Key Points

• Investors were taken on a wild ride through the first quarter. However, the second quarter is starting within shouting distance of the year’s starting mark. We believe the trend is generally higher, but bouts of volatility are likely to persist.

• Potential Federal Reserve action will likely stay at the forefront of investors’ minds, with some conflicting messages coming after its recent meeting adding to the consternation. This being a Presidential election year could make things a bit more interesting as we march toward November.

• Emerging markets have surged ahead, aided by a weaker U.S. dollar. Action has been encouraging but future gains likely hinge on improving global growth.

A lot of movement, little progress

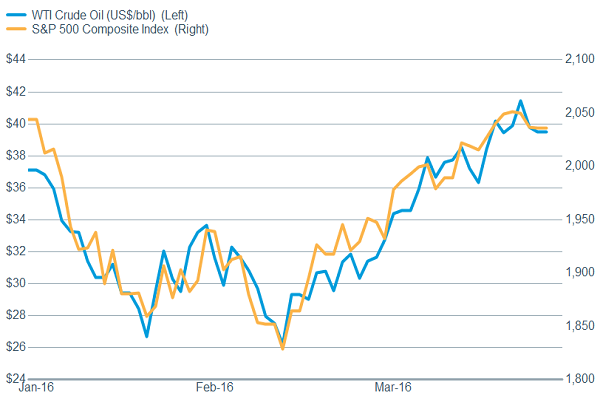

It was a quarter for the history books, but if one were to just look at the starting and ending point for equities you’d wonder what the fuss was about. We saw ramped up fears of both a global and domestic recession push stocks substantially lower and into correction territory. But on February 11, a rally ensued that brought equities back to within shouting distance of the flat line for the year. Recession fears faded with better data, and sentiment was aided by a dovish Federal Reserve meeting that saw forecasts for rate hikes this year move to two from four. Commodities also staged a nice turnaround, aided by a flattish to slightly weaker U.S. dollar, while oil and stocks continue to trade in pretty tight lockstep.

Stocks and oil continue to trade together

Source: FactSet, Dow Jones & Co. As of Mar. 28, 2016.

On to the second quarter

We remain neutral on equities—meaning investors should remain at their long-term equity allocations—and believe 2016 is shaping up to be much like the first quarter, volatile at times but generally trending higher. As long as the oil/stocks correlation remains elevated, continued improvement in the stock market may hinge on the path of oil prices. With oil inventories at historic highs and the ability of oil rigs which have been shuttered to restart in relatively short order, it’s tough to paint a picture of oil moving substantially higher from here over the course of the year. But as we’ve noted before, gross domestic product (GDP) growth has typically been boosted by a fall in oil prices with about a year lag, which could bode well for potential upside surprises in 2016. However, companies remain cautious and apparently reluctant to spend on capital improvements to any great degree. Their preference appears to be adding to the labor force as 215,000 jobs were added during the month of March. The calculation appears to be that given the uncertainty of economic developments, companies believe it’s easier to lay off employees if necessary, rather than trying to get rid of equipment at fire sale prices.

All of this plays into the upcoming earnings season, which is projected to be relatively weak, with another negative growth rate expected. This sets up the potential for upside surprises, but with stocks at what we consider about fair value, stronger earnings are likely needed before stocks can move demonstrably higher. We’ll be watching the reporting season to see whether companies are seeing an uptick in demand and gaining any real measure of pricing power.

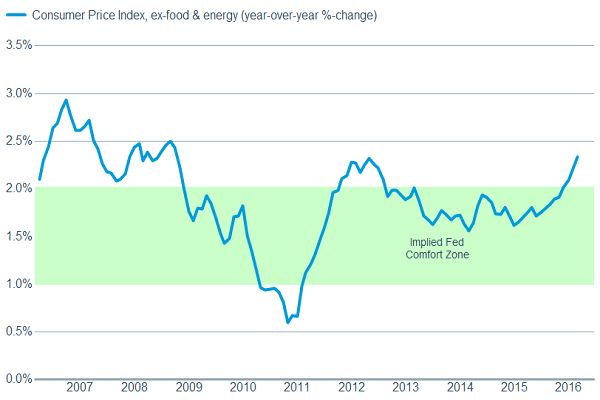

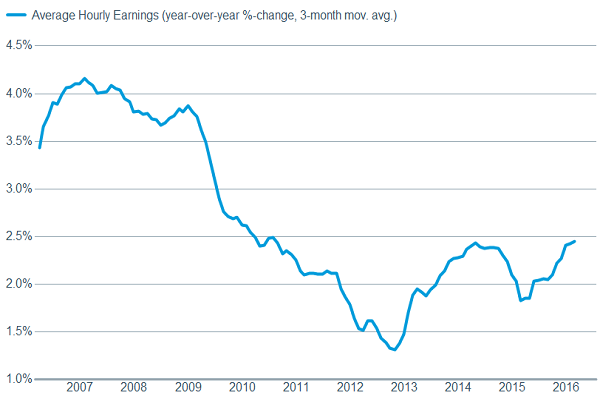

We are starting to see signs of inflation ticking higher, which could help companies’ profit margins—although wages are also showing signs of moving higher, with average hourly earnings rising by 2.3% year-over-year in the latest report.

Higher inflation could help prices

Source: FactSet, U.S. Dept. of Labor. As of Mar. 28, 2016.

Although rising wages could crimp profits

Source: FactSet, U.S. Dept. of Labor. As of April 1, 2016.

Also encouraging is that the manufacturing sector appears to be stabilizing and even showing some signs of returning to growth. Regional surveys such as the Richmond Federal Reserve Manufacturing Index and the Kansas City Manufacturing Index both posting nice increases, with the former hitting the highest level since 2010. These regional surveys can be quite volatile but we also saw improvement in the national surveys with Markit’s Preliminary Manufacturing PMI bumping slightly higher to 51.4 and remaining in territory depicting expansion, while the Institute of Supply Management’s (ISM) Manufacturing Index moved back into territory depicting expansion at 51.8, encouraging led by the forward-looking new order component rising to 58.3.

The U.S. consumer—the lynchpin of the economy—continues to look healthy, with low energy prices, low unemployment, higher wages, and reduced debt loads. But they also are maintaining a deleveraging mindset, which suggests only modest U.S. economic growth. Housing has been a strong point but has recently shown signs of leveling off a bit as existing home sales fell 7.1% in February, but did rise 2.2% year-over-year according to the National Association of Realtors; while new home sales rose a relatively benign 2.0% according to the US Department of Housing and Urban Development. Mortgage rates remain historically low and data shows that, although delayed, the millennial generation is increasingly looking to settle down with families and buy homes, which should continue to provide an upward push to housing.

A muddled picture to us…and them

Given this relatively muddied picture with a lot of room for interpretation, it makes sense that the leaders of the Federal Reserve have had some disagreements about the course of monetary policy. Although the last meeting was largely viewed as dovish, with interest rate hike forecasts being reduced and concern over global growth issues being expressed, there was one dissenting vote that preferred a rate hike. That’s only one vote, but after the meeting a couple of Fed presidents have sounded a bit more hawkish than did Chairwoman Yellen did at her press conference following the meeting. In addition, she arguably doubled down in a dovish speech this past week. The April Fed meeting is not off the table for a hike, but June seems more likely. We continue to believe the Federal Open Market Committee (FOMC), in general, wants to get to a more “normal” level of interest rates but that they’ll continue to be cautious about how they go about it. As we’ve shown in the past, historically, stock performed much better when the Fed was moving slowly, as will likely be the case this cycle.

Also a contributor to volatility will be the ramped up rhetoric from both sides of the aisle as we move closer to the November Presidential election. While it may be discouraging at time, resist the urge to think all is lost, or believe those that say it’s never been this bad. According to the Republican National Convention, there have been two contested contests in recent history, neither of which resulted in the dissolution of the party, while the Democrats managed to survive their very turbulent 1968 convention that at least partially contributed to riots in the streets of Chicago. And just when things seem like they can’t get any worse, remember 1804 (and the subject of the hottest show on Broadway) when a simmering political rivalry, which featured much name calling and insult hurling (sound familiar?) resulted in a duel (with guns) that saw a sitting Vice President shot and kill a former secretary of the Treasury—and the US managed to prevail through that as well. So stay calm and until we have the two final candidates—each of whom will have to put forth actual policy proposals—we believe the election will not be a major market volatility contributor.

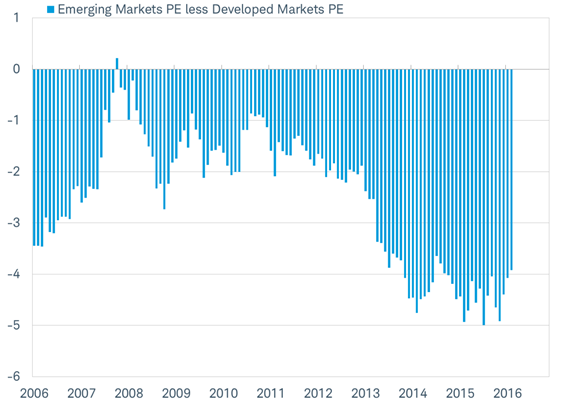

Return of the bull: emerging markets

Looking elsewhere around the globe, in recent weeks investors have been buying up emerging market stocks in their search for bargains, pushing the MSCI Emerging Market Index to its biggest monthly gain since January 2012. In fact, it was an emerging market exchange-traded fund (ETF) that had the largest inflows of any ETF over the past month as of March 29, according to data from Factset. Emerging market stocks had been trading near the widest discount to developed market stocks in over 10 years, as you can see in the chart below. The forward price-to-earnings ratio of the MSCI Emerging Market Index is 11.1 compared with the 15.0 for the MSCI World Index, per data from Factset.

Emerging market stocks had been trading at a steep discount to developed market stocks

Source: Charles Schwab, Factset data as of 3/28/2016.

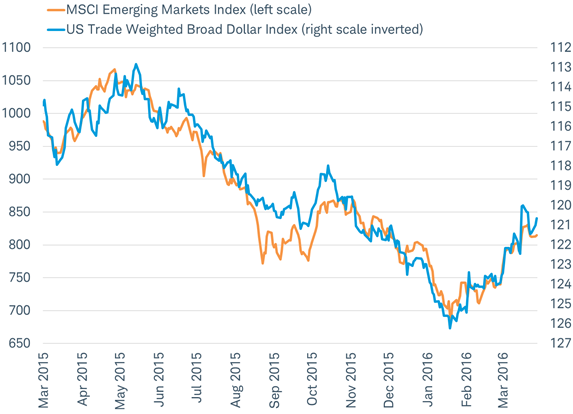

Emerging markets (Ems) are attractive to many long-term investors. However, as we wrote last fall after a rebound investors shouldn’t mistake the 20% rebound seen in emerging markets over the past two months as an all-clear sign to overweight this asset class in their portfolios. The start of the latest bull market (defined as a gain of 20% or more) in emerging market stocks followed the rebound of commodity prices that began on January 20. The powerful gains were sustained by a weaker dollar as the market reassessed the outlook for Fed policy. In fact, the MSCI Emerging Markets Index has tracked the moves in the broad trade-weighted dollar closely over the past year, as you can see in the chart below where the dollar index is inverted. Now that oil has rebounded by about 40%, the broad trade-weighted U.S. dollar has reversed five months of gains with a more than 5% decline…further gains may require improving growth prospects.

Emerging market rebound closely tied to dollar moves

Source: Charles Schwab, Bloomberg data as of 3/29/2016.

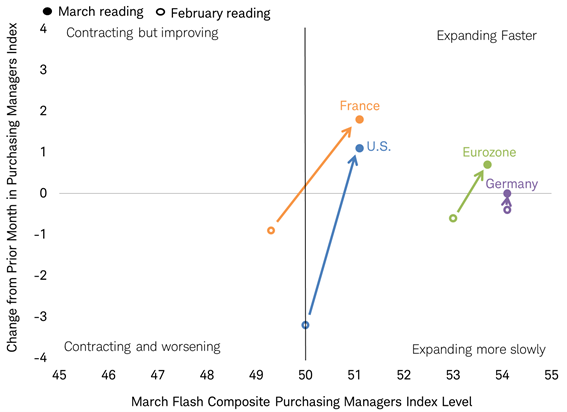

Fortunately, global growth may have improved in March after a weak start to the year. An early read on prospects for global growth is provided by the flash readings of the Markit purchasing managers’ indexes (PMIs) for March. While there are only four data points available, the preliminary figures showed an improvement from February. Each country’s flash reading (with the Eurozone influenced by member countries Germany and France) saw an improvement and were above 50, the key level for growth in these economies. More March economic data will be reported in the coming days and weeks which may determine the durability of the emerging bull market in emerging market stocks.

March saw an improvement in the flash purchasing managers’ indexes from February

Only the four countries referenced have flash PMI readings for March.

Source: Charles Schwab, Bloomberg data as of 3/28/2016.

So what?

The first quarter was the proverbial roller coaster, with stocks experiencing extreme volatility, but ultimately ending up back where they started. We continue to believe U.S. stocks are in a secular bull market; but in a more mature phase which will be dotted with volatility and pullbacks. Corporate earnings likely need to recover before stocks can move demonstrably higher. More clarity from the Fed and a better political environment would help, but both seem unlikely in the near term. However, a more dovish tone from the Fed has aided in some recent dollar weakening, which has boosted emerging markets’ performance. While it is an encouraging development, stay disciplined and diversified as we watch to see if global growth can improve.

©Charles Schwab & Co.