose to 2.83 million in November, the highest level since April 2008, indicating increasing confidence among job seekers. And this is contributing to both modestly improving wages and slightly stronger consumer spending, which should help to support the U.S. economy, and eventually, U.S. stocks.

Wages Moving Higher

Fed In Holding Pattern

The combination of the tumult in the equity market and the continued rout in oil/commodities, combined with the lack of inflationary pressures, will almost certainly mean the Fed will make no move at its upcoming meeting ending January 27. It’s too soon to say whether the Fed will move at its March meeting; but we are fairly confidence the Federal Open Market Committee (FOMC) will lower its projections for rate hikes this year from a total of four to closer to what the market’s been expecting, which is no more than two. The Fed continues to telegraph the desire to move slowly and deliberately, but it also seems the majority of FOMC members want to move further away from the extremes of its zero interest rate policy (ZIRP).