Key Points

- Stocks continue to be relatively volatile although the sharp downward slide has taken a breather. Markets are still recession-obsessed, but we believe if we are in the midst of a cyclical bear market, it’s of the “non-recession” variety.

- The US economy remains bifurcated, with manufacturing in a slump, but services hanging in there; although weaker service-sector growth helped to further expectations that the Federal Reserve is in no rush to raise rates again.

- Recent economic readings from around the world also suggest that the globe is not slipping into a recession.

Where to next?

After a record-breaking and unsettling start to the year, markets seem to have calmed at least a bit, although volatility still remains elevated and triple-digit moves on the Dow are the norm, not the exception. We’ve seen some oversold bounces—some of which have been fierce—but not yet indicative of a reestablishment of the bullish trend in stocks. The rampant uncertainty has manifested itself in a near-record number of “all or nothing” days; where trading volume is vastly skewed toward either the sell or buy side. We would discourage trying to navigate this short-term volatility, but instead maintain a “neutral” position in U.S. stocks (i.e., no risk above normal allocations). In particular, having a diversified portfolio and keeping your long-term goals in mind are keys. If you listen to financial media for any length of time you’ll hear “experts” on both sides—some believing we are headed into a deep and extended bear market, and others believing this is setting up to be the jumping off point for a strong bull. Let volatility be your friend though, and be mindful of the benefits of periodic rebalancing. Emotions are elevated during times of heightened volatility and emotional decisions are rarely rewarded financially. As Mike Tyson said, “Everyone has a plan until they get punched in the face.” Investors have been punched in the face to start 2016, but we urge them to stick with their plans.

Economic picture still muddy

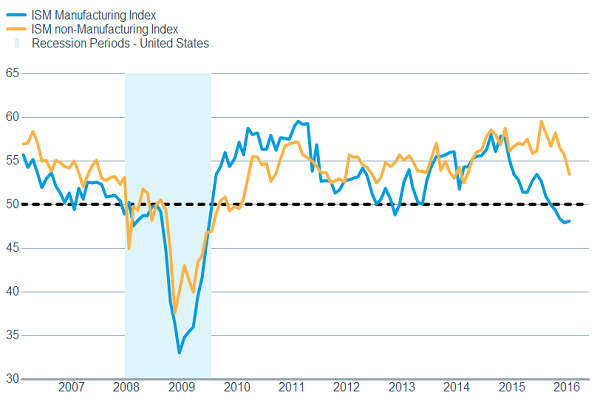

Contributing to investor unease is uncertainty about the direction of the U.S. economy. For sure we have a bifurcated economy, with manufacturing continuing to be weak alongside the surge in the dollar and crash in commodity prices, while services has remained in growth territory. History tells us these bifurcations don’t persist indefinitely. The good news is the service sector is a much bigger chunk of the economy at 88%. The bad news is that manufacturing has tended to be a leading indicator, and as noted earlier, services has weakened a bit recently with the Institute for Supply Managements (ISM) Non-Manufacturing Index falling to 53.5 from 55.8.

Tug of War Continues

Source: FactSet, Institute for Supply Management. As of Feb. 3, 2016.

The manufacturing side of the ledger continues to look weak, with orders for non-defense capital goods excluding aircraft, which is considered a proxy for business spending, falling a surprising 1.3% in December. However, the Markit Manufacturing PMI showed a nice gain to 52.7 from 51.2; the new order component of the ISM Manufacturing Index moved back above 50; and some regional surveys were better than expected, indicating manufacturing isn’t falling off a cliff.

The conundrum with which the market’s grappling is the tug of war between the headwinds associated with the plunge in energy and other commodity prices and the tailwinds in terms of the benefit to consumers and many businesses. For now, the headwinds have been blowing more swiftly than the tailwinds.

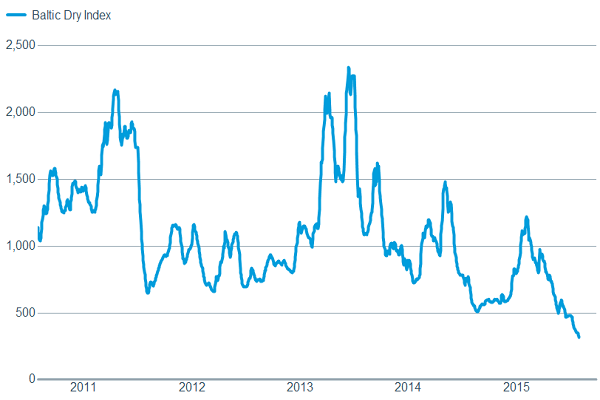

We have been negative on commodities for quite some time now; although we are likely now in a phase where investors should expect some fierce counter-trend rallies as some attempts to reign in supply take hold. You can read more detail about the energy sector here, but the plunge in the Baltic Index shows the extent to which the entire commodity space has negatively impacted manufacturing.

Plunge in commodities seen in Baltic Index

Source: FactSet, Baltic Exchange. As of Feb. 1, 2016.

But much of the rest of the economy continues to look fairly healthy, including the all-important labor market. Although a lagging indicator, the unemployment rate fell to 4.9%, while 151,000 jobs were added in January. Perhaps more importantly, the leading indicator of initial jobless claims fell nicely after a couple of slightly higher readings, indicating at least for now that companies are not panicking and laying off workers. Also, the National Association for Business Economics (NABE) reported that its net rising wage index jumped to 45 from 28, to the highest level since 2005, while average hourly earnings rose 2.5% year-over-year in January, up from 2.2% in December.

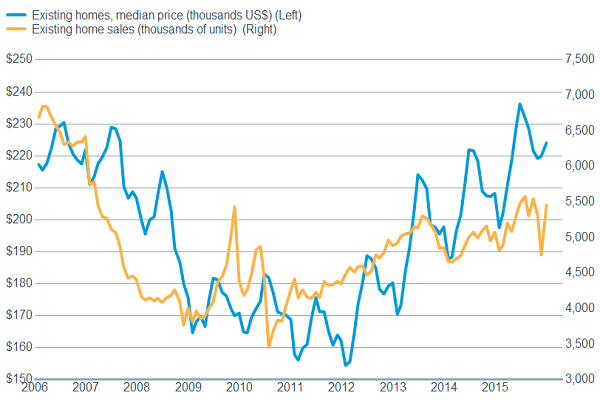

And although housing has moved a bit to the back burner, the data has been encouraging. Existing home sales rose 14.7% month over month in December and were up 7.7% year over year, according to the National Association of Realtors. Rising house prices indicate and help to facilitate confidence among consumers. Meanwhile the supply of homes for sale fell to 4.4 months, which is near a record low, helping to support price gains.

Home price gains can illustrate and facilitate consumer confidence.

Source: FactSet, National Association of Realtors. As of Feb. 1, 2016.

We continue to believe that a tight labor market, rising wages, lower energy costs, rising home prices, and continued low interest rates will help facilitate accelerating economic growth as we head through 2016.

Fed also in watch and wait mode

The Fed also faces a conundrum. The latest statement issued by the Federal Open Market Committee (FOMC) noted several risks to growth and getting inflation closer to its 2% target; but kept the possibility of further rate hikes this year on the table due to the strength in the labor market. A majority of the Fed seems to still want to move toward normalization, but they also don’t want to have to undo actions that may be premature. A lot can and will happen between now and the Fed’s March meeting but it seems increasingly likely that it will remain on hold at least through the first quarter.

PMIs: an early look at how 2016 is shaping up

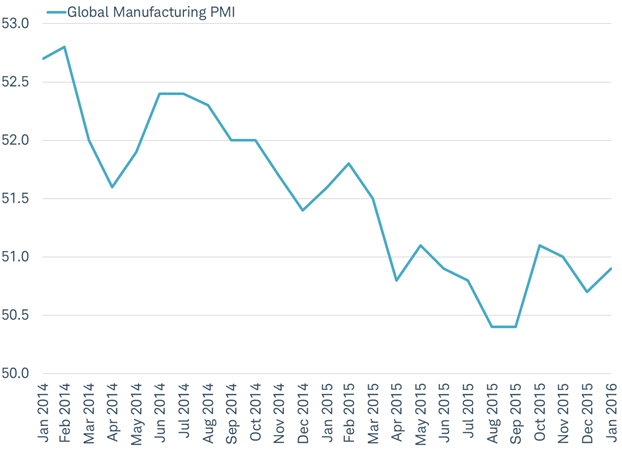

Several Fed speakers have noted that global developments could impact their decision making process. The purchasing managers indexes (PMIs) provide an early hint at how economies around the world are performing with the first look at economic data for the month of January. Fears that the global economy may slide into a recession eased a bit after last week’s release of the widely-watched measure of economic activity for January suggested the global economy is stable. The global manufacturing PMI was essentially unchanged in January, moving up slightly to 50.9 from 50.7 in December.

Recent months show stabilization in global manufacturing PMI

Source: Charles Schwab, Bloomberg, data as of 2/3/2016.

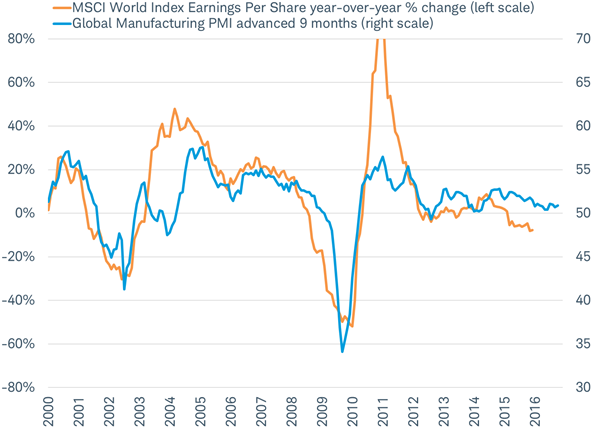

A PMI of more than 50 represents expansion, while a reading under 50 represents a contraction. Activity on this measure has stabilized over the past few months. The global manufacturing PMI was up 0.2 in January and up 0.5 above the two–year low set in September 2015. The 50 level is also the dividing line between profits and losses for companies in the MSCI World Index, as you can see in the chart below. The global manufacturing PMI has historically been a good leading indicator of profit growth three quarters later. While profits have been lagging the trend of the PMI due to the impact on earnings of plunging commodity prices; a collapse in earnings does not appear imminent. In fact, the stabilization in the manufacturing PMI at current levels points to flat-to-higher earnings per share in the coming quarters.

Global manufacturing PMI suggests no collapse in earnings ahead

Source: Charles Schwab, Bloomberg data as of 2/3/2016.

Taking a look at the January PMI readings for individual countries can offer some clarity on the stable, but mixed picture for global economic and profit growth painted by the global PMI.

Japan's results were encouraging, despite a dip in the manufacturing PMI to 52.3, as the overall composite PMI, which includes the larger services sector, rose to 52.6 continuing the rising trend from the 2014 recession low.

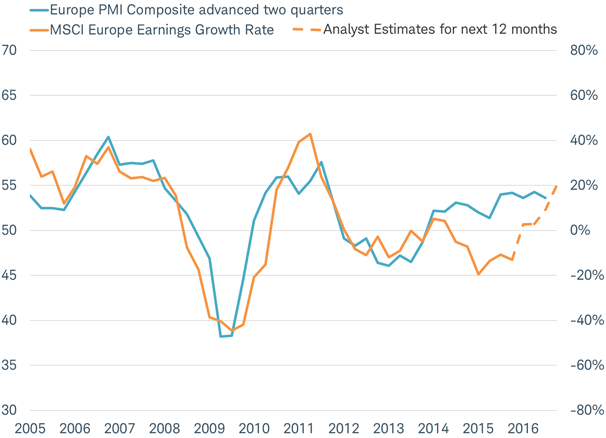

The Eurozone composite PMI slid to a still solid reading of 53.6. The Eurozone PMI has been within a tight range of half a point around 54.0 since March of last year. This suggests Europe is maintaining a solid, but not accelerating, pace of growth.

Eurozone PMI points to rebound in profits

Source: Charles Schwab, Bloomberg, Factset. Data as of 2/3/2016.

The composite PMI for China, which like the other country PMIs is produced by a private company rather than by the Chinese government, rose to 50.1 in January as a result of higher manufacturing and service PMIs. Encouragingly, among the components of the index, the leading new orders component rebounded to 50.6 from 49.1.

India, the world’s fastest growing economy, saw a rise in the composite PMI to 53.3 in January, the highest level in 11 months. The increase was led by a rebound in the manufacturing PMI which jumped by 2.0, reversing its fourth quarter drop. The services PMI also continued to display steady improvement rising to 54.3.

In short, the reading from the PMI on the global economy in 2016 so far is: stable, but below average, growth.

So what?

Don’t just do something, sit there! Not panicking can be tough to do in times of increased volatility, but often the best advice to avoid emotional decisions. We continue to expect severe bouts of volatility at least until the trajectory of the U.S. and global economy is more definitive. In the meantime, the Fed is likely to become more dovish in the near-term, which could stabilize the volatility. Recent results for global PMI readings are relatively encouraging and certainly argue against the apocalyptic forecasts so prevalent today.