Real estate investment trusts, or REITs, often swim against the stock market tide. That happened in 2013, when the FTSE NAREIT All Equity REIT Index had a total return of 2.86%, while the S&P 500 returned 32.4%. The contrarian tendency worked in the group’s favor in 2014, however, when REIT returns of 28% were more than double those of U.S. large-cap stocks.

With the threat of rising interest rates casting a shadow on the real estate market, 2015 proved to be a challenging year for the group. Nonetheless, equity REITs ended the year with a 2.83% return, while the S&P 500 was up only 1.3%.

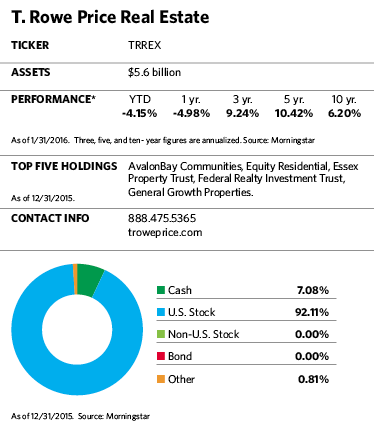

Given the unique nature of REIT returns, a lot of investors might wonder what 2016 is likely to bring. David Lee, who manages the T. Rowe Price Real Estate Fund, makes it clear he isn’t going to provide any answers. Instead, he prefers to focus the discussion on those individual securities in his $5.6 billion fund that have helped it deliver average annual returns of 11.25% over the last 15 years, a record that beats 77% of its peers.

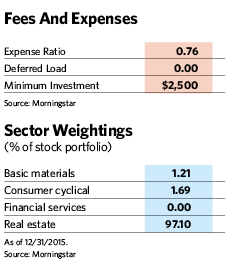

Like many other funds in the T. Rowe Price lineup, this one aims to lead the pack over the long term by hitting a lot of singles rather than batting for home runs, and keeping expenses low. To do that, Lee invests mainly in the higher quality, better-known players in the industry who are aided by high barriers to competitors’ entry and by what he considers desirable properties, and he typically holds on to these names for several years.

When describing the approach, he invokes a variety of well-worn synonyms for “boring.” “Shooting down the middle of the fairway.” “A sleep well, eat well portfolio.” “Steady Eddie.” Morningstar analyst David Kathman echoed that assessment in a report last year, which noted, “While [the fund] has seldom been among the best performers in any given year, it has mostly avoided big losses and has managed to outpace its peers in a wide variety of market conditions.”

Despite his aversion for prognosticating, the 53-year-old Lee, who began his career with T. Rowe Price as a research analyst in 1993 and has been the fund’s lead manager since its inception in 1997, sees both positive and negative developments on the horizon for portfolio companies in 2016. One concern he has is the disconnect between the strong official numbers for economic growth, which bode well for real estate, and the less-buoyant public perception of the economy.

“Lower unemployment, higher auto sales and other measures suggest that the economy is growing at a decent pace,” he says. “But a lot of people aren’t feeling that growth is as strong as it should be. And the impact of macroeconomic headwinds, such as inflation and slow growth in China, are very difficult to predict.”

Perhaps the biggest question mark is where interest rates are headed. Even the threat of rising rates, which increase borrowing costs and make dividend income look less attractive than that from fixed-income investments, can put fear into the hearts of investors. That was a major reason the group’s stock returns fell far short of the overall market in 2013, the year the Fed began dropping hints about tapering quantitative easing.

On a positive note, Lee says, the supply-demand balance for real estate appears sound. “The amount of commercial real estate being built relative to the existing base is fairly tame,” he says. “Oversupply is often the culprit when it comes to ending the party. But we don’t see that as a threat at this point.”

As a group, he also notes, REITs have stronger balance sheets and more reasonable debt levels than they did in 2004, when the last round of rate increases kicked in. Many have locked in low fixed rates on loans for several years, which would help offset any rise in rates for short-term lines of credit. And dividend payout ratios are low by historic standards, which means companies are in a good position to produce enough dividend income to keep investors happy without having to strain too much.

Recent changes in the Foreign Investment in Real Property Tax Act, which make it easier for foreign investors to take positions in publicly traded REITs, are another positive development. But Lee is less enthusiastic about the reforms than some REIT specialists, calling the changes “a marginal tailwind, rather than something that will open up a large flood of investment capital.”

To help weather a variety of market conditions, Lee favors REITs that focus their properties in locations that are more immune to overbuilding and new supply, including populated cities on the East and West coasts. At the sector level, he looks for developments with steady demand—for example, a shopping center that’s anchored by a supermarket with a dry cleaner and a fast, casual dining option. “It’s hard for those kinds of needs-based shopping areas to be swallowed up by the Internet,” he says.

Longtime holdings in the fund that reflect his philosophy include Regency Centers (REG), one of the country’s pre-eminent grocery-anchored shopping center owners and developers. Founded in 1963, the company went public in 1993 and has a market capitalization of about $8.7 billion. Eighty-six percent of its portfolio of properties, which are centered in major metropolitan areas such as Los Angeles; Washington, D.C.; Houston; and Atlanta, have grocery stores as their anchor. It has both short-term and long-term debt maturations, which gives it some protection in a rising rate environment.

REITs that focus on retail shopping malls are also represented in the fund, and Lee sticks with those that focus on Class A malls with well-known stores. “Despite rumors of the death of shopping retailers, we still believe that a bricks-and-mortar presence in the best malls is still desirable,” he says.

General Growth Properties (GGP) is the second-largest retail mall property REIT, by market capitalization, in the fund, and its portfolio includes 20% of the high-quality malls in the U.S. Headquartered in Chicago, this REIT owns and manages 131 retail malls in 40 states. Another retail REIT in the fund, Urban Edge (UE), was created last year as a spin-off of Vornado Realty Trust. Most of its mall properties are in the New York metropolitan area.

In the apartment sector, Equity Residential Properties (EQR) is “well positioned to ride the broad demographic shift by millennials and empty nesters toward more urbanized apartment living arrangements,” Lee says. Its portfolio focuses on the core coastal markets in Boston; New York; Washington, D.C.; Seattle; San Francisco; and Southern California. With median home prices of more than $500,000 in these key areas and strong demand for units, the average rents exceed $2,374 per month.

Douglas Emmett (DEI) is a longtime fund holding that focuses mainly on office buildings in Southern California and Hawaii. With development in its core Los Angeles area severely constrained by restrictive zoning laws and anti-development community groups, the company has a strong foothold in an area that poses high barriers to entry for its competitors and contains limited office space. Leases that specify 3% to 4% annual rent increases protect cash flows. “The Southern California area has been a little slower to participate in the economic recovery and is less glamorous than Northern California, but Douglas Emmett has done a fine job within its market,” Lee says.