With all the recent press concerning the so-called robo-advisor, reviewing software that resembles such automation might seem redundant. However, SmartPlanner (www.smartplanner.com) has been around in one form or another since the 1990s. Robo-advisors are typically in the investment space, so Web-based software that provides an overview of a client’s financial situation and needs is quite different.

SmartPlanner, the brainchild of public television host and financial expert Jonathan Pond, was designed for financial planners. Pond also offered what is now called the original robo-advisor tool, SmartInvestor. Smart planner was designed to be coupled with SmartInvestor. He switched to offering it to the public 20 years ago. SmartPlanner is offered to the public for $40 per report. Financial advisors can get a $10 discount if it is used by the advisor for a client or prospect.

SmartPlanner comes in three separate versions for individuals, employers and associations.

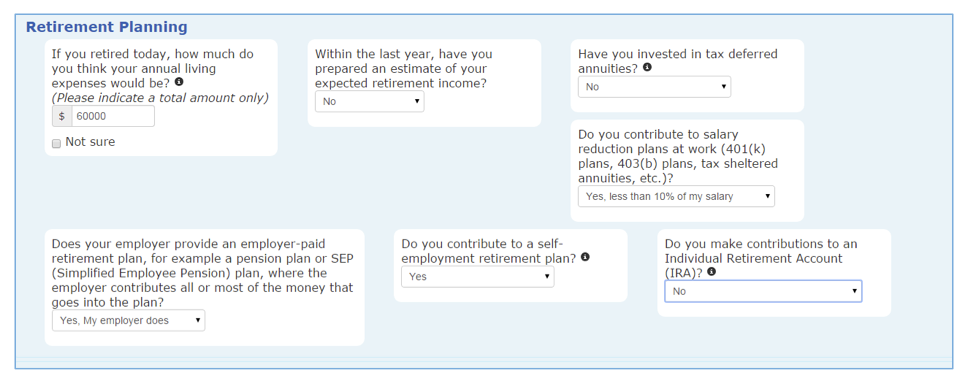

SmartPlanner is a Web-based questionnaire that leads to an automated report for the client. The report, according to Pond (the recipient of an Emmy Award for his work on public television), is intended to provide common sense advice for the user to accomplish his or her goals. It does not go into detailed mathematics. Instead, it has a simplified set of questions that can easily be answered by the client. As can be seen in the accompanying chart, answers often are available from drop-down menus, making the information gathering easier:

Upon submission of the answers, an automatic report (usually 27 or more pages) is generated and sent via email to the user.

For security purposes, the software does not ask for full name, address, Social Security number or birthdates. Instead, it uses first name only and asks questions such as "How old are you?" The text-based, plain English approach is intended to make the planning process easier for the user, according to Pond. For this reason, Pond suggested that this is a tool that is useful for financial advisors. The software could be used with a financial planning prospect to identify the level of planning needs and to make a case for engaging the advisor for higher level planning and investment advice and management.

Pond said that people want words--something that is understandable. With other financial planning solutions, complicated graphs and charts can be confusing to clients. So, his approach was to create a tool that drills down to the issues in an easy-to-understand format.

The report starts out with a section titled "Overall Findings," It covers savings, insurance issues, retirement plan contributions, etc. The report is then divides into three sections: highlights, summary of recommendations and the main report. The summary of recommendations is organized by priority, ranging from high to "items to keep up to date."

An example of a high priority recommendation is: