The financial markets’ summer calm broke recently as new concerns arose about the interest rate outlook. While it’s clear that financial markets have been supported by easy monetary policy, the degree of the support is up for debate. A former Federal Reserve governor recently attributed half of the U.S. stock market gains since 2007 to Fed meeting decision days. Our own research shows this to be an exaggeration — inflated by the market declines during the financial market crisis and also by the dates of measurement. When you include the day after the Fed’s meetings in the analysis (because the Fed’s announcements are made two hours before trading ends), only 11% of the 79% market gain has been tied to short-term Fed-related trading.

Having said this, we have little doubt that the low interest rates resulting from central bank policy have supported risk taking and valuations outside of the bond markets. This makes the economic outlook even more important, because risk assets like stocks need to see corporate earnings continue to grow without the economy overheating and higher interest rates. This benign scenario remains our base case, and recent data generally supports it. U.S. economic data has been mixed, with solid labor market reports offset by slowing in the purchasing manager surveys. European growth has shown minor signs of slowing after the Brexit vote, but is broadly resilient. Private measures of Chinese growth show improving trends over the last year, evidence that China has avoided the feared hard landing this year.

What could lead to a sustained upturn in market volatility during the next year? It could come from the political sphere or through an upending of the current monetary policy environment. Our base case for the U.S. election envisions a continuing split government — which will limit the scope of new policy action. We also face referendums and elections in many of the major European economies during the next year, where populism is likely to continue to push political change and hinder the establishment. The risk to continuation of the predictably easy monetary policy outlook comes from either a change of fundamentals or a change of heart. We don’t see the growth or inflation picture accelerating to push central bankers to a more hawkish position during the next year. A change of heart, where policymakers decide that low interest rates have run their course and a new strategy is needed, will require more time and probably new players.

U.S. EQUITY

• Equity investors reacted nervously to the potential of higher interest rates.

• Equity markets are right to be on alert, but we believe the Fed will proceed with caution.

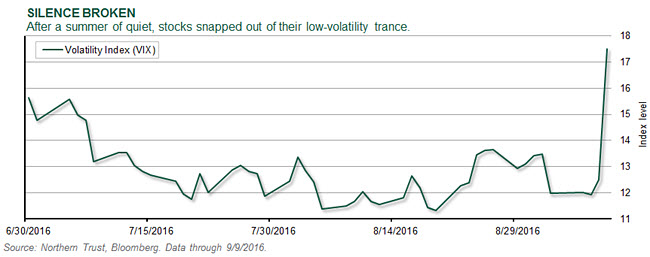

Post-Brexit, equity markets entered a summer slumber — supported by the belief that ultra-accommodative monetary policy would be extended until the effects of Brexit could be fully sorted out. As some of the litany of Fed speakers hinted at a possible rate hike this year, alongside less-dovish developments overseas, equity investors repriced risk into the market. We believe the Fed’s jawboning will remain just that. We see monetary policy discussions focusing on the continued subpar global economic environment, leaving extended financial asset valuations in some markets to regulatory policy. As long as growth remains slow (but positive) and inflation remains below the Fed’s target, we believe the Fed will stay on hold and U.S. equities will remain more attractive than fixed income.

EUROPEAN EQUITY

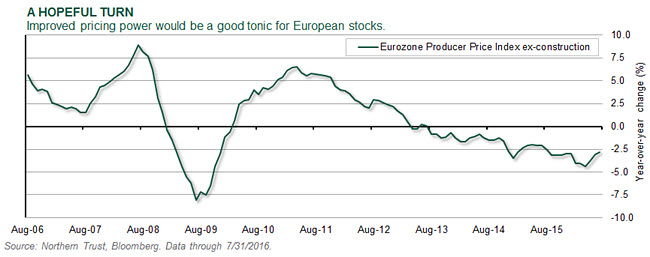

• Deflationary pressure has been rising since early 2013.

• We’re watching for a sustainable upturn which will support pricing power.

The eurozone has been under a deflationary threat for several years now, as evidenced by the declining Producer Price Index (PPI). This is especially important for equities, because the PPI is usually a macroeconomic indicator of supply/demand balance. As equity investors, a large part of our valuation work surrounds the ability to grow revenues over time. A big factor in that growth is the ability to exercise pricing power, which also flows through strongly into profit growth. If we were to see a sustained turn higher in the year-over-year PPI, it would indicate a stronger demand for eurozone companies’ goods and services, leading to better results from equities. While we don’t expect growth to be strong enough to lead to a major upturn, further relief from falling prices would be well received.

ASIA-PACIFIC EQUITY