Key Points

• Stocks moving nowhere for over a year, and a continued low yield environment is fueling investor frustration. There doesn’t appear to be a lot of impetus for that to change soon, but investors should remain patient as positive signs are emerging.

• For the frustration to end, we believe businesses need to pick up their capital spending. For now, a relatively healthy consumer and housing are keeping the U.S. economy afloat and making it possible that we’ll see a Fed hike this summer.

• The discontent in the UK has led to an upcoming vote on whether to leave the European Union or not. We believe they’ll stay, but there are risks, and unfortunately stocks likely won’t rally on a vote to remain, but could slide on a vote to leave.

Summer fun or frustration?

As amusement park visits rise in the summer months, the ever-popular roller coaster analogy seems appropriate for the stock market. Since the beginning of 2015, stocks have had some fairly major ups and downs, but we now sit about where we began. Unfortunately, it’s not as easy for investors to get off the ride, and we expect the frustrating, grinding environment to continue for the near future. Equities have yet been unable to break through to new highs, while fixed income continues to offer little in terms of yield.

We know discontent among investors is elevated from talking to them around the country; but also by the continued outflow we are seeing in U.S. equity funds. Through May 25, according to Evercore ISI, the outflows had reached $71 billion, which almost reaches the total of $72 billion from last year, and the $77 billion outflow seen in 2008—the heart of the financial crisis. Although exchange-traded fund (ETF) flows are positive this year, they are more than offset by the drain from traditional mutual funds.

The positive caveat is that there is likely a lot of liquidity on the sidelines which could be the fuel for another market advance. Investor sentiment continues to be one of the stand-out bright spots in an otherwise fairly gloomy environment; hence our continued “neutral” rating on U.S. equities. As a reminder, this means investors should remain at their long-term strategic allocations and use volatility to tactically rebalance around that norm.

Glimmers of hope

We have been accused at times of wearing rose colored glasses, but we believe a default setting of optimism has been more rewarding for investors longer-term relative to one of doom. But we are aware of the risks.

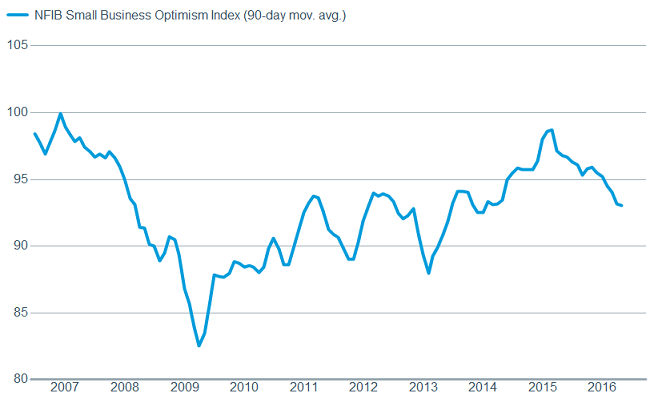

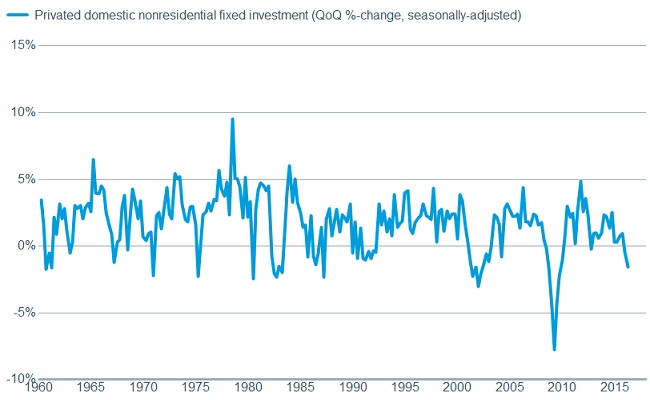

Profit growth was nonexistent for the broad market through much of the first half of the year and business caution remains elevated, hampering potential further growth. Business optimism as measured by the National Federation of Independent Businesses (NFIB) remains relatively low, and according to the Federal Reserve, business spending actually declined in the most recent month.

Business optimism remains lackluster

Source: FactSet, Natl. Federation of Independent Business. As of June 7, 2016

Translating to weak business spending

Source: FactSet, U.S. Bureau of Economic Analysis. As of June 7, 2016.

There are modest signs that things may improve over the second half of the year. Profit growth estimates bottomed in February and have been moving higher, helped along by easier year-over-year comparisons for the energy sector. Additionally, we’ve seen some improvement in manufacturing as the Institute for Supply Management’s (ISM) Manufacturing Index gained slightly in May to 51.3 from 50.8; while new orders, the forward looking component, stayed fairly solid at 55.7. And as noted, we believe businesses need to get on board to really get the economy rolling. With productivity still running quite low there is hope that companies will start to spend more on longer-term capital investments vs. using excess cash to increase dividends and/or buy back their own stock.

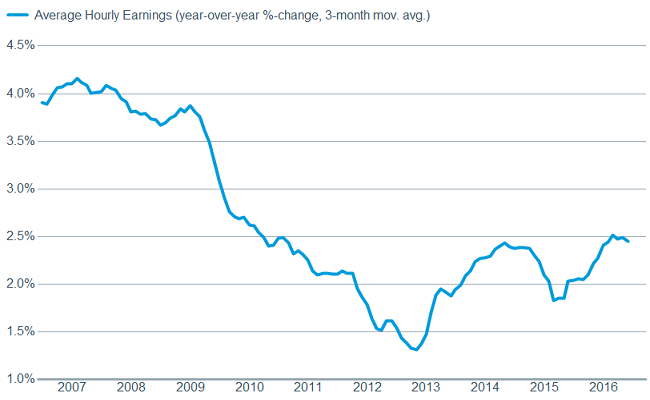

The rise in wages that we’re starting to see alongside the tightening labor market could further incentivize businesses to invest more in order to boost productivity and improve longer-term profit margins. Notwithstanding the weak May jobs report, the improvement in job growth during this expansion has contributed to a stronger consumer and a healthier housing market, which have offset the drag from manufacturing and capital spending. The May jobs report was indeed much weaker than expected as only 38,000 workers were added to U.S. payrolls. Even taking into account the Verizon strike, the reading would have only been roughly 78,000. Although the unemployment rate did fall from 5.0% to 4.7%, it was for the “wrong” reason—the labor force participation rate fell. Average hourly earnings were a bright spot, increasing 2.5% year-over-year, while other measures of wages show even more upward momentum. At this point we believe the job market is maturing, which suggests a slower pace of payroll additions; but the trend needs to be watched carefully over the next couple of months. For further discussion of the U.S. job market, please read Liz Ann’s article,Are the Glory Days of Job Growth Over?

Rising wages

Source: FactSet, U.S. Dept. of Labor. As of June 7, 2016.

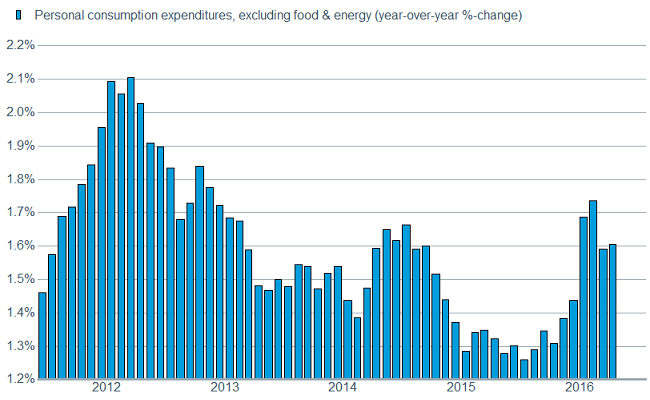

Could be helping consumer spending

Source: FactSet, U.S. Bureau of Economic Analysis. As of June 7, 2016.

As seen above, the strength to-date in the job market may be leading to an acceleration in consumer spending, as personal spending rose 1.0 % month-over-month in April. This was in conjunction with a strong retail sales report for the month and was the largest monthly increase since 2009. It’s much too early to call this a trend, but they are positive signs and what we have been expecting given the improvement-to-date in the job market and the lagged impact of lower oil prices. A more confident consumer should be supported by an improving housing market. According to the U.S. Department of Housing and Urban Development, new home sales rose a robust 16.6% month-over-month in April, while inventories fell to only 4.7 months, which should also support business confidence and the economy more broadly.

Fed setting the stage

Although the Fed (and the market) took a more dovish stance following the weak May jobs report, it still appears that the goal is to raise interest rates at least once this year; possibly as soon as July or September. This is far from suggesting that monetary policy will be “tight” in the near-term; while the trajectory of future rate hikes is highly likely to be of the gradual variety. Regardless, the potential summer of discontent could be further fueled by Fed-induced volatility.

Brexit: a one-sided risk

Another more immediate sign of discontent will likely come from across the Atlantic Ocean. In the first half of the year, investors kept a watchful eye on political developments in Europe, including the refugee crisis and negotiations over Greece’s bailout. Europe’s political risk may be approaching the 2016 peak with the June 23 “Brexit” referendum as the U.K. decides to exit or remain a member of the European Union (EU). We see this as a one-sided risk to the markets given the likelihood of a sharp stock market sell off in the event of a vote to leave, while only a modest relief rally may result from a vote to remain in the EU.

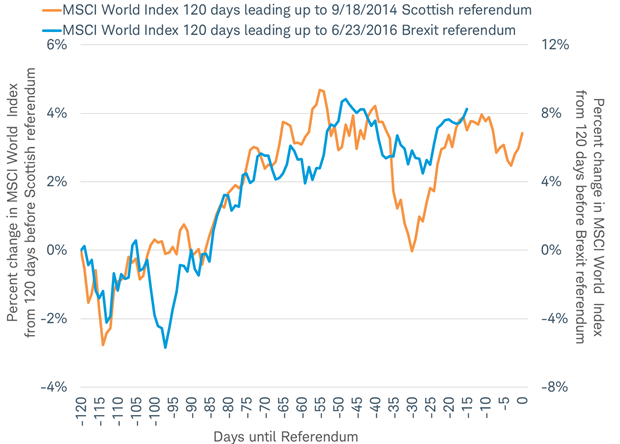

While it may simply be a coincidence, the pattern taken by global stocks in the run up to the Brexit referendum is similar to the pattern seen in the run up to the 2014 Scottish referendum (when Scotland voted to stay or leave the U.K.), as you can see in the chart below. If the pattern continues, we could be due for a short-term dip in the next two weeks as the referendum becomes top of mind for investors.

Stocks have followed a pattern ahead of the Brexit referendum that is similar to the 2014 Scottish referendum

Source: Charles Schwab, Bloomberg data as of 6/6/2016.

Past performance is no guarantee of future results.

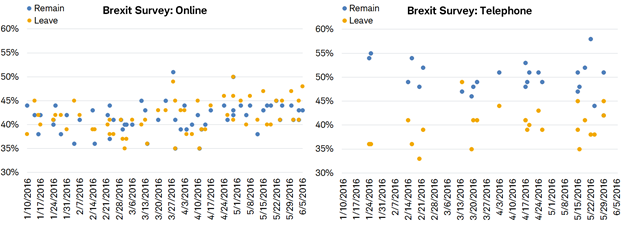

Fortunately, it looks like the U.K. may vote to remain in the EU, based on polling data. As you can see in the charts of 2016 Brexit poll results, online polling shows a tight vote, but telephone polling shows about a 10% advantage to remaining in the EU. Telephone polling is statistically sampled and historically tends to be more accurate than online surveys. We are not political analysts and the vote could go either way, but 10% is a pretty wide margin—not quite a landslide, but enough to put the issue to rest for some time if the vote ends up reflecting what we are seeing in the telephone polls.

Brexit: online versus telephone polls

Source: Charles Schwab & Co., Inc., Financial Times, ComRes, ICM, Ipsos MORI, ORB, Pew Research Center, Survation, Financial Times, BMG Research, Greenberg Quinlan Rosner Research, Harris, ICM, Lord Ashcroft Polls, Opinium, ORB, Panelbase, Populus, Survation, TNS, YouGov. Data as of 6/6/2016.

The 10% margin is similar to what we saw in both the 2014 Scottish referendum and the 2015 general election in the U.K.. In the 2014 Scottish referendum, the online polls were similarly tight; but ultimately the Scots voted in their economic best interest and remained part of the U.K. by a 10% margin. A similar pattern was seen in the run up to the 2015 general election in the U.K.; where polls showed a tight race between the Conservative and Labour parties, but the Conservatives winning by a 7% margin.

In the case of a Brexit result

If the U.K. were to leave the EU, it seems likely the EU would raise tariffs and take actions to encourage the movement of trade back within the EU. The U.K. would have less influence to block or negotiate these regulations. With trade making up 40% of gross domestic product (GDP), keeping favorable trade agreements in place is critical to the UK economy. The financial sector is likely to suffer most—over time, London would likely lose its place as Europe’s financial hub to Paris or Frankfurt as new EU rules are written. The uncertainty of what newly-crafted trade deals would look like between Europe’s second-largest economy and the rest of the EU would limit capital spending across the channel in both directions, as well as weigh on trade in the interim.

Global stocks may react to the concern the Brexit could result in a wave of similar votes across different countries in the EU. Today, half the voters in eight EU countries believe their own governments should hold votes on staying in the EU, according to polls conducted by Ipsos Mori. The Brexit result could renew the debt crisis of 2011, when bond yields of southern European countries soared on fears they would be forced to exit. The euro would also likely to slide on fears of a breakup of the Eurozone. Investors may favor perceived safety and move to assets considered more defensive such as the U.S. dollar and gold. Lastly, a Brexit would be likely to raise global economic uncertainty, perhaps enough to prompt the Fed to push out U.S. interest rate expectations.

In the case of a Remain result

Global stocks may not see much of a relief rally following a vote to remain in the EU. The global stock market is near the high for the year and does not appear to have priced in the consequences of a vote to leave, so there is little room to rally on the news. Also, since stocks have been following a similar pattern to the 2014 Scottish referendum, it is worth noting that there was no relief rally after the referendum results. Stocks in the U.K. and around the world, as measured by the MSCI United Kingdom Index and the MSCI AC World Index, fell 8% over the month following the referendum as an unrelated slide in oil prices began.

While we see the Brexit vote as a one-sided risk to the markets, we believe economic considerations will favor the U.K. remaining within the EU despite how much the British may resent bailed-out banks and bureaucrats in Brussels.

So what?

This isn’t a comfortable time for investors, which isn’t a bad thing from a contrarian sentiment perspective. We urge investors to stick with their asset allocations, but use volatility to tactically rebalance. Economic data shows signs of improvement, and the Fed continues to be cautious about tightening policy too quickly, which could aid stocks in the second half. Internationally, the “Brexit” vote will likely be the focus for the near term—we expect the U.K. to remain in the EU, but there is a risk that the leave camp will prevail.