Rising volatility sends shivers down the spines of Wall Street executives and financial advisors alike. Even in the calmest of markets, volatility is never truly gone. But when uncertainty and fear grip investors, volatility can rise rapidly, creating an environment that whipsaws investment portfolios — leaving investors unsure how to position themselves to try to weather the storm.

Driven by the Federal Reserve's unprecedented monetary policy, which held interest rates near zero for an extended period, volatility levels were largely suppressed relative to historic norms from early 2012 through the middle of last year. Many investors became complacent as a result. Since the May 2015 market high, however, the clouds have once again begun to swirl, creating a sense of urgency for financial advisors to consider tools to mitigate the impact volatility can have on investment portfolios.

Often referred to as the "fear gauge," the "VIX" index (CBOE Volatility Index) is a common barometer market participants use to gauge expected volatility. The VIX is based upon real-time pricing of options on the S&P 500 index and is designed to reflect investors’ consensus view of future (30 day) expected stock market volatility. Levels have historically been as low as nine and as high as 80, with historic averages right around 20. Implied volatility as measured by the VIX has been higher since December 2015, with monthly averages registering the highest that we've seen since the EuroZone crisis in 2011. While nowhere near the levels observed in late 2008, VIX levels are on the rise against the backdrop of a bull market that is now amongst the longest and strongest since the Great Depression.

Why is volatility ratcheting up? As the old adage goes, above all else the markets hate uncertainty — and there is plenty of that to go around, as financial advisors position portfolios for the balance of 2016: uncertainty in the go-forward drivers of global growth, uncertainty in US company earnings growth, uncertainty created by increasingly divergent global monetary policy, and uncertainty about the direction of oil and commodity prices and the related impact on the economy. These sources of uncertainty create a conundrum for investors — where to invest when risk of loss is elevated yet investment options are few?

Why is volatility such a concern for investors?

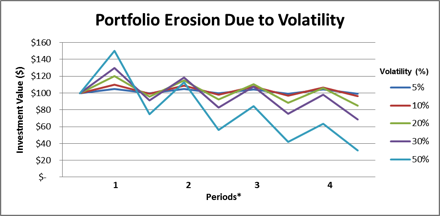

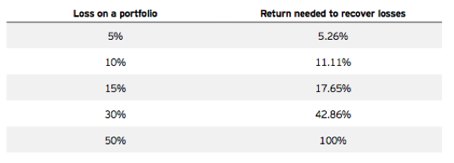

Simply put, it threatens investment outcomes over time. Greater volatility has a negative effect on investments because it erodes assets much faster than assets that exhibit lower volatility. This theme is illustrated in the portfolio erosion graphic and chart below. Each line (level of volatility) shows the impact—up and down—of a move by one standard deviation, the dispersion of a data set from its mean, repeated four times. For those investors with shorter time horizons, volatility heightens the risk that they may not meet their investment objectives and, as a result, managing this risk becomes vital. The challenge is that investors and their financial advisors have become accustomed to both low interest rates and low volatility — a mindset that, in our opinion will need to change to deal with the current reality.

*Each period reflect both an up and down movement of one standard deviation. This is for illustrative purposes only and is not reflective of any past or implied future performance.

Mitigating Risk

What tools can advisors use to address volatility? Diversification across a broad menu of asset classes is a great first step, as some are likely to rise as others fall out of favor. If the mindset is that there will be significant volatility (as individually predicted and defined), then moving assets to cash may also be a strategy. The problem here is that if clients are on the sidelines, even a modest equity upturn will be missed.

A low volatility equity strategy can help investors stay invested in the market by embracing those stocks that have historically exhibited lower levels of risk. In addition, a substantial volume of research suggests that lower volatility equities have outperformed higher volatility equities on both an absolute and risk-adjusted basis over extended periods of time. As with everything there is a catch, however: investors must understand that in strong bull markets low volatility strategies will almost certainly lag. Given how far equity markets have come since early 2009, we see many advisors that are comfortable with the tradeoff of being able to participate in equity market returns while potentially protecting against the more extreme downward movements.

As you consider low volatility investment options for clients, be sure to take a look under the hood. Not all low volatility investment products are created equal. One key consideration is the degree to which the methodology has constraints to force investments to be more "market-like" from a sector perspective. This approach typically tethers the allocation to +/- a certain percentage weight within the parent benchmark index. To help illustrate this point, consider the 33% weight to technology within the S&P 500 at the height of the Tech Bubble in March of 2000. A constrained low volatility approach forces investors to allocate a certain percent of the weight based upon the allocation within parent index, despite the fact that the sector may be in the midst of a meltdown as we saw when the tech bubble burst.

Unconstrained investment offerings tend to be more nimble and will allocate to those stocks that have demonstrated lower volatility versus allocating based upon the sector weight within the parent index. When rebalanced, unconstrained approaches can (and many times do) rapidly shift weight across sectors to maneuver around emerging trouble spots in the market.

Low volatility investments can help investors manage risk and navigate turbulent markets while maintaining equity exposure. Participating in the market's upward movement while potentially protecting against significant downdraft may lead to a smoother ride for investors.

John Feyerer is vice president and director of equity ETF product strategy at Invesco PowerShares.