In a recent global survey that measured consumers’ trust in 18 major industries, financial services scored dead last. Worse yet, a further breakdown revealed that the financial advisory/asset management segment was the least trusted within financial services.

These are the results of the 2013 Edelman Trust Barometer, the latest installment of the annual trust and credibility survey run by global public relations giant Edelman. The company polled 26,000 online respondents in 26 countries—people who are college-educated, who keep up with business and public policy issues, and who have household income in the top quartile for their age in their countries.

The technology industry scored highest; 73% of respondents said they trusted that sector, which was followed by consumer electronics manufacturing (70%) and automotive (66%). The next spot was a three-way tie among the food and beverage, aerospace and defense, and entertainment industries, which each won the trust of 62% of respondents.

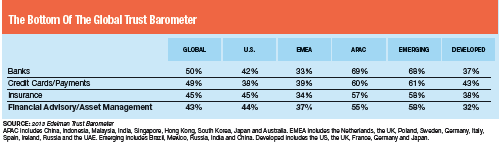

Financial services finished last, trusted by just 46% of respondents, followed in ascending order by banks (49%), the media (50%), chemical companies (51%) and brewing and spirits companies (54%). Edelman’s overall global trust index rose from 45 points last year to 48 points in 2013.

Edelman found the financial advisory/asset management segment scored highest in the Asia/Australia and emerging regions, while it took a particular drubbing in Europe as a result of the Continent’s financial imbroglio. The segment was trusted by only 44% in the United States, just a pinch better than the category’s overall 43% global rating.

Why doesn’t the public––or at least a sizable portion of people contacted by Edelman––trust financial advisors and asset managers? Laura Burke, the New York financial services sector leader for Edelman, offers a hypothesis.

“Clients rely on their advisors for education, information and navigation of the financial markets,” she says. “So in many ways, the advisor comes to represent the marketplace to their clients, and trust in that advisor becomes linked to the performance of their portfolio and/or their overall financial well-being. For better or worse, trust in the advisor is impacted in hard times.”