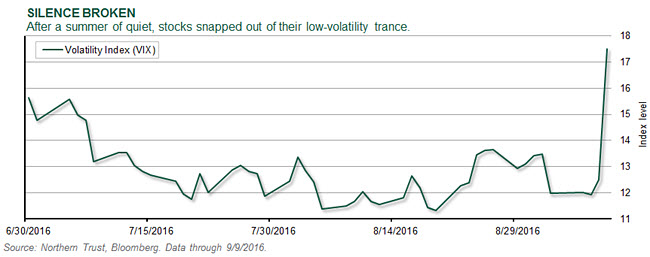

The financial markets’ summer calm broke recently as new concerns arose about the interest rate outlook. While it’s clear that financial markets have been supported by easy monetary policy, the degree of the support is up for debate. A former Federal Reserve governor recently attributed half of the U.S. stock market gains since 2007 to Fed meeting decision days. Our own research shows this to be an exaggeration — inflated by the market declines during the financial market crisis and also by the dates of measurement. When you include the day after the Fed’s meetings in the analysis (because the Fed’s announcements are made two hours before trading ends), only 11% of the 79% market gain has been tied to short-term Fed-related trading.

Having said this, we have little doubt that the low interest rates resulting from central bank policy have supported risk taking and valuations outside of the bond markets. This makes the economic outlook even more important, because risk assets like stocks need to see corporate earnings continue to grow without the economy overheating and higher interest rates. This benign scenario remains our base case, and recent data generally supports it. U.S. economic data has been mixed, with solid labor market reports offset by slowing in the purchasing manager surveys. European growth has shown minor signs of slowing after the Brexit vote, but is broadly resilient. Private measures of Chinese growth show improving trends over the last year, evidence that China has avoided the feared hard landing this year.

What could lead to a sustained upturn in market volatility during the next year? It could come from the political sphere or through an upending of the current monetary policy environment. Our base case for the U.S. election envisions a continuing split government — which will limit the scope of new policy action. We also face referendums and elections in many of the major European economies during the next year, where populism is likely to continue to push political change and hinder the establishment. The risk to continuation of the predictably easy monetary policy outlook comes from either a change of fundamentals or a change of heart. We don’t see the growth or inflation picture accelerating to push central bankers to a more hawkish position during the next year. A change of heart, where policymakers decide that low interest rates have run their course and a new strategy is needed, will require more time and probably new players.

U.S. EQUITY

• Equity investors reacted nervously to the potential of higher interest rates.

• Equity markets are right to be on alert, but we believe the Fed will proceed with caution.

Post-Brexit, equity markets entered a summer slumber — supported by the belief that ultra-accommodative monetary policy would be extended until the effects of Brexit could be fully sorted out. As some of the litany of Fed speakers hinted at a possible rate hike this year, alongside less-dovish developments overseas, equity investors repriced risk into the market. We believe the Fed’s jawboning will remain just that. We see monetary policy discussions focusing on the continued subpar global economic environment, leaving extended financial asset valuations in some markets to regulatory policy. As long as growth remains slow (but positive) and inflation remains below the Fed’s target, we believe the Fed will stay on hold and U.S. equities will remain more attractive than fixed income.

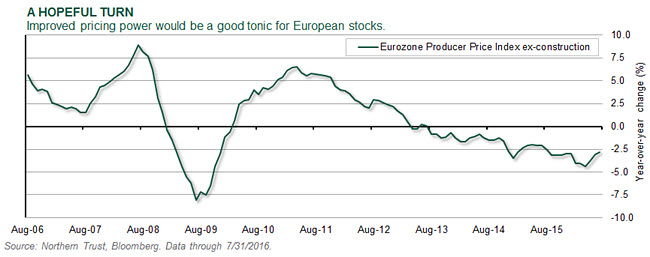

EUROPEAN EQUITY

• Deflationary pressure has been rising since early 2013.

• We’re watching for a sustainable upturn which will support pricing power.

The eurozone has been under a deflationary threat for several years now, as evidenced by the declining Producer Price Index (PPI). This is especially important for equities, because the PPI is usually a macroeconomic indicator of supply/demand balance. As equity investors, a large part of our valuation work surrounds the ability to grow revenues over time. A big factor in that growth is the ability to exercise pricing power, which also flows through strongly into profit growth. If we were to see a sustained turn higher in the year-over-year PPI, it would indicate a stronger demand for eurozone companies’ goods and services, leading to better results from equities. While we don’t expect growth to be strong enough to lead to a major upturn, further relief from falling prices would be well received.

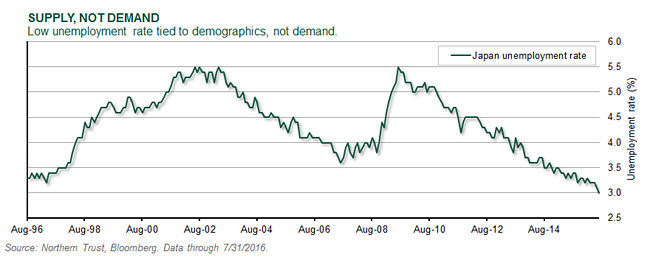

ASIA-PACIFIC EQUITY

• Japan’s 3% unemployment rate is the lowest in the last 20 years.

• We don’t believe the low unemployment rate is a precursor to wage and price inflation.

Although a low unemployment rate is usually the sign of strong demand for labor, we believe it’s more likely to be demographics driving it in Japan. Wage inflation hasn’t increased significantly despite the fact that the unemployment rate surpassed its previous highs back in 2013. We would expect that wage inflation would be higher if the low unemployment rate were driven by corporate demand for skilled labor. Lower wage growth has been a boon to Japanese companies with high levels of domestic labor expense, allowing them to keep costs under control. With recent inflation data the weakest of Bank of Japan (BOJ) Governor Haruhiko Kuroda’s tenure, there’s still considerable pressure on policymakers to improve the growth and inflation outlooks.

EMERGING-MARKET EQUITY

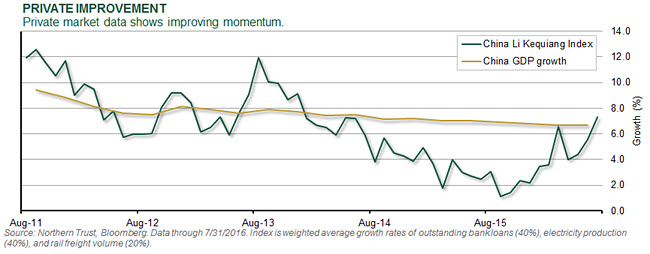

• China’s official economic statistics haven’t shown much rebound.

• Private measures of economic activity show some signs of improvement.

The low volatility in official Chinese economic statistics has both baffled and amused analysts for years. The Li Keqiang Index, named after the People’s Republic of China’s current premier, comprises the three statistics he has said provide a much better read on economic growth: bank lending, electricity production and rail freight volume. As seen in the accompanying chart, this measure of economic activity slowed significantly from August 2013 through August 2015, and has been steadily improving since. In fact, the index reached a low of 1.2% growth in September 2015 and leapt to 7.3% in July. While relying on just three statistics to measure the growth of an economy the size of China’s has its limits, this improvement does match up with the commentary suggesting that Chinese efforts to avoid a hard landing are working.

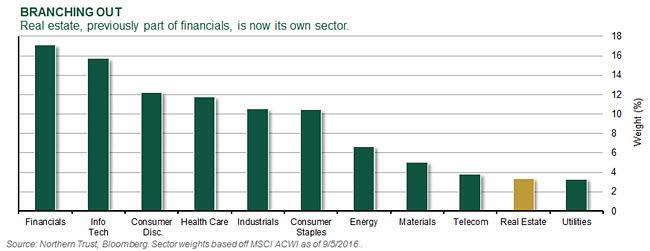

REAL ASSETS

• The new real estate sector represents approximately 3% of global equities.

• Expectations that the new real estate sector will generate new investor interest seem overstated.

The Global Industry Classification Standard (GICS) — used by major equity index providers such as Standard & Poor’s and MSCI — has now moved most real estate companies into their own sector (mortgage REITs will remain in financials). Some are heralding this as a “coming of age” for real estate stocks that will result in a flood of new investor money pushing up stock prices. We aren’t convinced. Real estate companies aren’t being newly added to market indexes such as the S&P 500; they were always there, tucked into the financials sector. In fact, this specification may only make it easier for active strategies to manage to an “ex-real estate” benchmark. That said, we believe real estate stocks can stand on fundamental merits, providing income and diversified risk exposures to the investment portfolio.

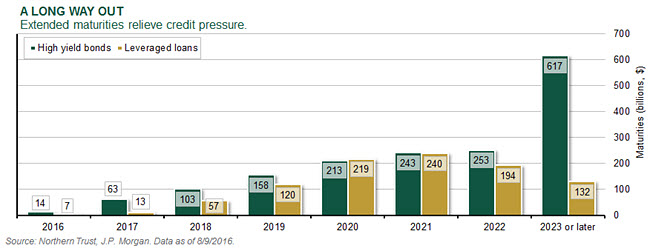

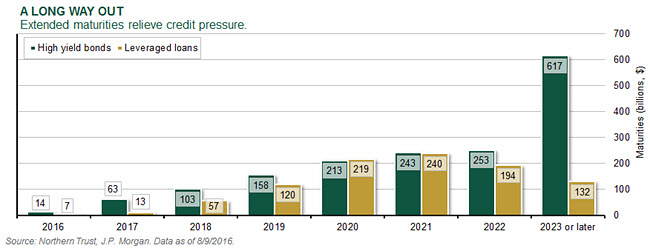

U.S. HIGH YIELD

• The U.S. high yield default rate has increased from 2.3% to 5.7% during the last year.

• A supportive maturity profile will moderate the overall rate.

As expected, the Moody’s U.S. high yield default rate continues to increase from the low levels of the past several years, and is expected to reach 6.2% by year end. The increase has been driven by the commodity sectors, with metals and mining expected to reach an 8.3% default rate while the energy default rate is expected to be 6.4%. Even though defaults are increasing, it’s unlikely to become a broad-based issue. The accompanying chart shows the market’s maturity profile during the next several years, and the refinancing requirement is very low through 2018 and modest through 2022. For context, new issue volume has averaged $302 billion a year for the past four years, while the peak refinancing in 2022 is $253 billion. The modest maturity profile is supportive of the market going forward.

U.S FIXED INCOME

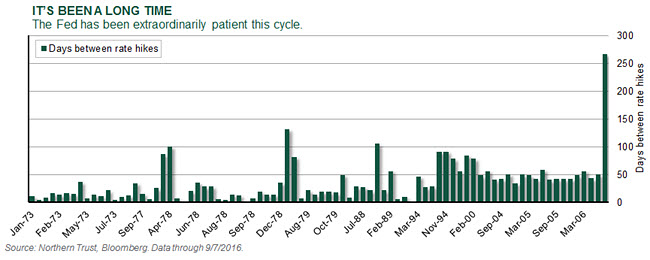

• The Fed’s desire to hike rates continues to be hampered by soft fundamentals.

• We believe the path to higher rates will continue to be slow and measured.

Despite numerous members of the Fed stating that a rate hike at the September meeting is on the table, the markets (and we) remain skeptical. Fed Funds futures, a good gauge of the probability investors assign to the Fed raising rates, signal a probability of around 30% toward a September hike. With the number of days between interest rate increases already 200 days longer than in any other tightening cycle during the past 60 years, this cycle is certainly different. As growth in the United States remains mediocre and inflation muted, we continue to believe the Fed will move at a slow and measured pace. Investors should focus on the projected path of Fed Funds and not the specific timing of Fed activity.

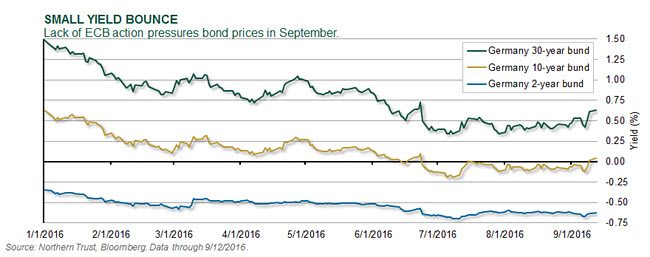

EUROPEAN FIXED INCOME

• The ECB disappointed markets by holding monetary policy steady.

• Brexit concerns have faded as economic data remains resilient.

Investors expecting the European Central Bank (ECB) to announce further measures in September were left disappointed. Although ECB President Mario Draghi confirmed the bank’s easing bias with a focus on evaluating stimulus options, he indicated no discussion for an extension of asset purchases, and the bank’s official forecasts for growth and inflation were largely unchanged. European government bonds sold off sharply following the news, however yields are expected to stay low as the ECB continues its purchases in the bond markets. Markets appear to have brushed off any Brexit concerns as longer-dated Gilt yields approach their highest levels since June. Although the risks remain skewed to the downside, economic data appears resilient, which may warrant the Bank of England to be more patient with regards to monetary policy accommodation.

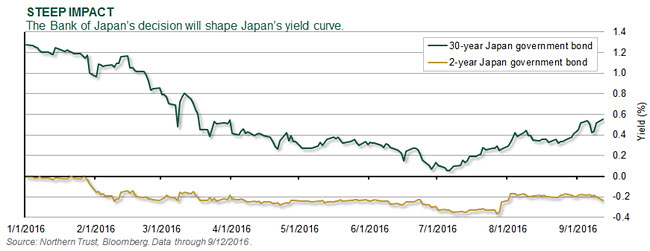

ASIA-PACIFIC FIXED INCOME

• The Japan government bond yield curve steepens as markets contemplate BOJ action.

• China growth concerns have receded along with expectations for interest rate cuts.

The BOJ has dominated headlines with a notable increase in market communications, including the announcement of a “comprehensive” review of its policies in September. This is leading markets to expect further policy adjustments, and the pressure persists with second-quarter gross domestic product growth slowing to a mere 0.2%. As such, the desire for maintaining low short-term rates will remain, although recent rhetoric around the risks of negative long-term yields may signal a change in direction from the BOJ. Chinese concerns have receded, corroborated by a rise in the manufacturing purchasing managers’ index (PMI) to its highest level in almost two years. With signs of an emerging credit bubble, this will be welcomed by the People’s Bank of China as it may give it room to consider nonstandard measures in its pursuit for economic rebalancing.

CONCLUSION

Even though the recent uptick in market volatility is fresh in our minds, it has so far been noticeably more limited than the market downturns earlier this year. The catalyst for this increase in risk aversion was a somewhat nebulous concern about the path of global monetary policy, which we expect to abate over time. The early year selloff was tied to concerns about global economic growth, which has proven unwarranted. The Brexit-related selloff in June also proved to be passing, as the timing of the exit process will be measured in years and the economic impact has been limited so far. These developments comport well with two of our key tactical themes: constrained channel growth and trapped monetary policy.

We see global growth as “constrained in a channel” as slow demand limits upside risk, while a lack of economic excess and monetary policy accommodation limit the downside. This is playing out in the global economy, as recent weaker data in the United States is offset by somewhat stronger data in Europe. As the markets have had occasional growth tantrums, this theme has helped us stay fully invested because we’ve expected growth to “stay in the channel.” Our “trapped monetary policy” theme highlights our view that the Fed will find it difficult to tighten monetary policy given global pressures. Committing to this theme has helped us avoid overreacting to monetary policy tantrums, as recently demonstrated. As we highlighted in our U.S. Fixed Income commentary, we’ve now gone longer between interest rate hikes during this cycle than any cycle during the last 60 years!

We made no changes to our tactical asset allocation recommendations this month, after a relatively active first seven months of the year. We’re frequently asked what would cause us to step back from our moderate overweight to risk assets — a policy that’s been fruitful despite the uptick in market volatility. The most likely catalyst would be a downgrade in our economic growth outlook. We need earnings growth to underpin and grow stock prices, as the support from monetary policy increasingly fades. While we have had increasing debate about the sustainability of the U.S. expansion, including recognition of the recent weakening of the PMI data, we still believe a slow expansion is the most likely outcome. Our risk cases continue to focus on populist political risk in the United States and Europe, while we also consider some upset to the Fed’s complacent stance as a potential risk during the next year. With investor sentiment still muted, we expect moderate growth along with stable inflation to continue to support risk taking during the next year.

Jim McDonald is an executive vice president and the chief investment strategist for Northern Trust.