Key Points

- Stocks continue to be relatively volatile although the sharp downward slide has taken a breather. Markets are still recession-obsessed, but we believe if we are in the midst of a cyclical bear market, it’s of the “non-recession” variety.

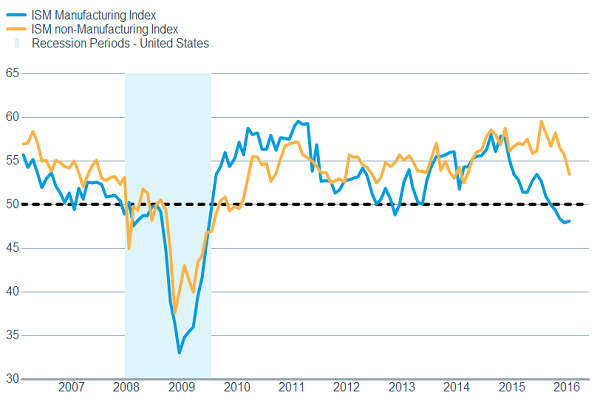

- The US economy remains bifurcated, with manufacturing in a slump, but services hanging in there; although weaker service-sector growth helped to further expectations that the Federal Reserve is in no rush to raise rates again.

- Recent economic readings from around the world also suggest that the globe is not slipping into a recession.

Where to next?

After a record-breaking and unsettling start to the year, markets seem to have calmed at least a bit, although volatility still remains elevated and triple-digit moves on the Dow are the norm, not the exception. We’ve seen some oversold bounces—some of which have been fierce—but not yet indicative of a reestablishment of the bullish trend in stocks. The rampant uncertainty has manifested itself in a near-record number of “all or nothing” days; where trading volume is vastly skewed toward either the sell or buy side. We would discourage trying to navigate this short-term volatility, but instead maintain a “neutral” position in U.S. stocks (i.e., no risk above normal allocations). In particular, having a diversified portfolio and keeping your long-term goals in mind are keys. If you listen to financial media for any length of time you’ll hear “experts” on both sides—some believing we are headed into a deep and extended bear market, and others believing this is setting up to be the jumping off point for a strong bull. Let volatility be your friend though, and be mindful of the benefits of periodic rebalancing. Emotions are elevated during times of heightened volatility and emotional decisions are rarely rewarded financially. As Mike Tyson said, “Everyone has a plan until they get punched in the face.” Investors have been punched in the face to start 2016, but we urge them to stick with their plans.

Economic picture still muddy

Contributing to investor unease is uncertainty about the direction of the U.S. economy. For sure we have a bifurcated economy, with manufacturing continuing to be weak alongside the surge in the dollar and crash in commodity prices, while services has remained in growth territory. History tells us these bifurcations don’t persist indefinitely. The good news is the service sector is a much bigger chunk of the economy at 88%. The bad news is that manufacturing has tended to be a leading indicator, and as noted earlier, services has weakened a bit recently with the Institute for Supply Managements (ISM) Non-Manufacturing Index falling to 53.5 from 55.8.

Tug of War Continues

Source: FactSet, Institute for Supply Management. As of Feb. 3, 2016.

The manufacturing side of the ledger continues to look weak, with orders for non-defense capital goods excluding aircraft, which is considered a proxy for business spending, falling a surprising 1.3% in December. However, the Markit Manufacturing PMI showed a nice gain to 52.7 from 51.2; the new order component of the ISM Manufacturing Index moved back above 50; and some regional surveys were better than expected, indicating manufacturing isn’t falling off a cliff.