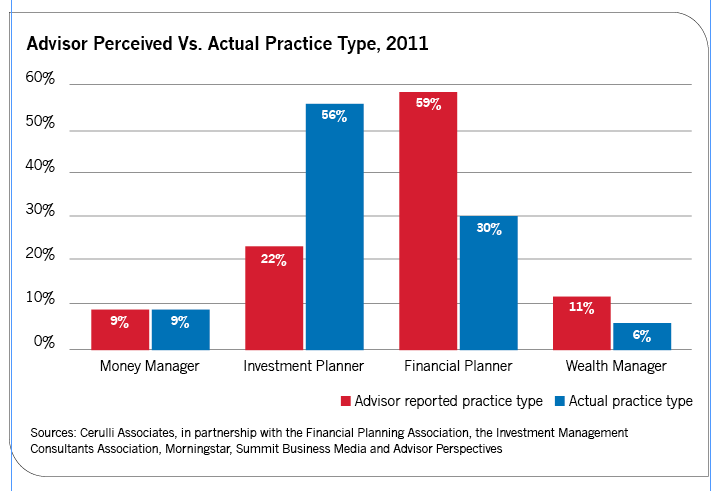

A recent study from industry research firm Cerulli Associates looked at advisors across all channels and compared how they describe themselves with how they actually do business. The result: 59% of advisors reported their practice type as "financial planner," but just 30% of them fit the bill.

Cerulli analyst Scott Smith says the firm looked at whether an advisor had planning designations such as the certified financial planner (CFP) license, the personal financial specialist (PFS) designation or some other credential. Then Cerulli looked at what percentage of an advisor's clients received comprehensive or modular financial planning--or no planning at all. Cerulli then contrasted that information with what advisors thought they were doing.

Even though just 22% of advisors considered themselves to be "investment planners," by Cerulli's reckoning that percentage was actually 56%. "There's nothing wrong with being an investment manager," Smith says. "For many investors with less than $2 million, that's all they need because many of them don't require intensive planning."

Smith says 35% of advisors in the RIA space were actually true planners, as defined by Cerulli. That number was 23% among wirehouse advisors, and it was lower in the other channels it measured.

Cerulli looked at two other practice types--money managers and wealth managers. Smith suggests that the difference between money managers and investment planners is that the former is all about stocks and bonds. "They don't even want to go through the accumulation calculator; it's just 'give me your money and I'll make it bigger,'" Smith says.

He notes that the difference between wealth managers and financial planners comes down to the core market being served. "If half of your book is clients with more than $5 million, then you can justify calling yourself a wealth manager."