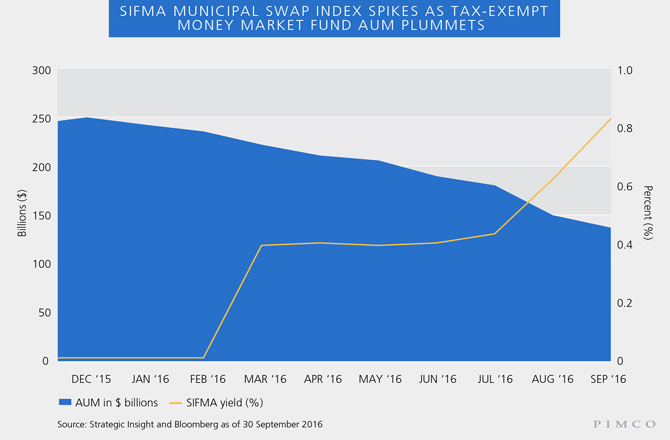

Like their taxable counterparts, tax-exempt money market funds have experienced large outflows – to the tune of over $100 billion – as investors prepared for reforms that became effective on 14 October.

The resulting supply and demand imbalance at the front end of the tax-exempt curve has been pushing short-term municipal yields higher: The yield on the SIFMA Municipal Swap Index (SIFMA), a weekly high-grade market index made up of tax-exempt variable-rate demand obligations (VRDOs), spiked from 1 basis point (bp) in February to over 80 bps currently (see chart), the highest level since 2008. This is equivalent to a pretax yield of 1.5% for a U.S. taxpayer in the highest federal tax bracket (43.4%, assuming the top federal marginal tax rate of 39.6% plus a Medicare tax of 3.8% for top earners).

Notably, the front end of the muni curve recently became inverted, with SIFMA actually yielding more than many municipals maturing in one year and at levels more than 150% of one-month Libor. To put this in context, the short end of the muni curve has not experienced a dislocation of this magnitude since 2008 and 2009.

OPPORTUNITIES FOR ACTIVE MANAGERS

We expect SIFMA to remain elevated for the foreseeable future as institutional tax-exempt money market funds continue to close, merge and experience outflows. This dislocation has created opportunities for active managers – specifically in VRDOs and other SIFMA-based floating instruments, which have recently been outyielding longer-duration fixed rate maturities in many cases. Additionally, these low duration floating rate bonds should outperform longer-duration fixed rate debt if the Federal Reserve continues to gradually raise rates.

While we believe the imbalance will eventually normalize as municipal issuers refinance expensive floating rate risk into fixed rate debt, the process will be slow. In the meantime, we continue to see an opportunity for active managers to add attractive incremental federally tax-exempt yield to portfolios. At PIMCO, we have increased our floating rate exposure over the course of the year, while simultaneously reducing duration and sensitivity to additional Fed rate hikes.

David Hammer is head of PIMCO’s municipal bond portfolio management.

Julie P. Callahan is a PIMCO municipal bond portfolio manager.

Aditi Gupta is a PIMCO product manager focused on municipal strategies.