With investment characteristics of both stocks and bonds, convertible securities don't fall neatly into one of the distinct, separate asset classes that advisors typically rely on to craft asset allocation strategies.

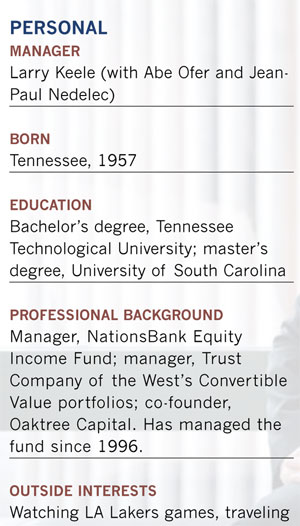

Larry Keele, who manages the Vanguard Convertible Securities Fund, knows all too well the confusion that surrounds these fish-nor-fowl hybrids. Since he began mining the niche world of convertible securities decades ago as the manager of the NationsBank Equity Income Fund, the same question pops up over and over again.

"To be frank, I can't tell you how many times I've been asked over the years where convertibles fit into a portfolio," says the 53-year-old Keele. Today, he continues to clear the fog at Los Angeles-based Oaktree Capital, where he heads the convertible securities team. Founded in 1995 by Keele and five other Trust Company of the West (TCW) refugees who specialize in alternative investments, the firm oversees some $82 billion in assets, including $1.8 billion for the fund.

His usual response is that most people use convertible bonds and convertible preferred stocks as a way to get equity-like returns over the long term with less volatility. "But with interest rates so low over the last few years, I've seen plenty of people putting them into the fixed-income basket to enhance returns. And a few even consider them an alternative investment. To me, they are just fun, interesting and complicated all at once."

Wherever they fall in the asset allocation spectrum, convertible securities are like nothing else in the investment world. As their name implies, convertible bonds, which account for most of the fund's assets, can be converted into a specific number of shares of common stock.

Like regular bonds, they pay interest and have a maturity date. But they also offer growth potential because as the price of the stock rises, the value of the convertible will also increase to a lesser extent. If the stock price declines, the cash coupon and senior position in the capital structure will help protect investors, although they will still be exposed to other risks from interest rate fluctuation and credit deterioration.

Convertible securities tend to perform well compared to other types of investments in sideways or volatile markets, although their reputation for smoothing out market bumps was sorely challenged in 2008. That year, the Bank of America Merrill Lynch All Convertible Index fell by nearly 36% as the economy sank into recession and hedge funds dumped huge chunks of the bonds into the market.

Since then, they have posted higher returns than most equity markets, though with some unusually high volatility along the way. In 2009, the Bank of America index shot up 49% and rose an additional 17% in 2010.

The fund has also delivered equity-like returns, with average annualized returns of 5.64%, 8.05% and 6.88% over three, five and ten year periods that ended December 31, 2010. By comparison, the Dow Jones Total Stock Market Index has posted annualized returns of -1.56%, 3.17% and 2.64% during the same periods.

Despite their stock-like behavior over the last few years, the securities should continue to live up to their reputation for providing attractive returns with less downside risk than stocks, says Keele.

"The basic premise for investing in convertibles remains the same as always-to capture a reasonable amount of equity upside and less of the downside," he maintains. "If stocks are up 10%, the fund will likely rise 7% to 8%. If stocks fall 10%, we'll probably be down 4% or 5%." He anticipates that fund returns in the high single digits are "certainly achievable" for 2011.

Since the fund's current 30-day SEC yield of just under 3% is considerably lower than its long-term historic yield of around 5%, it's especially important for the bonds' equity kicker to make a mark this year. Keele anticipates that about two-thirds of fund returns will come from a push from the equity market, with the fixed-income side accounting for the rest.

Over the last few years, the impact of falling interest rates on bond prices hasn't been much of a concern for convertible managers. But this year could be a different story.

Like other bonds, convertibles are susceptible to fluctuations in interest rates, although a rising stock market would help offset the impact of higher interest rates. Keele points to other portfolio risk modifiers such as a relatively short duration of 4.5 years and diversification among over 100 different names in 40 industries. To further minimize risk, he emphasizes convertible securities with loss-preventive features such as the right to "put" a security back to the issuer within a few years.

He also keeps about half the benchmark weighting in convertible preferred securities, which are usually more sensitive to interest rate fluctuations than convertible bonds. At the end of 2010, the fund had 83.5% of its assets in bonds, 14% in preferred stocks and the remainder in cash equivalents.

Going Global

A major expansion of the fund's investment parameters into international securities this year should spice up the growth side and provide additional ballast to the portfolio. The international sleeve, now at 10% of assets, is absorbing most new inflows. The goal is to have a 30% allocation to international convertible bonds by the end of the year.

Although international convertible bonds are newcomers to the Vanguard fund, Abe Ofer and Jean-Paul Nedelec have been mining that largely neglected territory for Oaktree's institutional clients since 1995. "At about $250 billion, the non-U.S. convertible market is as big as the domestic market, so this addition adds a lot of diversification to the portfolio," says Ofer. "And historically, non-U.S. convertibles have been more attractive than their U.S. counterparts in terms of fixed-income characteristics, equity participation and credit quality." To achieve the goal of being currency-neutral, the managers hedge foreign currency exposure to the U.S. dollar.

Because Europe has the most well-established convertible bond market outside the U.S., its issuers account for half of the international part of the portfolio. But the fund also invests in emerging markets such as Malaysia through convertibles such as YTL Corporation. A diversified conglomerate with holdings in industries such as electric utilities and property development, YTL represents "a proxy for Malaysia's growing economy," says Ofer. "It's a way to get exposure to that growth with less risk than the stock."

Whether it's on the domestic or international side, the managers look for the stable and improving credit quality of the issuer first, and equity characteristics second. "Most convertible bond investors come from the stock side of the business and get their ideas from equity analysts," he says. "We approach things from a bond perspective first, then look at the potential for capital appreciation."

Keele typically buys bonds when they are selling between 90% and 115% of par value. He considers a moderate conversion premium in the 25% to 35% range as a sweet spot that offers an optimal mix of potential for appreciation and a reasonable yield.

He also maintains a strict sell discipline. If a bond rises dramatically because the underlying stock has done well, it will lose its fixed-income characteristics, including an attractive yield, and offer little or no downside protection. At that point, Keele will likely sell.

"When a bond starts going into the 140s, we will start moving out of the position," he says. "Once it's reached the 170s or 180s, we're usually out." He will also sell if a stock goes down significantly, the convertible becomes too bond-like or its upside potential becomes too muted.

With its conservative, middle-of-the road strategy, the fund typically outperforms its peers in down-to-sideways stock markets. Keele says returns are about average in up markets but can lag at times when the equity markets rise rapidly, as they did in 2009.

The portfolio's most recently reported turnover rate of 106% is unusually high because a number of holdings shot past the fund's price targets during 2009's strong bull market. Keele anticipates that turnover will be lower going forward unless another strong market takes hold and the bonds reach their pricing targets sooner than expected.

A number of holdings, such as SBA Communications, have been in the portfolio for a year or more. The convertible bond of the cellular tower operator, which has a coupon of around 2% and matures in 2013, became part of the portfolio two years ago. Although the stock didn't do much in 2010, it has been showing signs of life this year.

"SBA generates high cash flow and is a play on the build-out of the cellular industry," he says. "This is a good example of using a convertible to get paid to wait for good things to happen with the stock."

Late last year, Keele began paring the fund's position in Ford as the convertible reached its pricing target, and replaced it with more attractively valued General Motors convertible preferred stock. "This is a way to reinvest in the automobile industry with a company that should do well over the long term," he says.