Key Points

1. U.S. equity indices finally broke through to new record highs but skepticism remains elevated among investors. Ironically, this could help to support stock gains, but risks do remain.

2. The U.S. economy has been improving and earnings season has been better than expected, helping to support stocks. Meanwhile, the fed funds futures market shows the chances of a Fed hike at some point this year have gone up considerably since the Brexit-related panic.

3. The Brexit aftermath on a global basis has been better than many had been expecting, leading to improved optimism that some of the more dire scenarios being painted won’t come to fruition.

Finally! Now what?

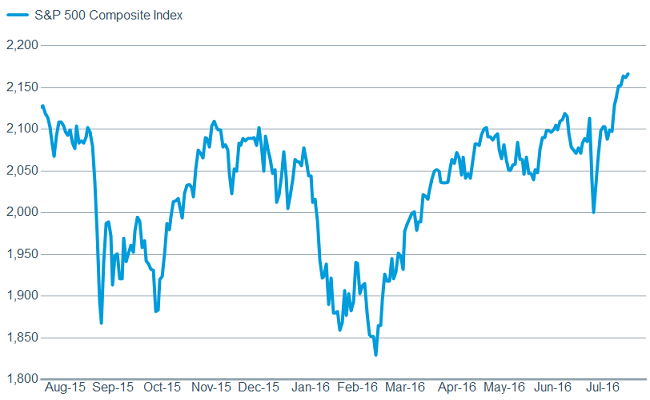

After repeatedly failing to break through to new highs over the previous year, the Dow Jones Industrial Average and the S&P 500 finally broke through with gusto, moving to all-time highs (read more on this move from Liz Ann Sonders article “19th Nervous Breakout”).

S&P finally breaks through

Source: FactSet, Standard & Poor's. As of Jul. 19, 2016.

This latest move continues the equity bull market that has been in place since 2009, with some investors increasingly worried about the possibility that it’s getting a bit long in the tooth. We counter that argument by noting that this appears to be one of the least respected bull markets of all time. According to ISI Evercore Research, to this point in the year, U.S. equity fund outflows have totaled around $85 billion—a record (even surpassing 2008 during the financial crisis); while inflows to bond funds have been close to $100 billion. One of our favorite quotes comes from Sir John Templeton when he noted, “Bull markets are born on pessimism, grow on skepticism, mature on optimism and die on euphoria.” To us, it’s hard to argue that we’re anywhere near euphoria and in fact investors still seem quite skeptical. That’s not to say that there won’t be times of short-term investor enthusiasm which could lead to pullbacks, but a near-term end to the bull market doesn’t seem likely.

"

We remain neutral on U.S. equities, which means investors should remain at their normal long-term allocations and use volatility to rebalance around those targets. Risks remain, however, including any aforementioned spike in investor optimism, election-related uncertainty, as well as Fed-related uncertainty. Valuations are a bit rich, which suggests earnings will have to do more of the market’s heavy lifting.

Uncertainty around global central bank policy persists as well. Global economic growth remains sluggish, in spite of $1.3 trillion in assets the Fed, the European Central Bank (ECB), the Bank of Japan (BoJ), and the Peoples Bank of China (PBoC) have added to their balance sheets over the past 12 months through May, according to Yardeni Research. (Note—when central banks buy assets, they put cash into the economy.) Additionally, about one-third of the bonds in developed international market bond indexes have negative yields, the ultimate consequences of which are unknowable, but the effect so far has neither boosted growth nor inflation.. And although Brexit angst has dissipated with the appointment of a new U.K. prime minister, bouts of volatility are likely to persist.

Earnings season offers insight, while economy perks up

With global uncertainty still high, the view from the corporate suite becomes even more interesting. Commentary from second quarter earnings season has so far been relatively cautious, although the results have been better than the relatively low expectations so far. It appears the first quarter marked the trough in S&P 500 earnings, although the growth rate may not move back into the black until the second half of this year.

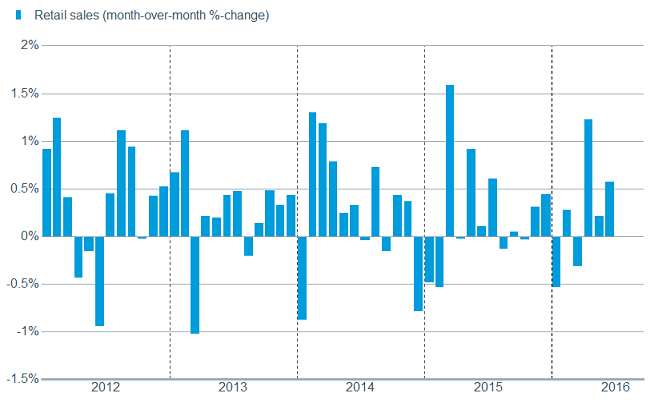

Meanwhile, the U.S. economy continues to show meaningful signs of improvement. The U.S. Citigroup Economic Surprise Index moved back into positive territory, and to its best level since January 2015; indicating economic releases have largely bested expectations. Initial unemployment claims continue to reinforce the much healthier employment data since the strong June jobs report. And wages are starting to perk up with average hourly earnings rising 2.6% year-over-year, and the Atlanta Fed’s Wage Tracker measure up a full percentage point more. This appears to be helping retail sales, which posted another gain in June, rising a solid 0.7% ex-autos and gas.

Retail sales looking healthier

Source: FactSet, U.S. Census Bureau. As of Jul. 19, 2016.

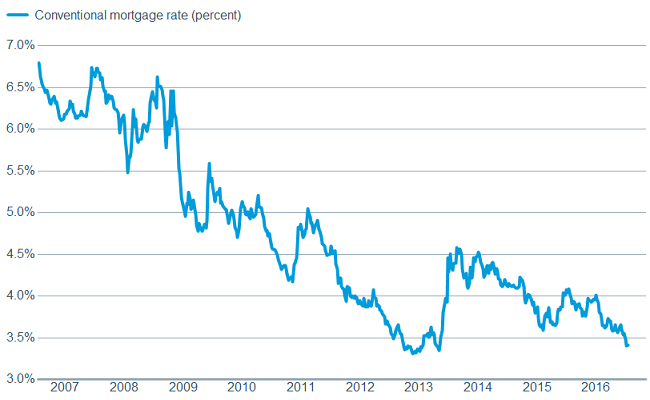

Additionally, housing continues to be a relative bright spot in the economy, indicating better confidence among consumers as well as buyers taking advantage of low interest rates. Housing starts rose a solid 4.4%, while building permits advanced by 1.5%.

Lower mortgage rates helping housing

Source: FactSet, Federal Reserve. As of Jul. 19, 2016.

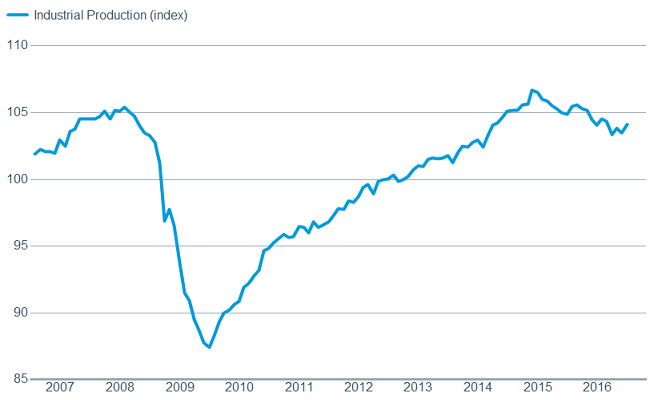

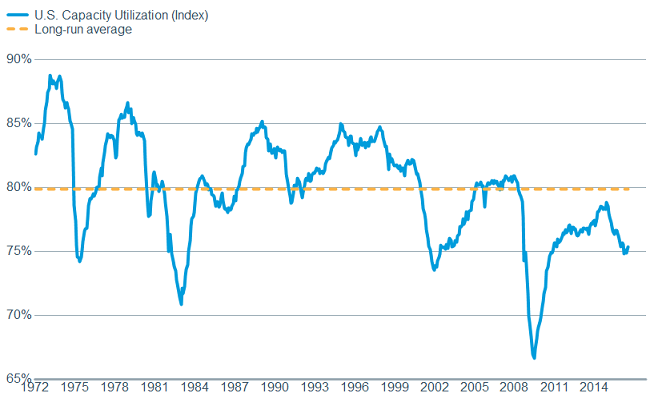

Unfortunately not all is rosy, as business confidence remains low. There are some signs of light though, with the National Federation of Independent Businesses (NFIB) recently reporting that its optimism index rose to 94.5, besting expectations. But industrial production and capacity utilization readings—albeit up a bit over the past month—continue to indicate a lack of longer-term capital investments.

Business investment still appears weak

Source: FactSet, Federal Reserve. As of Jul. 19, 2016.

Source: FactSet, Federal Reserve. As of Jul. 19, 2016.

We continue to believe that the extremely low interest rate environment is contributing to this phenomenon, contrary to central bankers’ goals. We believe ZIRP (zero interest rate policy) and QE (quantitative easing) in their latter stages both dented confidence and incentivized companies to bias their spending toward stock buybacks over longer-term capital investments.

We’re in for an interesting few months!

While there’s a near unanimous opinion that the Federal Open Market Committee (FOMC) will stay put at its meeting next week, market expectations for a rate hike later this year have risen over the past couple of weeks, coming closer to what we have believed was the more realistic possibility. The financial markets have stabilized following the initial Brexit-related volatility, while economic data has improved; setting the stage for a resumption of rate hikes.

Additionally, some inflation measures heating up may force the FOMC’s hand. As noted, wage growth has accelerated a bit, while the June Producer Price Index (PPI) surprised on the upside, rising 0.4% month-over-month. We believe the risk of an actual inflation problem remains low; but we could have an inflation scare.

And then there’s the drama-filled election. Regardless of what happens during the conventions, it is almost assured that this election season will be unlike any other. Once the conventions are over and we head into debate season—likely to break viewership records—expect more bouts of volatility.

Post-Brexit global outlook

The recovery by many markets should not breed complacency in the aftermath of Brexit. It has only been one month since the vote in the U.K. on June 23, which resulted in Britain planning on leaving the European Union (EU). At the time of the vote we noted that the stock market typically recovered after initial shocks like Brexit, but that recovery usually took about three months. For the Brexit shock it took just three weeks. Why has the global stock market been so resilient? We believe there are three primary reasons: stable economic data, better political sentiment in the EU and improving financial conditions. These have appeared to combine to limit the contagion effect from Brexit.

First, post-Brexit economic data in Europe is somewhat limited since it has only been a month since the vote, but so far that data hints at relative stability.

While the preliminary readings of the purchasing managers indexes (PMIs) for July have yet to be released as of the writing of this piece—and may show some impact from the Brexit vote—the final June post-Brexit purchasing managers’ indexes for both manufacturing and services were higher than their pre-Brexit preliminary readings.

The first reading of Eurozone consumer confidence for July revealed a slight decline, but this puts the European Commission Consumer Confidence Indicator for the first month of the third quarter only 0.1 point below the average for the second quarter. This suggests growth in consumer spending may remain relatively stable.

The July ZEW Eurozone investor survey, conducted shortly after the Brexit vote reflected a big drop in future expectations, reflecting Europe’s stock market drop. But the survey only reflected a slight move in the assessment of the current situation, suggesting the July drop may be temporary as investor sentiment tracks the rebound seen in the stock market.

Analysts’ earnings per share estimate revisions for Eurozone companies in the MSCI Euro Index had been on the rise since February. But on the Brexit news they quickly slipped 2%; since stabilizing and remaining more than 2% above the lows of four months ago.

Despite warnings of potentially severe economic consequences from a Brexit vote, the International Monetary Fund (IMF) updated their global economic forecasts this week. It lowered its 2016 outlook by just 0.1%, to the same 3.1% pace as 2015; and lowered its outlook for 2017 by 0.3%, to a reflect only a modest acceleration in growth to 3.4%.

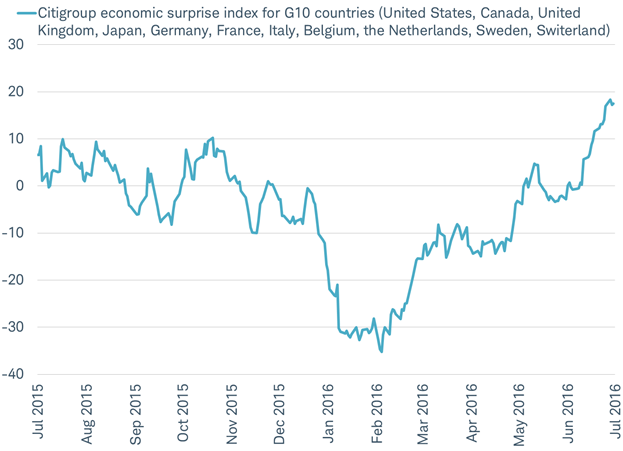

The Citigroup Economic Surprise Index (CESI) for the G10 is updated every day to reflect how economic data is faring compared with economist expectations. Much like the U.S. CESI mentioned above, the rise in the Eurozone surprise index reflects how the data continues to exceed economists’ expectations in July, as you can see in the chart below.

Europe’s economic data has been better than expected recently

Source: Charles Schwab, Bloomberg data as of 7/21/2016.

Second, the political implications of Brexit may be more important to markets than the economic impact given the threat of a breakdown of the EU. However, the political risks appear to be fading in the aftermath of the Brexit vote.

In the U.K., political uncertainty has been reduced with Theresa May’s fast-tracked appointment as Prime Minister (PM). The PM change went surprisingly easily as “Brexiters” dropped out, leaving May to seek a “soft-Brexit” deal which would have been less likely under a more Euroskeptic PM. May‘s non-confrontational style suggests that she may be able to hold the Conservative party together and embark on a new relationship with the EU as soon as possible in a constructive way, which could mitigate the downside risks to business investment and hiring.

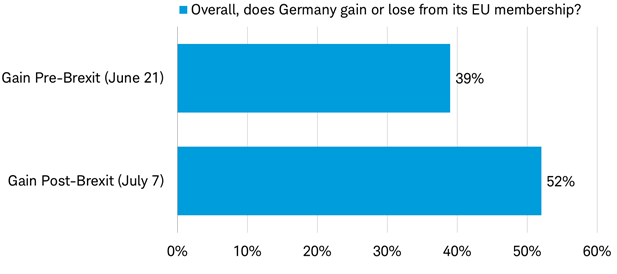

In Europe, polls show support for EU surging in wake of the Brexit vote: 52% of Germans said EU membership has advantages; up sharply from 39% in May, according to Infratest dimap ARD. In Denmark, the percentage of people backing EU membership jumped to 69% following the Brexit vote from 59% before the vote, per a Voxmeter poll. There was a similar trend in Finland where 69% said they were not interested in a referendum on EU membership following Brexit in a poll conducted by the Finnish newspaper Iltalehti. In France, 55% of those polled by CSA rejected the idea of holding a referendum on EU membership after Brexit, and 61% saying they will vote remain if such a referendum happened.

Rising political sentiment on EU membership

Source: Charles Schwab, Infratest dimap ARD data as of July 7, 2016.

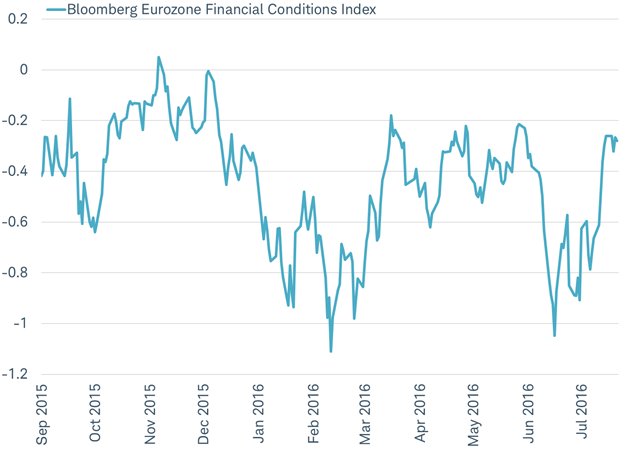

Third, for the Brexit shock to lead to a crisis in Europe, financial conditions would likely need to deteriorate sharply, as they did in 2008 and 2011, which is not happening—in fact, conditions are improving. Not only have global stocks measured by the MSCI AC World Index recovered all their Brexit-related losses, the Bloomberg Eurozone Financial Conditions index has been improving and is now better than its pre-Brexit level.

Eurozone financial conditions have fully rebounded following the Brexit vote

Source: Charles Schwab, Bloomberg data as of 7/21/2016.

Based on stable economic data and improved political sentiment and financial conditions, any contagion has been limited so far, lending support to global stock markets. The post-Brexit environment for global stocks continues to support our view that investors should remain invested according to their asset allocation targets.

So what?

New equity index records often generate investor excitement, but skepticism seems to be the consistent and dominant emotion this time. We understand this sentiment as risks and uncertainties persist; but we continue to recommend investors remain at their longer-term strategic equity allocations. It’s early still, but the fallout from the Brexit vote appears to be relatively limited at this point; however, we believe volatility will persist in the context on an ongoing (but maturing) bull market.