After the housing crash and resulting financial crisis, investor attention was quite understandably laser-focused on the housing market’s recovery. Now that the crisis has faded and housing has largely recovered, there has been less attention paid to this area of the economy. But it’s important to keep tabs on housing, as it can have a big impact on the economy overall—as we’ve certainly seen—and on various sectors and industries, beyond just homebuilders.

Of course, we all recognize that a house is typically the largest purchase most Americans make, and will probably make up a decent portion of their net worth. And most have heard of the so-called “wealth effect,” in which increased financial wealth translates into more spending by consumers. But what part of that impact is from housing, as opposed to stock or other asset appreciation?

We can estimate that, thanks to a study1 on wealth effects that was further developed by Ned Davis Research. We’ll spare you the relatively complex equation that was developed and get to the conclusion: They found the housing impact on spending was substantially greater than the impact of an overall increase in real financial wealth (the inflation adjusted total asset value). Specifically, a 1% increase (or decrease) in real housing wealth leads to a 0.12% increase (or decrease) in real personal consumption expenditures (PCE), while a 1% change in real financial wealth leads to a 0.04% change in real PCE.2

In addition to consumer spending, which is the lifeblood of the American economy, housing can have an impact on the financials sector, through mortgages and insurance; the utilities sector, through new customers; the materials and energy sectors, due to the materials needed to build new houses; and on and on.

So where does housing stand now?

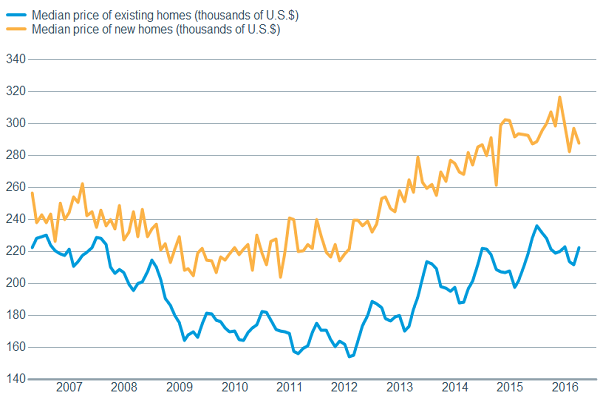

To get to the punchline: We’d say good, but not great. First, prices have increased on new and existing homes, which—given the above information—potentially bodes well for the American economy.

Home prices are trending higher...

Source: FactSet, National Association of Realtors. As of 4/26/2016.

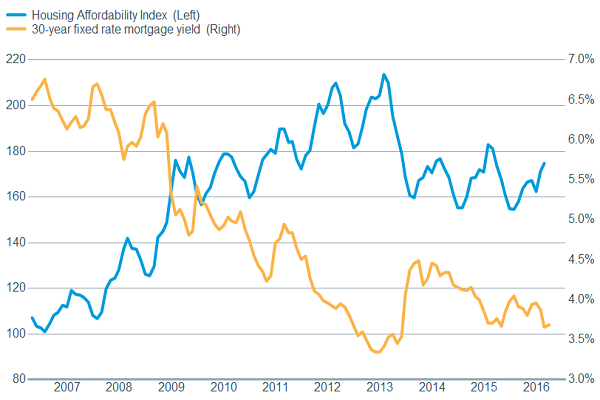

Those rising prices have reduced housing affordability. However, given the continued extremely low interest rate environment and the uptick in wages we’ve seen, affordability still remains fairly good.

…leading to a decrease in housing affordability.

Source: FactSet, National Association of Realtors, Federal Home Loan Mortgage Corporation (Freddie Mac). As of 4/25/ 2016. The Housing Affordability Index measures whether or not a typical family earns enough income to qualify for a mortgage loan on a typical home at the national and regional levels based on the most recent price and income data.

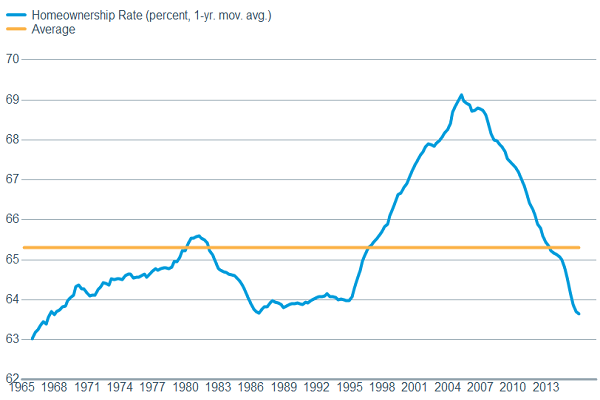

The prospects for further improvement seem solid at this point, although a wild card continues to be the degree to which the so-called millennial generation will enter the homeowner market. As you can see, the homeownership rate is well below its historical level, due at least in part to millennials being slow to buy homes. In fact, according to the Department of Commerce and Goldman Sachs Global Investment Research, the share of 18- to 34-year-olds living with their parents increased from below 27% before the financial crisis, where it had been roughly for the previous two decades, to over 31%, where it has remained for the past five years. A return to the longer-run average, with more young adults living independently, likely would boost the overall U.S. homeownership level.

Homeownership levels are below average

Source: FactSet, U.S. Census Bureau. As of 4/25/2016.

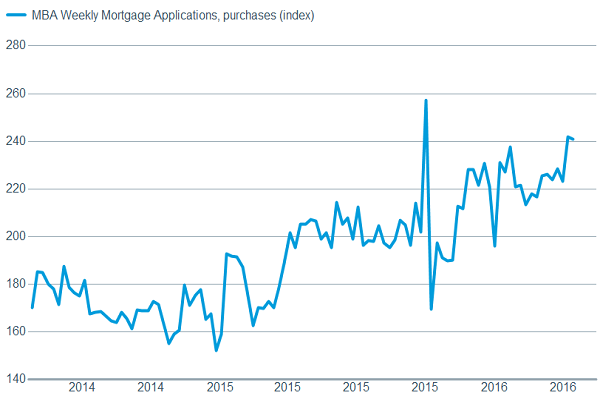

But we have heard anecdotal stories of millennials increasingly shift to a more traditional American way of living, including owning a home, although at a later age. It’s too early to tell if that is a substantial and sustainable trend, but an increase in mortgage applications for purchases may bode well.

Increase in mortgage applications is encouraging

Source: FactSet, Mortgage Bankers Association. As of 4/25/ 2016. MBA's Weekly Applications Survey offers a comprehensive analysis of mortgage application activity. The Purchase Index includes all mortgages applications for the purchase of a single-family home. It covers the entire market, both conventional and government loans, and all products. The Purchase Index has proven to be a reliable indicator of impending home sales.

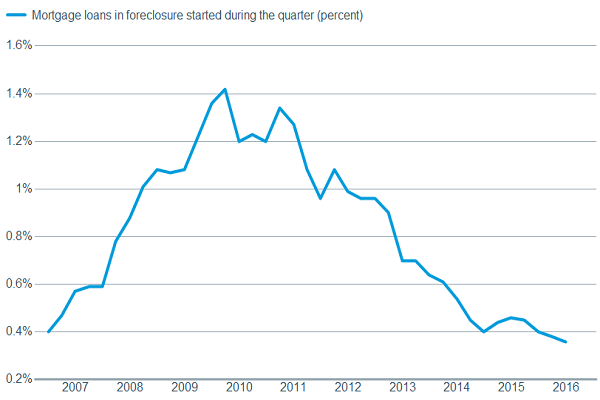

Finally, we’ve seen the number of homes in foreclosure greatly decline. Meanwhile, folks that may have been involved in a foreclosure or a short sale during the housing crisis are now starting to be able to access mortgage funding again.

Foreclosures down sharply

Source: FactSet, Mortgage Bankers Association. As of 4/25/ 2016.

So what does it all mean? To us, the housing market looks healthy and should continue to improve, but higher prices and still-cautious consumers and homebuilders could weigh on the pace of improvement. The strengthening housing market should provide at least a modest tailwind to both the overall economy and the American consumer, although not to the point that we are looking at upgrading the consumer discretionary sector at this point. Finally, the increase in loan demand and the decrease in foreclosures should aid the financials sector, potentially providing support to our current outperform rating on the group.

1 Case, Karl, Quigley, John, Shiller, Robert. “Comparing Wealth Effects: The Stock Market Versus the Housing Market.” National Bureau of Economic Research Working Paper No. 8606, November 2001.

2 Source: Ned Davis Research

Brad Sorensen, CFA, is managing director of market and sector analysis at the Schwab Center for Financial Research.