A few years ago, mutual funds and exchange-traded funds with the word “infrastructure” in their names began popping up. Fund sponsors latched on to companies poised to profit from the anticipated building boom in emerging markets and the upgrade of aging roads, schools and other public facilities in the U.S.

Among those investors is Joshua Duitz, the manager of the Alpine Global Infrastructure Fund. “Infrastructure companies have a number of common characteristics, including steady and predictable cash flow and inelastic demand for their services,” says the 42-year-old manager. “They also tend to be quasi monopolies or monopolies with high barriers to entry that are less sensitive to changes in technology than most companies.”

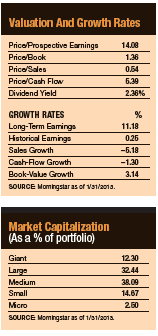

Such stocks can act as a hedge against inflation because the cost of replacing physical assets appreciates over time, and in many countries changes to the consumer price index dictates hikes in tolls and other fees. Investors facing a world of low interest rates also appreciate infrastructure companies’ generous dividend yields in the 4% to 6% range. (The Alpine Global Infrastructure Fund’s institutional shares recently posted a distribution yield of 3.9% after expenses.)

Yet even with their growing popularity among investors, many infrastructure companies have been forced to tread water as political bickering and scantily stocked government coffers push public projects to the back burner. A report released in February 2013 by consulting firm KPMG said 2012 was a challenging year for infrastructure companies. “Many governments around the world struggled to bring projects to market, and as a result, pipelines were thin. Financing markets continued to be tight, economic stability remained [elusive] and activity subdued.” With the economic slowdown, electric utilities in particular saw a decline in demand, and these are a major component of many infrastructure funds and indexes.

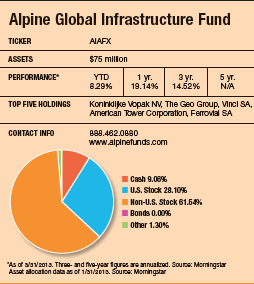

Selling the concept of infrastructure investing to the public has also been a slow build. Today, about a dozen mutual funds and eight exchange-traded funds focus on the group. Most of them still hold less than $100 million.

The performance has varied in these funds because of their different investment strategies and indexing methodologies. But the Alpine Global Infrastructure Fund has proved to be one of the more profitable entrants. Over the three years ended February 28, it had an annualized total return of 15.9%, while the MSCI EAFE Index returned 6.85% and the iShares S&P Global Infrastructure Index Fund (IGF) returned 7.63%.

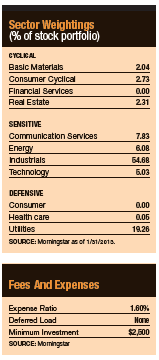

Duitz attributes the outperformance thus far to his exposure to utilities, which is lower than that of his competitors, and his exposure to emerging markets, which is higher. “A lot of infrastructure funds began life as utility funds and morphed into something else,” he says. “Others follow indexes that have heavy exposure to utilities. Neither is the case with this fund.”

Going forward, he has more modest performance expectations for the fund. “I think over the longer term, an annualized return of 8% to 12% would be a realistic expectation,” he says. “That’s still better than what we expect from the broader markets.”

Launched in late 2008, the Alpine Global Infrastructure Fund has managed to outshine its rivals by deviating from the typical infrastructure script. Again, it has much less utilities exposure—only 23% of assets, much less than the S&P Global Infrastructure Index’s 37% (and other mutual funds’ stakes, which can be as high as 50%). The fund instead has more presence in transportation construction and operations (railroads, airports and toll roads). These plays represent 32% of the fund’s assets, which is much more prominent than they would be in other infrastructure portfolios.

The same holds true of emerging markets, where the fund has about one-third of its money. Brazil, which accounts for 11% of assets, tops Duitz’s list of favored foreign countries. With the World Cup slated to take place there in 2014, and the Olympics on the horizon in 2016, the country has ample motivation to shore up its infrastructure and meet construction deadlines.

Individual sectors under the infrastructure banner, however, would seem to have little in common (they include utilities, railroads, transportation and telecommunications). Yet a growing number of investors, including pensions and other institutions, say infrastructure has emerged as a distinct asset class with its own unique flavor.

Individual sectors under the infrastructure banner, however, would seem to have little in common (they include utilities, railroads, transportation and telecommunications). Yet a growing number of investors, including pensions and other institutions, say infrastructure has emerged as a distinct asset class with its own unique flavor.

Slow Motion

April 29, 2013

« Previous Article

| Next Article »

Login in order to post a comment