Charles Schwab & Co. may have joined the ETF party late in the game, but the discount brokerage is breaking new ground with expense ratios that undercut everyone else in the industry.

The low-cost gamble, which started in November 2009 with the launch of four equity ETFs bearing the Schwab name, quietly raised the stakes for Vanguard, the longtime venerated price chopper. Investors seem to be benefiting from the competition. When Schwab came out with one of its first ETFs, the U.S. Broad Market (SCHB) fund, its 0.08% expense beat the similar Vanguard Total Stock Market (VTI) by one basis point. Since then, both firms have lowered expense ratios on those ETFs by two basis points-certainly not a savings landslide, but enough to suggest that each is looking over its shoulder to see what the other is doing.

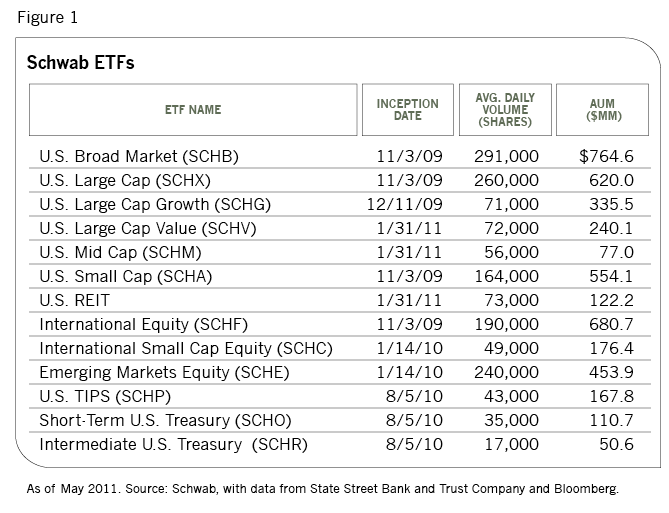

Rock-bottom expenses, along with commission-free trades on its lineup, have given the funds a running start. By the end of May, the 13-member lineup had $4.4 billion in assets, up from $1.2 billion a year earlier, according to the National Stock Exchange.

With over $120 billion in ETF assets custodied at the firm, the opportunity for expansion is huge, says Tom Lydon, the president of Global Trends Investments who also runs the Web site ETFTrends.com. "As the largest custodian of ETF assets in the U.S., Schwab made the right strategic move to be competitive in this space. More advisors are shifting assets to ETFs, and they're being more tactical and opportunistic in their investment disciplines." About 84% of financial advisors who trade through Schwab use ETFs in their strategies, according to a recent firm survey, and about one-third plan to use more of them in the future.

Individuals were the first to home in on the new funds when they first came out, says Tamara Bohlig, vice president of product management at Schwab. Now, she says, financial advisors account for about half of all shareholders. "In the mutual fund world, advisors usually like to see a three-year track record, so the uptake on the ETFs has been much faster than we anticipated," she says.

Still, many investors aren't biting yet. "Advisors often take a wait-and-see attitude before they move in," says Bohlig. "But we think that the combination of low expense ratios and commission-free trades are going to resonate with a lot of them."

With its move into exchange-traded funds, Schwab has run the risk of cannibalizing assets from its own stable of equity index mutual funds, the first of which became available in 1991. The largest, the Schwab S&P 500 Index fund (SWPPX), has more than $11 billion in assets. The oldest member of the firm's indexing group, the Schwab 1000 Index fund (SNXFX), spreads a relatively plump 0.29% expense ratio over on a $5 billion asset base.

So far, though, there's little evidence of intra-family asset grabbing. Most of the new money for Schwab's ETFs come from individual securities sales or cash rather than the company's index mutual funds or its other mutual fund products, says Bohlig.

Schwab has an incentive to make ETFs the indexing format of choice for investors. Compared to mutual funds, exchange-traded funds are much less expensive to administer and easier to launch. They tend to attract larger investors than Schwab's index mutual funds, which have an investment minimum of just $100.

The ETFs typically draw more sophisticated individual investors and financial advisors, many of whom already trade on the company's brokerage platform. According to data provided by Schwab, the average order size of its ETF lineup ranges from $11,000 for its small-cap international product to $46,000 for a short-term Treasury offering.

But smaller investors could also be brought into the ETF loop, since the no-commission feature makes it more financially feasible to invest small amounts. It also paves the way for dollar cost averaging into the funds, which would be prohibitively expensive and cumbersome with a commissioned trade. But Bohlig sees little evidence of such small investor strategies in the ETFs, at least not yet.

Schwab is also focusing on exchange-traded funds because it plans to launch a 401(k) platform that offers them as the exclusive investment choice. This plan package, scheduled to become available to employers in 2012, could dramatically boost market share for the Schwab ETF offerings if it catches on.

Should advisors bite?

While low-cost, no-commission trading is a big plus, as are Schwab's name and indexed mutual fund experience, the challenge for the firm will be to differentiate the 13 ETFs and the indexes they follow from similar ones launched years ago by more established players such as BlackRock, State Street and Vanguard. The asset classes covered by the ETFs include already-saturated market segments such as broad market, large cap, small cap, REITs and emerging markets.

Yet for some, even minor differences in indexes offer sufficient reason to make the switch. David Cowles, the director of investments at Mosaic Financial Partners in San Francisco, began investing in Schwab International Equity (SCHF) soon after it came out. The ETF, which covers large-cap stocks outside the U.S., uses the FTSE Developed ex-U.S. Index of 1,400 international stocks. About 9% of its assets are in Canadian stocks, which aren't included in the MSCI EAFE Index that many other ETFs follow.

"Before the Schwab ETF came out, we were using a Vanguard ETF and also buying a Canada-only ETF to gain exposure to that country," he says. "Now, we can just buy the one investment instead of two."

The commission-free trades weren't a huge draw for Cowles, whose firm practices long-term strategic allocation and doesn't do a lot of trading.

The funds' lower expenses didn't sway his decision much either, since they only beat the competition's by a slim margin.

With an expense ratio of just 0.06%, the $740 million Schwab U.S. Broad Market has the distinction of being the lowest-cost ETF in the world. But it's just a tad cheaper than Vanguard Total Market, which clocks in at 0.07%, and it's still within shouting distance of the expenses for the iShares Russell 3000 (IWV) and the SPDR Total Market (TMW) funds, which charge 21 basis points and 20 basis points, respectively. At 35 basis points, the most expensive Schwab fund, International Small Cap Equity, undercuts the equivalent Vanguard and iShares funds by only about 5 basis points.

Cowles and others worry that the advantage of lower expenses may be offset by lower trading volume among some of the ETFs. In eight of them, the average daily trading volume falls under 100,000 shares. In four, it's less than 50,000 shares.

Among the more thinly traded funds, Schwab International Small Cap Equity (SCHC), for example, has $176 million in assets under management and average daily trading volume of 49,000 shares. A similar fund, iShares MSCI EAFE Small Cap (SCZ), has a $1.6 billion asset base and average daily trading volume of 279,000. Schwab U.S. Mid-Cap (SCHM) trades 56,000 shares a day compared to over 2 million shares for the SPDR S&P Mid-Cap 400 (MDY). The most thinly traded offering, Intermediate U.S. Treasury, has daily trading volume of just 17,000 shares.

Though the funds have fewer shares in circulation than more established offerings, the bid-ask spreads have been fairly narrow for those broad market funds that have been around for a year or more. Schwab U.S. Broad Market and Schwab U.S. Large Cap, for example, have average daily trading volume of 291,000 shares and 260,000 shares, respectively, and modest bid-ask spreads of around four basis points. The 22-basis-point bid-ask spread for Schwab International Small-Cap Equity is somewhat higher, but not outrageous given that it covers less liquid markets. The same holds true for Emerging Markets Equity, which has a 13-basis-point spread.

"My baseline for reasonable liquidity is trading at least 100,000 shares a day, and only five of the Schwab ETFs do," says Carolyn Hill, an ETF analyst at Indexuniverse.com. "Larger investors may still have trouble with Schwab's less liquid ETFs."

Hill believes that while Schwab's low expense ratios and the commission-free trades on its platform have been very effective in drawing investors, the build-out is likely to be a gradual one. "At this point, Schwab's ETFs are making more of a ripple than a splash. But over the long haul, that ripple could turn into a more significant wave."