Meanwhile, increased market volatility has pushed investors to sharpen their focus on valuations. In August, for example, the 25 highest valued stocks by P/E had a return of -8.83 percent. By comparison, the lowest 25 stocks by P/E had a return of -0.28 percent. (Data provided by Bloomberg.)

In addition, 509 out of 1,888 names on the Russell 2000 are losing money, resulting in a negative P/E ratio. Compare this to the Russell 1000 (mid- to large-cap stocks), where only 8 percent are losing money.

Given the current over-priced nature of the small-cap market, a traditional long-only manager can, at best, avoid overvalued stocks. At worst, long-only managers get hit significantly when the small-cap bubble bursts. It is clear, however, that a long-only approach to small-cap investing is unlikely to generate alpha in the current market environment.

Adding An Active Short

Our Convergence Opportunities Strategy applies this active shorting strategy to the small-cap space. We believe the strategy is well positioned to deliver for investors, regardless of when ore if the small-cap bubble bursts.

How To Identify A Good Short

To take advantage of the law of averages and ensure the strategy performs over various stages of the market cycle, it is vital that the investment approach employ a repeatable process that emphasizes fundamental metrics over a wide range of securities. By avoiding large positions on individual names and sectors, risk can be more evenly spread across the portfolio.

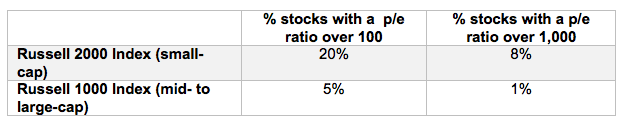

In addition, it is key to identify companies whose stock prices are not supported by underlying fundamentals in terms of sales, cash flow or earnings. These are ideal companies to short, as they have the potential to mitigate risk and also add alpha when incorporated with long positions. Most market strategists and analysts agree that small-cap stocks are trading at a premium, especially relative to their large-cap peers. With an average price-to-earnings (P/E) ratio of 18, the Russell 2000 Index may be inflated when compared to the Russell 1000 Index, as illustrated in the accompanying chart.

Most market strategists and analysts agree that small-cap stocks are trading at a premium, especially relative to their large-cap peers. With an average price-to-earnings (P/E) ratio of 18, the Russell 2000 Index may be inflated when compared to the Russell 1000 Index, as illustrated in the accompanying chart.

Although the outlook for small caps may seem bleak, there’s still opportunity to add alpha by using an active short. In addition to increasing alpha, an active short has the potential to mitigate risk and provide a hedge during periods of increasing interest rates. Here’s how:

In order to realize the potential benefits of an active short on a small-cap strategy, short holdings must meet the following criteria:

Small Cap Equity Investing

September 28, 2015

« Previous Article

| Next Article »

Login in order to post a comment