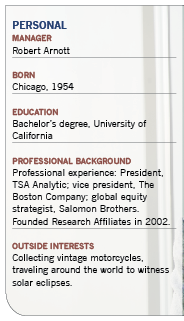

Robert Arnott isn't a big fan of tame hobbies. An avid motorcyclist who has paid six-figure sums for two-wheeled treasures to add to his vintage collection, he has traveled to exotic locales such as Easter Island and Antarctica to witness solar eclipses.

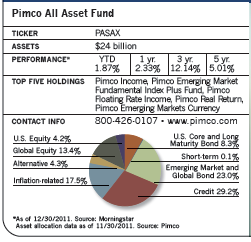

Those rock star pastimes stand in sharp contrast to an investment style that focuses on protecting capital and mitigating risk through broad asset diversification. Unlike traditional mutual fund managers that stick with developed market stocks or bonds, Arnott's broader palette of assets for the $24 billion Pimco All Asset fund includes emerging market debt, global bonds, commodities, international equities and Treasury Inflation Protected Securities (TIPS).

"Most investors build portfolios using stocks for growth and bonds for income," says Arnott, the founder of Newport, Calif.-based Research Affiliates, the only fund subadvisor Pimco has ever hired. "But to provide true diversification, portfolios need a 'third pillar' in the form of an investment that doesn't focus on those mainstream asset classes."

The 57-year-old Arnott, whose firm manages some $78 billion for mutual funds and institutional investors, believes having that third pillar is critical today as investors face the threat of inflation to their portfolios.

In a recent firm newsletter, Arnott opined that inflation "will be a factor in the next decade or two. Unending deficits, massive debt and unfavorable demographics, like low pressure eddies over warm ocean waters, are the kinds of conditions that create stagflationary squalls over the next decade or more. The beach days are over. It's time to get to work, carefully and deliberately-building protection from the greatest threat to our portfolios."

Such dire warnings may seem Chicken Little-like in a slow-growth economic environment in which inflation has been relegated to the back burner for several years. But Arnott argues that the warning signs of its growing presence aren't too hard to find.

Year-over-year inflation stood at around 4% as of December 2011, a figure Federal Reserve Chairman Ben Bernanke has dismissed as a temporary spike. But Arnott maintains that the method the Fed uses to calculate inflation figures masks the squeeze in prices for groceries and other basic necessities and produces figures that are 2% to 4% lower than they would have been under the old calculation method. And if inflation becomes more recognized as a threat, he says, stocks would likely tumble as investors flee riskier assets, while bond prices would fall because of rising interest rates.

While interest rates should remain tame at least through the next few months as the recession lingers, he believes it is likely they will follow the upward march of rising prices by year-end. And with tax receipts down and government spending likely to slow in the face of mounting deficits, a double-dip recession isn't out of the question.

The results of this year's presidential elections, he says, won't change that outlook much. "If Obama gets re-elected in a Republican-dominated House and Senate, we'll get paralysis. If a Republican wins the White House, we may see some spending cuts, but that's going to happen in a very gingerly fashion so that representatives don't alienate their constituencies. There's little to indicate either party will be able to stem the tide."

Positioning The Portfolio

If this bleak scenario Arnott envisions plays out, the Pimco All Asset fund, which invests in a wide swath of asset classes through corresponding Pimco mutual funds, would likely outperform its pure equity peers. (Another fund Arnott manages, the $14 billion Pimco All Asset All Authority portfolio, takes the concept a step further by amplifying bets with short positions and leverage when its manager believes doing so is warranted.)

In 2008, Pimco All Asset fell only 16% for the year. That was less than half the decline of the S&P 500 and six percentage points less than the average fund in Morningstar's moderate target risk category. But if the stock market picks up steam, the fund could lag pure equity offerings. That happened in 2009, when the S&P 500 index's 26.5% return topped its 22% increase in value.

Eschewing such benchmarks, Arnott has fashioned his own bogey, the Consumer Price Index (CPI) plus 5%, and aims for "modest volatility in between that of stocks and bonds." The CPI plus 5% is a long-term goal, though, and the fund often deviates considerably from it from year to year. In 2009, its 22.2% return was nearly triple that of its benchmark. In 2008, the benchmark was up 5.2%, while the fund declined 16%.

Morningstar analyst Ryan Leggio observed in a recent report: "Arnott's sensible strategy and big tool kit has kept the fund ahead of the pack. A disciplined process is required to endure bull-market underperformance and to leap into equities as the markets plunge. Long-term investors should find a lot to like here."

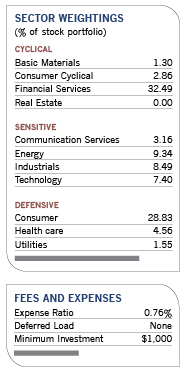

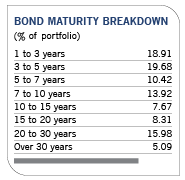

To craft an asset allocation strategy, Arnott relies on quantitative models that factor in growth, yield and valuations, and he uses a roster of 25 Pimco funds to fill out the portfolio's eight designated strategy sleeves. Those include short-term bonds; U.S. core and long maturity bonds; emerging market global bonds; credit; inflation-related bonds; U.S. equity; global equity; and alternative strategies.

The top five funds, which account for some 40% of assets, include the multi-sector bond Pimco Income fund; the Pimco Emerging Market Fundamental Index Plus Total Return fund, which uses derivatives to capture the price return of the FTSE-RAFI Emerging Markets Index; the Pimco Floating Rate Income fund, a low-duration portfolio that invests mainly in variable and floating-rate securities; the Pimco Real Return fund, which focuses on Treasury Inflation-Protected Securities (TIPS); and the Pimco Emerging Markets Currency fund, designed to benefit from the strengthening of emerging-market currencies against the U.S. dollar.

Over the past two years, Arnott has focused on what he calls traditional "real return" asset classes such as TIPS, commodities and REITs as well as "stealth inflation fighters," such as bank loans, emerging market local currency debt, high-yield bonds and convertibles. Equity assets, mostly emerging market securities, make up only 17% of the portfolio.

"We'll use stocks tactically if they are cheap, but not as a core holding," he says. "The long-term average allocation for equities since the fund was launched is around 15%, and the high 38%. We prefer a more diversified tool kit to pounce on opportunities when they become cheap."

With a large allocation to high-yield and foreign bonds and emerging market stocks, the fund's 30-day SEC yield is close to 7.5%. The fund's current high yield is unusual, says Arnott, a byproduct of the assets he likes rather than his specific pursuit of a high-yield strategy.

Emerging market investments in the form of equities, currency investments and bonds have become more prominent in the portfolio, particularly over the last year. During the downturn that occurred during the third quarter of 2011, Arnott added to his positions in these securities as "a sense of alarm moved the pricing of those assets from reasonable to cheap."

Those attractive prices are made more appealing by economies that are stronger and more vibrant than developed markets. "Broadly speaking, emerging market countries have deficits that are mild, manageable debt burdens and favorable demographics where the median age ranges from 25 to 35 years old. That's the sweet spot group that fuels the fastest GDP growth. Combine that with high yields for bonds and stocks, and you have a compelling story." Adding to his argument for emerging market investment, such markets have 38% of the world's GDP, 81% of its population, 65% of its landmass and 45% of its energy consumption-but only 11% of the debt.

He views the slowdown in China's GDP growth, a major reason for the downturn in that country's stock market last year, as a reflection of a maturing economy rather than a reason to jump ship, since the 8% to 11% growth was not sustainable. "And 5% growth is still great," he says.

The fund has a minimal presence in developed world sovereign debt, including U.S. Treasurys. "While Treasurys and other ultra-low-yielding safe haven assets will likely provide liquidity and possible short-term protection on a nominal basis, their long-term real return outlook is bleak." U.S. and developed market equity allocations are also low, as are assets in short-term money market securities that offer no protection from inflation.

While the All Asset fund has about 8% of its portfolio allocated to commodities through a broad-basket commodities fund, gold isn't part of the picture. Arnott views it as "a nonproductive asset that provides no income and doesn't increase in value over the long term. If people want gold in a portfolio, they should buy Krugerrands and bury them in their backyards."