With U.S. stocks surging to new highs and trouble brewing elsewhere in the world (the failed Italian referendum and resignation of Matteo Renzi, not to mention the continued decline in the Chinese currency), I’ve been getting questions about whether investors should just stay here in the USA.

In a scary international environment, does investing outside the U.S. make sense anymore?

Viewed in isolation, maybe not. You can make a good case not to invest in any one country, or even any one region—China, Italy, Japan, the list goes on and on. The U.S. has been, and continues to be, one of the healthiest economies and markets out there.

How soon we forget . . .

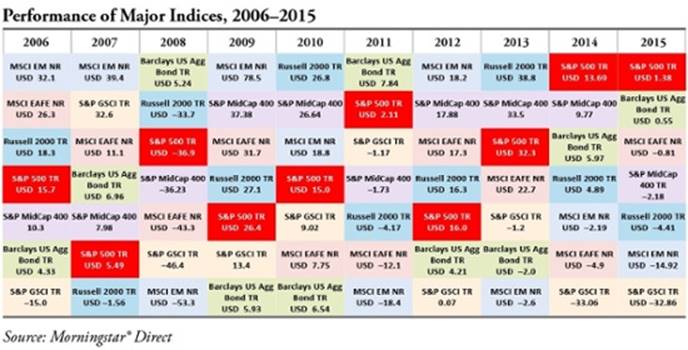

Over the past couple of years, U.S. stocks have been the place to be, but what about before then? Consider the following chart:

For five of the past ten years, emerging markets have beaten the S&P 500. For four of the past ten years, developed international markets, as tracked by the MSCI EAFE Index (the acronym stands for Europe, Australasia, and Far East) have beaten the S&P. On a year-to-year basis, you would be adding more volatility—and risk—to your portfolio by excluding international investments.

You’ve probably seen this chart before, but take a closer look. It really does show why diversification can work.

Looking ahead, why might U.S. stocks do worse?

A big reason is valuations. The more you pay for something, the less room there is for it to appreciate. Buy low is, after all, the first part of conventional investing wisdom. When stock markets are expensive, future returns tend to be lower, and the U.S. is expensive at the moment. Looking at the forward price-to-earnings ratio, from yardeni.com, you can see that the U.S. is far and away the most expensive market out there.

Buying into the U.S., you are paying for all the good news and relative outperformance (and certainly not buying low). Other markets, even if their companies don’t perform as well, may be better investments simply because they can be bought more cheaply.