With investment characteristics of both stocks and bonds, convertible securities don't fall neatly into one of the distinct, separate asset classes that advisors typically rely on to craft asset allocation strategies.

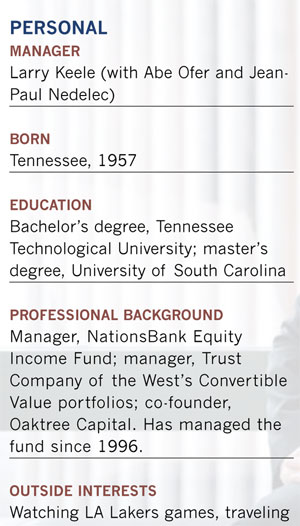

Larry Keele, who manages the Vanguard Convertible Securities Fund, knows all too well the confusion that surrounds these fish-nor-fowl hybrids. Since he began mining the niche world of convertible securities decades ago as the manager of the NationsBank Equity Income Fund, the same question pops up over and over again.

"To be frank, I can't tell you how many times I've been asked over the years where convertibles fit into a portfolio," says the 53-year-old Keele. Today, he continues to clear the fog at Los Angeles-based Oaktree Capital, where he heads the convertible securities team. Founded in 1995 by Keele and five other Trust Company of the West (TCW) refugees who specialize in alternative investments, the firm oversees some $82 billion in assets, including $1.8 billion for the fund.

His usual response is that most people use convertible bonds and convertible preferred stocks as a way to get equity-like returns over the long term with less volatility. "But with interest rates so low over the last few years, I've seen plenty of people putting them into the fixed-income basket to enhance returns. And a few even consider them an alternative investment. To me, they are just fun, interesting and complicated all at once."

Wherever they fall in the asset allocation spectrum, convertible securities are like nothing else in the investment world. As their name implies, convertible bonds, which account for most of the fund's assets, can be converted into a specific number of shares of common stock.

Like regular bonds, they pay interest and have a maturity date. But they also offer growth potential because as the price of the stock rises, the value of the convertible will also increase to a lesser extent. If the stock price declines, the cash coupon and senior position in the capital structure will help protect investors, although they will still be exposed to other risks from interest rate fluctuation and credit deterioration.

Convertible securities tend to perform well compared to other types of investments in sideways or volatile markets, although their reputation for smoothing out market bumps was sorely challenged in 2008. That year, the Bank of America Merrill Lynch All Convertible Index fell by nearly 36% as the economy sank into recession and hedge funds dumped huge chunks of the bonds into the market.

Since then, they have posted higher returns than most equity markets, though with some unusually high volatility along the way. In 2009, the Bank of America index shot up 49% and rose an additional 17% in 2010.