Key Points

-The U.S. economy continues to trudge ahead at a low growth rate—not able to generate “escape velocity” on the upside, but not looking like a recession. But U.S. manufacturing looks to have exited its six-month contraction, courtesy of the reversals in the dollar and commodity prices.

-The Federal Reserve has been sending mixed messages; with some members expressing a desire to raise rates further, while Fed Chair Janet Yellen continues to sound a dovish tone. Meanwhile, government actions as well as election season rhetoric have taken a decidedly business-unfriendly tone.

- Global manufacturing has been muddling along, but there are signs of improvement which could lead to rising global stock prices.

Stuck in the middle

Economic data has been mixed, pointing to continued soft economic growth, while first quarter profits are expected to post a decline. But commodity prices have stemmed their decline, and the dollar has been consolidating its prior gains, which has helped propel stocks higher and improve market breadth. Investor sentiment has recovered alongside the rally, but remains in neutral territory according to Ned Davis Research.

The environment for stocks appears more positive than negative as modest economic growth, low inflation, and a dovish Federal Reserve have tended to be positive for stocks historically. One of the big flies in the ointment, however, is the earnings picture. First quarter earnings are projected by Thompson Reuters to be down about 8% year-over-year—not a great backdrop for stocks. A low bar, however, can mean potential upside should those low expectations be exceeded, as frequently happens. So what does this all mean for investors? We continue to have a neutral view on stocks, which means investors should remain at their long-term strategic allocation to stocks, being mindful of not stretching for greater yields or faster price appreciation at the cost of greater risk.

Manufacturing awakes from its slumber

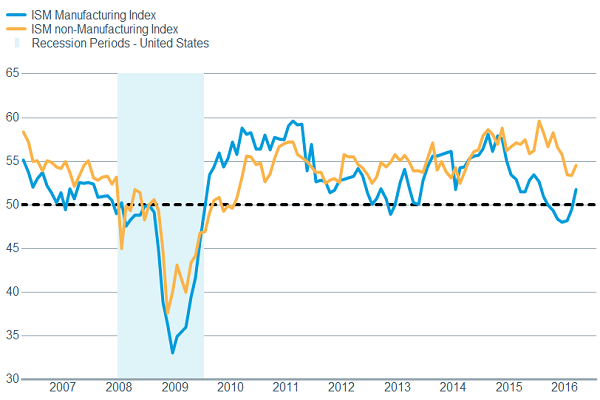

U.S. manufacturing has posted a bit of a rebound, with the Institute of Supply Management’s (ISM) Manufacturing Index moving back above 50, which is the demarcation between expansion and contraction; while even more encouragement came from the new orders component jumping to 58.3, potentially setting the stage for further improvement. Similarly, the much larger service side of the U.S. economy has bounced a bit, with the ISM Non-Manufacturing Index bouncing to 54.5 from 53.4, while the new orders component also bumped higher.

Good, but not great

Source: FactSet, Institute for Supply Management. As of Apr. 11, 2016.

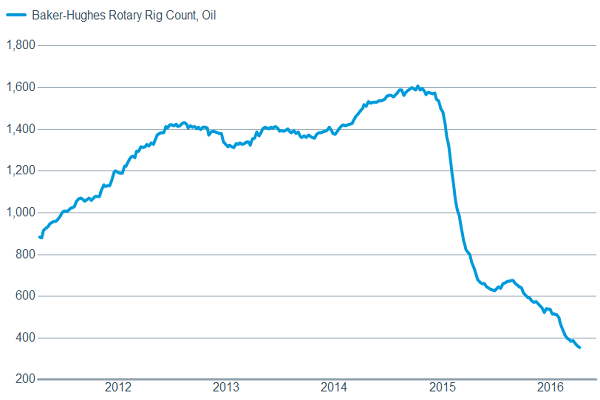

Part of the earlier downturn in manufacturing can at least partly be attributed to the oil price collapse, which resulted in the laying off of thousands of oil workers, while also idling many oil rigs. The good news is that the shutting down of rigs seems to be reaching a bottom, while the price of oil also seems to have put in at least a near-term bottom.

The decline in rigs likely hasn’t much further to go

Source: FactSet, Backer Hughes, Inc. As of Apr. 11, 2016.

While the rebound in the price of oil may be getting stretched

Source: FactSet, Dow Jones & Co. As of Apr. 13, 2016.

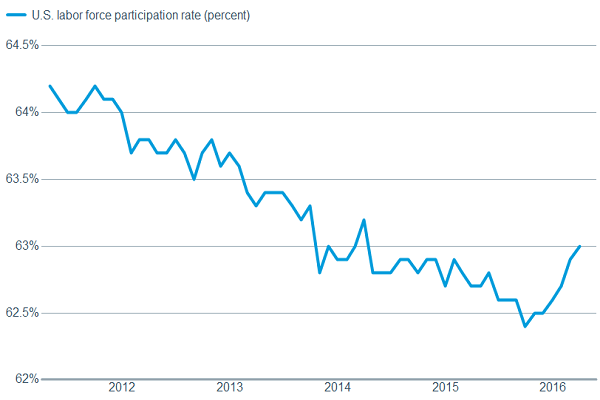

The employment picture on the surface seems to be quite healthy, with unemployment at a low 5.0% and initial jobless claims continuing to trend near historic lows. However, the U-6 unemployment rate, which includes discouraged workers and those working part time who would like to be working full time, stands at 9.9%—down from 11.0% a year ago, but still elevated. And there may be some more “invisible” workers coming into the workforce as the participation rate has started to increase—positive for the economy as a whole longer-term, but could put some upward pressure on unemployment in the short term.

Participation starting to tick higher

Source: FactSet, U.S. Dept. of Labor. As of Apr. 11, 2016.

Fed dealing with lukewarm environment, while government isn’t helping

The Fed is dealing with the same frustrations that investors are. Its extraordinary and unprecedented measures meant to stoke growth have been less effective than anticipated; and now some members are getting anxious to get rates to a more normal level, concerned about the risks that could be building with continued extreme monetary policy measures. However, other members, including Yellen, are largely dismissive of those concerns, and much more worried about being too aggressive in raising rates. After the release of the minutes from its most recent meeting, and Yellen’s recent speech in New York, the April meeting seems to be off the table for a rate hike. But although the odds of a June hike have diminished, we believe it’s still on the table, and that two rate hikes this year are possible.

Also adding to the uncertainty, the U.S. government has been on a decidedly non-business friendly kick—not helping engender confidence among corporate decision makers. When rules can be changed midstream and without going through the normal legislative process (such as when the Treasury Department issued new regulations restricting so-called tax inversions), it makes longer-term decisions, such as capital expenditure choices, harder to make. Few would argue that tax inversion transactions are particularly desirable; but the better move for business (and investors) would be to reform the tax code more broadly, given the significant disadvantage of the United States vs. elsewhere in the world.

Manufacturing earnings?

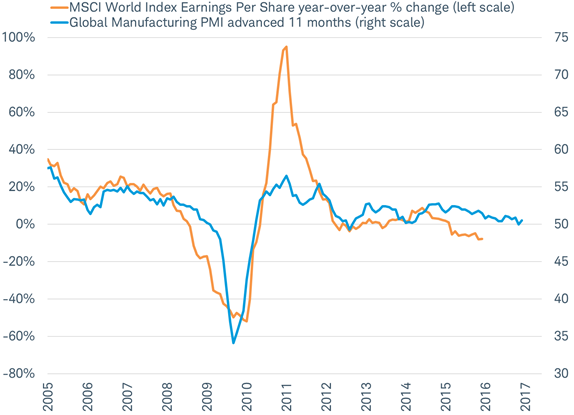

Just as we believe earnings in the United States are important to further domestic stock market gains, we also think the return of earnings growth is an important ingredient in getting global stocks to begin to move materially higher once again. Growth in global earnings is driven by economic growth and there appears to have been little of either in the first quarter. While still stuck in the middle ground here as well, potentially boding well for the future; it appears that the global economy may be showing signs of improvement, particularly in manufacturing where economic weakness has been focused.

A turnaround in the global manufacturing purchasing managers index (PMI) could be good news for earnings. Historically, the global manufacturing PMI has indicated the direction of earnings growth about one year ahead, as you can see in the chart below. If February marked the end of a two-year soft spot in manufacturing, the outlook for profits in 2017 may improve.

Manufacturing index tends to lead trend in earnings growth by about a year

Source: Charles Schwab, Bloomberg and Factset data as of 4/13/2016.

The global manufacturing PMI increased 0.5 points to 50.5 in March, indicating a modest expansion in global manufacturing activity after a brush with 50 threshold. While the rebound is welcome after February's recession warning, it points to just tepid growth at best. The good news is that the new orders component of the index, which acts as a leading indicator for the overall index, rose to 51.2, above its 12 month average.

We can see the general pattern of improvement as we look at the PMIs from nine major countries and regions of the world highlighted in the chart below. After the PMI readings clustered around the intersection of the four quadrants last month—indicating a stall in manufacturing activity—March showed a clear rebound as most PMIs rose and moved above the 50 level, indicating they were expanding faster. More broadly, the share of the PMIs in over 30 countries that are in expansion (above 50) rose to 70%. Even more impressive is the fact that the share of all PMIs that rose in March surged to 77%, the highest since July 2009.

Global manufacturing returns to expansion in March

.jpg)

Source: Charles Schwab, Bloomberg data as of 4/11/2016.

Not all the PMIs improved in March. Brazil and Russia continue to be among the world’s worst. Brazil's manufacturing PMI has remained below 50 over the past year and Russia's manufacturing PMI has been below 50 for 14 of the past 16 months. Most notably, Japan was a disappointment with its PMI slumping below 50 to 49.1. The stronger yen sent the export orders component of the PMI down to the lowest reading since January 2013, when Europe was in a recession. But elsewhere in Asia, both China and Australia saw improvement. In fact, when including the service sector along with the manufacturing sector in China’s composite PMI, the rebound to 51.3 marked the best level in a year and return above the five-year average.

China’s composite PMI rebounded above the five year average

.jpg)

Source: Charles Schwab, Bloomberg data as of 4/11/2016.

The takeaway from this discussion of the global PMI readings is that while we’re still in that frustrating middle ground, the worst may be behind us in manufacturing. If so, this points to a potentially brighter outlook for global markets.

So what?

Patience and discipline. Those are the two words to commit to memory in the face of the current environment. A sluggish expansion and a cautious corporate environment leads us to have a neutral view on equities, which means investors should stick with their longer-term objectives and remain committed to their plan. There are glimmers of hope domestically and globally with strong U.S. job growth and U.S. and global manufacturing looking better.