KEY TAKEAWAYS

• We continue to expect that the Fed won’t raise rates until the December 2016 meeting, but a potential path to a September hike also exists.

• Key items to watch for a possible September hike include U.S. manufacturing, financial conditions, the labor market, wage inflation, foreign central banks, and comments from key Fed officials.

As of Monday, August 1, 2016, the fed funds futures market is pricing in less than a 20% chance that the Federal Reserve (Fed) raises rates by 25 basis points at the conclusion of its next policy meeting on September 21, 2016. This assessment is the result of the Federal Open Market Committee (FOMC) statement released on July 27, 2016, which provided no hint of a hike as soon as September, and a weaker than expected report on gross domestic product (GDP) in the first half of 2016, released on Friday, July 29, 2016. We continue to expect that the Fed will raise rates once this year, likely at the December 2016 meeting. However, there is likely a narrow path to a September hike, which includes U.S. manufacturing, financial conditions, the labor market, wage inflation, actions of foreign central banks, and of course comments from key Fed officials. We’ll take a look at that potential path in this week’s report.

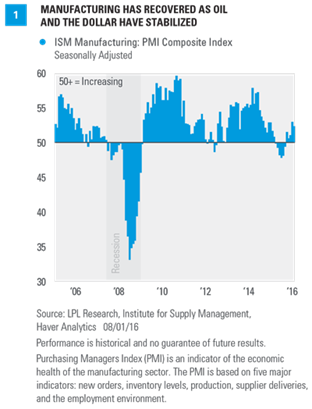

U.S. MANUFACTURING

As this commentary was being prepared for publication, the Institute for Supply Management (ISM) released its manufacturing index for July. The index was at 52.6 in July 2016 versus 53.2 in June 2016. The 52.6 reading in July 2016 was the fifth consecutive reading over 50, indicating an expanding manufacturing sector in the United States. The ISM had been below 50 for six months, ending in February 2016, held down by a soaring U.S. dollar and plunging oil prices. Another ISM report is due out on September 1, 2016, and in order for the Fed to consider raising rates on September 21, 2016, the September ISM report — along with the other key reports on the health of the manufacturing economy due out over the next seven weeks — would have to continue to show solid improvement despite another leg down in oil prices in recent weeks and a modest move higher in the value of the U.S. dollar after the Brexit. In short, the timing of the next Fed rate hike remains “data dependent.”

These reports include:

• Industrial production for July (released August 16, 2016) and August (September 15, 2016)

• Markit PMI for manufacturing for August (August 24, 2016)

• Orders and shipments of durable goods for July (August 25, 2016)

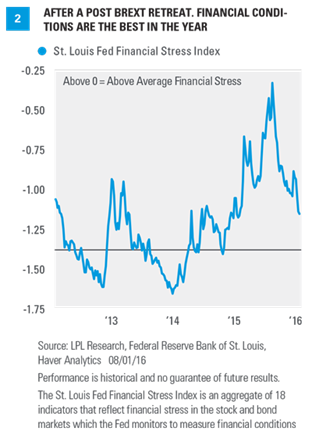

FINANCIAL CONDITIONS

Financial conditions are also likely to play a key role for the Fed over the next seven weeks. In a sense, tighter financial market conditions do the Fed’s work for them, and policymakers won’t want to “overtighten” policy in the current, somewhat fragile economic environment. As measured by the St. Louis Fed’s Financial Stress Index, financial conditions in early August 2016 are the most accommodative since just prior to the spike in financial stress following the Chinese yuan revaluation in August 2015. Over the final few weeks of July 2016, the initial post-Brexit tightening of financial conditions seen in late June and early July 2016 has more than reversed, and if that trend continues — aided by a weaker dollar, stabile oil prices, more bank lending, and narrower credit spreads — the Fed may be in a position to act in September.

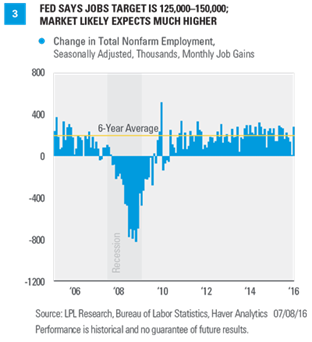

LABOR MARKET & WAGE INFLATION

Further progress on the labor market and wages also remain key to a Fed rate hike in September. This Friday, August 5, 2016, the U.S. Bureau of Labor Statistics (BLS) will release its July employment report. The August employment report is due out on Friday, September 2, 2016. In addition to those two crucial reports, the weekly readings on initial claims (released every Thursday morning), along with the July and August Job Openings and Labor Market Turnover Summary reports (JOLTS) due on August 10, 2016 and September 7, 2016, will provide the FOMC with plenty of information on the health of the labor market and the pace of wage pressures in the economy for July, August, and early September. We continue to expect that monthly job growth, which averaged 200,000 per month from mid-2010 through early 2016, will continue to decelerate and move into the 120,000 to 150,000 range by the end of the year.

Despite that deceleration, the pace of job gains should still be enough to tighten the labor market and push up wages, and ultimately, inflation, and help prompt the Fed to act to raise rates in December. However, if there are strong (200,000+) readings in both the July and August jobs reports, initial claims remain near 250,000 per week, wage inflation moves from 2.6% in June to closer to 3% by August, and the JOLTS data continue to show record high levels of job openings and quit rates (the percentage of job leavers who leave their jobs voluntarily), the Fed may be in a position to raise rates in September. The Fed’s next Beige Book, due in early September, will also contain key information on wage pressures in the economy that will be closely watched by Fed officials. (The Fed’s Beige Book is a qualitative assessment of economic, banking, consumer and labor market conditions in each of the 12 Fed districts.)

TIMELINE: LABOR MARKET

• August 5, 2016: July Employment Report

• August 9, 2016: July JOLTS

• September 2, 2016: August Employment Report

• September 7, 2016: July JOLTS

CENTRAL BANKS

Late last week, Japan’s central bank, the Bank of Japan (BOJ), met and did increase the size of their quantitative easing program, though they did not take interest rates further into negative territory. The next BOJ meeting is the same day as the September FOMC meeting (September 21, 2016), and between now and then the Japanese government is expected to enact fiscal policy to help the Japanese economy escape deflation. The Bank of England (BOE) meets this week and is expected to cut rates to aid the U.K.’s post-Brexit economy. The BOE meets again on September 15, 2016, a week before the next FOMC meeting. The European Central Bank next meets on September 8, 2016, and is currently in a “wait and see” mode, but is leaning toward more easing following the Brexit vote on June 23, 2016, and the results of the European bank stress tests that were released last Friday, July 29.

While the Fed, the BOJ, the BOE, and the ECB all have set meeting schedules and are generally loathe to surprise markets, China’s central bank, the People’s Bank of China (PBOC) does not have a set meeting schedule and its decisions often catch the market off guard. Any action by the PBOC to tighten policy or to dramatically alter the value of the Chinese yuan would make a September Fed rate hike highly unlikely. The global imbalances that buffeted financial markets in early 2016 were mainly the result of discord between the markets and central banks and among the central banks themselves. Six months later, the discord has dissipated somewhat, and that has led to fewer global imbalances, looser financial conditions in the U.S., and less financial market volatility. Any central bank driven unwinding of this 6-month old regime may keep the Fed on hold in September and beyond.

TIMELINE: CENTRAL BANKS

• August 4, 2016: Bank of England Meeting

• August 17, 2016: Minutes of the July 28 – 29, 2016 FOMC meeting released

• August 26, 2016: Fed Chair Yellen speech in Jackson Hole, WY

• September 7, 2016: Fed releases Beige Book

• September 8, 2016: European Central Bank Meeting

• September 15, 2016: Bank of England Meeting

• September 21, 2016: Bank of Japan Meeting

• September 21, 2016: FOMC decision, Yellen press conference and new FOMC economic forecast.

FEDERAL RESERVE

Fed Chair Janet Yellen will address the Kansas City Fed’s annual Monetary Policy Symposium in Jackson Hole, WY on August 26, 2016. Yellen skipped the meeting last year, but in the past, her predecessors — notably Ben Bernanke — have used Jackson Hole as a launching pad for new policies. Bernanke famously hinted at the Fed’s second round of quantitative easing (QE2) in August 2010 and hinted at QE3 at the Jackson Hole symposium in 2012. If the pre-August 26, 2016, data and events we discussed above have lined up on the side of a September hike, we expect to see:

• Stable oil prices and improved manufacturing data

• Looser financial conditions

• Solid readings on the labor market and inflation

Ongoing concord among global central banks Fed Chair Yellen may lay out the case for a September rate hike. If the data are mixed — or worse — Yellen may have to deliver an entirely different message at Jackson Hole.

John Canally is chief economic strategist for LPL Financial.