Key Points

• Investors were taken on a wild ride through the first quarter. However, the second quarter is starting within shouting distance of the year’s starting mark. We believe the trend is generally higher, but bouts of volatility are likely to persist.

• Potential Federal Reserve action will likely stay at the forefront of investors’ minds, with some conflicting messages coming after its recent meeting adding to the consternation. This being a Presidential election year could make things a bit more interesting as we march toward November.

• Emerging markets have surged ahead, aided by a weaker U.S. dollar. Action has been encouraging but future gains likely hinge on improving global growth.

A lot of movement, little progress

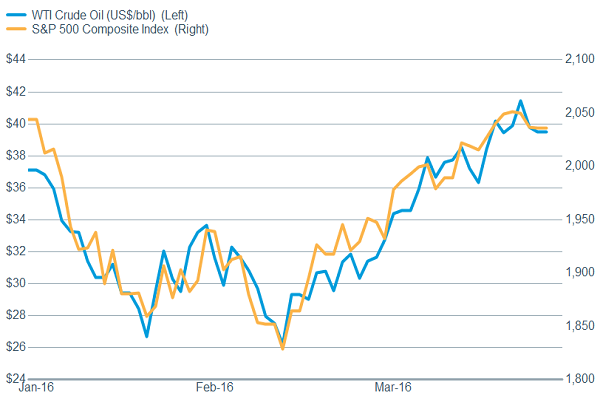

It was a quarter for the history books, but if one were to just look at the starting and ending point for equities you’d wonder what the fuss was about. We saw ramped up fears of both a global and domestic recession push stocks substantially lower and into correction territory. But on February 11, a rally ensued that brought equities back to within shouting distance of the flat line for the year. Recession fears faded with better data, and sentiment was aided by a dovish Federal Reserve meeting that saw forecasts for rate hikes this year move to two from four. Commodities also staged a nice turnaround, aided by a flattish to slightly weaker U.S. dollar, while oil and stocks continue to trade in pretty tight lockstep.

Stocks and oil continue to trade together

Source: FactSet, Dow Jones & Co. As of Mar. 28, 2016.

On to the second quarter

We remain neutral on equities—meaning investors should remain at their long-term equity allocations—and believe 2016 is shaping up to be much like the first quarter, volatile at times but generally trending higher. As long as the oil/stocks correlation remains elevated, continued improvement in the stock market may hinge on the path of oil prices. With oil inventories at historic highs and the ability of oil rigs which have been shuttered to restart in relatively short order, it’s tough to paint a picture of oil moving substantially higher from here over the course of the year. But as we’ve noted before, gross domestic product (GDP) growth has typically been boosted by a fall in oil prices with about a year lag, which could bode well for potential upside surprises in 2016. However, companies remain cautious and apparently reluctant to spend on capital improvements to any great degree. Their preference appears to be adding to the labor force as 215,000 jobs were added during the month of March. The calculation appears to be that given the uncertainty of economic developments, companies believe it’s easier to lay off employees if necessary, rather than trying to get rid of equipment at fire sale prices.

All of this plays into the upcoming earnings season, which is projected to be relatively weak, with another negative growth rate expected. This sets up the potential for upside surprises, but with stocks at what we consider about fair value, stronger earnings are likely needed before stocks can move demonstrably higher. We’ll be watching the reporting season to see whether companies are seeing an uptick in demand and gaining any real measure of pricing power.

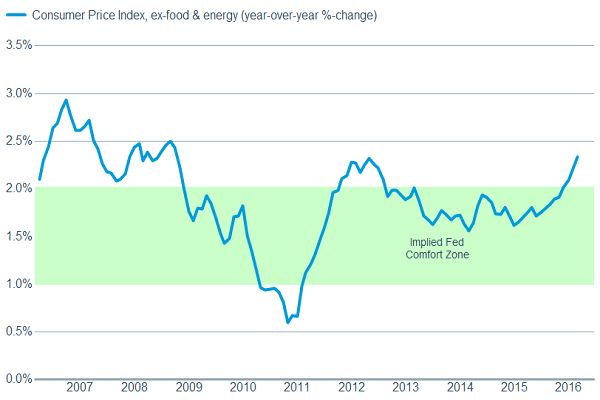

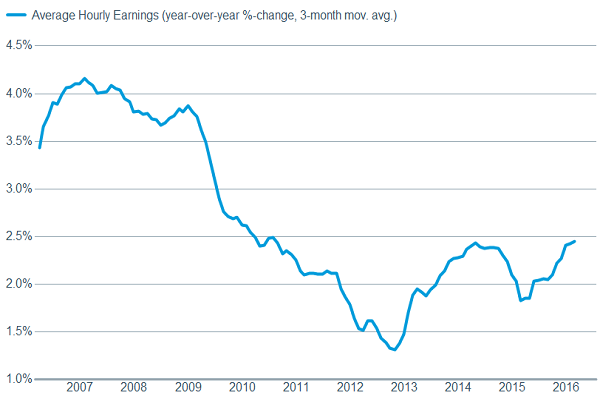

We are starting to see signs of inflation ticking higher, which could help companies’ profit margins—although wages are also showing signs of moving higher, with average hourly earnings rising by 2.3% year-over-year in the latest report.

Higher inflation could help prices

Source: FactSet, U.S. Dept. of Labor. As of Mar. 28, 2016.

Although rising wages could crimp profits

Source: FactSet, U.S. Dept. of Labor. As of April 1, 2016.

Also encouraging is that the manufacturing sector appears to be stabilizing and even showing some signs of returning to growth. Regional surveys such as the Richmond Federal Reserve Manufacturing Index and the Kansas City Manufacturing Index both posting nice increases, with the former hitting the highest level since 2010. These regional surveys can be quite volatile but we also saw improvement in the national surveys with Markit’s Preliminary Manufacturing PMI bumping slightly higher to 51.4 and remaining in territory depicting expansion, while the Institute of Supply Management’s (ISM) Manufacturing Index moved back into territory depicting expansion at 51.8, encouraging led by the forward-looking new order component rising to 58.3.

Schwab Market Perspective: What A Quarter! What's Next?

April 4, 2016

« Previous Article

| Next Article »

Login in order to post a comment