The conundrum with which the market’s grappling is the tug of war between the headwinds associated with the plunge in energy and other commodity prices and the tailwinds in terms of the benefit to consumers and many businesses. For now, the headwinds have been blowing more swiftly than the tailwinds.

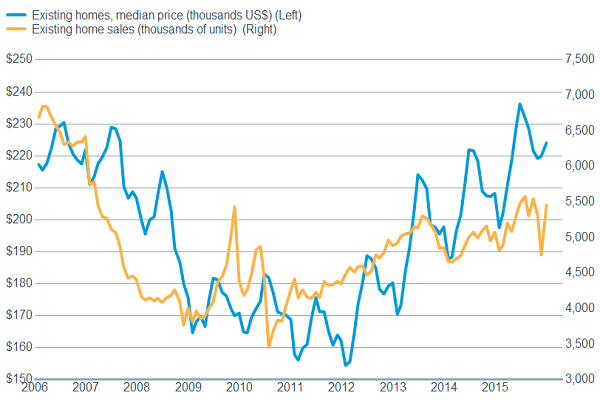

Source: FactSet, National Association of Realtors. As of Feb. 1, 2016.

We continue to believe that a tight labor market, rising wages, lower energy costs, rising home prices, and continued low interest rates will help facilitate accelerating economic growth as we head through 2016.

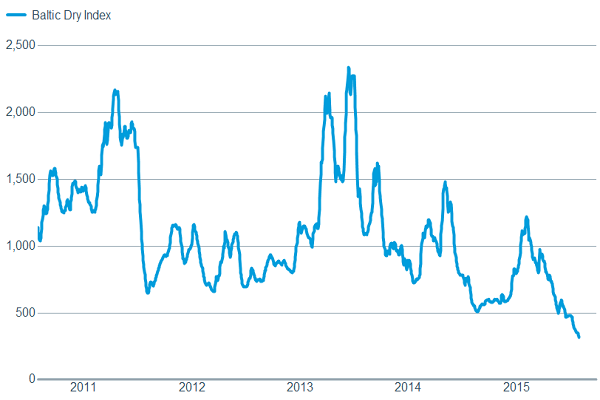

We have been negative on commodities for quite some time now; although we are likely now in a phase where investors should expect some fierce counter-trend rallies as some attempts to reign in supply take hold. You can read more detail about the energy sector here, but the plunge in the Baltic Index shows the extent to which the entire commodity space has negatively impacted manufacturing.

Plunge in commodities seen in Baltic Index

Source: FactSet, Baltic Exchange. As of Feb. 1, 2016.

But much of the rest of the economy continues to look fairly healthy, including the all-important labor market. Although a lagging indicator, the unemployment rate fell to 4.9%, while 151,000 jobs were added in January. Perhaps more importantly, the leading indicator of initial jobless claims fell nicely after a couple of slightly higher readings, indicating at least for now that companies are not panicking and laying off workers. Also, the National Association for Business Economics (NABE) reported that its net rising wage index jumped to 45 from 28, to the highest level since 2005, while average hourly earnings rose 2.5% year-over-year in January, up from 2.2% in December.

And although housing has moved a bit to the back burner, the data has been encouraging. Existing home sales rose 14.7% month over month in December and were up 7.7% year over year, according to the National Association of Realtors. Rising house prices indicate and help to facilitate confidence among consumers. Meanwhile the supply of homes for sale fell to 4.4 months, which is near a record low, helping to support price gains.

Home price gains can illustrate and facilitate consumer confidence.

Fed also in watch and wait mode

The Fed also faces a conundrum. The latest statement issued by the Federal Open Market Committee (FOMC) noted several risks to growth and getting inflation closer to its 2% target; but kept the possibility of further rate hikes this year on the table due to the strength in the labor market. A majority of the Fed seems to still want to move toward normalization, but they also don’t want to have to undo actions that may be premature. A lot can and will happen between now and the Fed’s March meeting but it seems increasingly likely that it will remain on hold at least through the first quarter.

PMIs: an early look at how 2016 is shaping up

Schwab Market Perspective: Watching And Waiting

February 5, 2016

« Previous Article

| Next Article »

Login in order to post a comment