The way people communicate and do business is changing, and many advisors have looked to social media as a great opportunity to meet people and share influence. They’ve also seen it as a swamp full of traps and possibly a compliance nightmare. Many still wonder how best to use it.

But it is little surprise that most financial professionals believe social media could be a game-changer for their businesses—if they can find cost-effective ways of overcoming the challenges, such as their uncertainty about how to get started, how to access content, the time commitment and the lengthy approval times for compliance.

Unsurprisingly, social media use is highly correlated to the age of the advisors using it. Those under 30 use social media 50% more in their practice than their peers over 60 years of age.

Financial advisors are largely not active on social media—and not committed to social media marketing—but the results of a new survey by Gainfully, a social media marketing firm, and our firm, WealthVest Marketing, make it clear—those advisors now starting their practices are using social media and will be the most successful advisors as their practices mature.

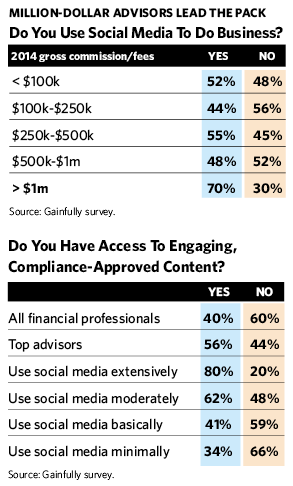

The Gainfully survey, which queried more than 1,100 investment professionals from all channels of distribution, including financial planners, RIAs, wirehouse brokers, bank advisors and independent insurance agents, found, most tellingly, that advisors generating more than $1 million in annual revenue use social media marketing over 40% more than low-producing advisors. Their commitment to social media has a high correlation to success in social media and advisor revenue.

Advisors committed to social media marketing are also the most successful. Among advisors who characterized their social media use as “extensive,” more than 70% reported an increase in assets under management or revenue due to social media marketing. Among the dabblers, only 40% reported increases due to that kind of marketing.

The story was similar when advisors were asked about the effects of social media on their ability to attract clients. Overall, about two out of 10 financial professionals reported that social media had helped expand the number of clients they served by 10% or more during 2014. In contrast, almost six in 10 “extensive” users realized similar results.

About 4% of the respondents said they relied on a third-party platform to post content on various digital and social media platforms on their behalf, and two-thirds said they were or might be interested in engaging such a service. Since most respondents (82%) do not spend much on social media marketing, the cost of such a service may need to be low or free to attract users.

Recognizing The Potential Of Social Media

The vast majority of financial professionals (90%) believe that social media is or could be valuable to their businesses. And they’re right. While relatively few currently take full advantage of social media platforms, those who do reported adding new clients, increasing assets under management and growing revenue streams, often within months (and sometimes weeks) of becoming actively engaged in social media.

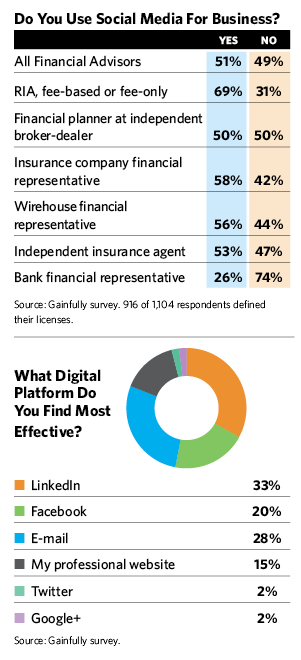

Some platforms are more helpful than others. LinkedIn is dominant. Google+ and Twitter barely register with financial advisors. But the respondents said they commonly engaged with prospects, clients and peers on LinkedIn and Facebook, through e-mail and on their professional websites.

Top Advisors Are Top Social Media Users

Successful advisors (financial professionals who earned $1 million or more in gross commissions or fees during 2014) participated in social media more than any other income group. Thirty-eight percent characterized their social media use as moderate to extensive, and 21% said they were basic users, while the remainder reported using social media minimally or not at all.

When engaging clients through social media, 66% of high-income earners said their primary goals were to improve their professional brands, while 53% said they wanted to share relevant news and content with clients. Forty-seven percent said social media also helped them generate new prospects and leads, while 44% said it helped them network with professional peers. Forty-four percent also said it helps them access expert commentary and news, while 16% said it helps them reduce marketing expenses.

Almost one-third of million-dollar advisors saw results immediately after engaging clients and prospects via social media, and 56% realized benefits within the first 12 months. That’s a significantly better result than experienced by the group as a whole. Just 20% of all financial representatives who participated in the survey reported immediate results, although 58% realized positive outcomes within the first year.

LinkedIn, e-mail and professional websites are the most valuable digital tools for top producers. All reported spending time on LinkedIn every week. Eighty percent logged into the site two or more times each week. Facebook was the second most frequented site (59% visited two or more times weekly), followed by Twitter (35%), Google+ (34%), YouTube (33%) and blogs (24%).

The majority (70%) of high-income earners plan to increase their social media use in the future. Many indicated interest in finding a third-party platform that could manage social media communications on their behalf. Seven percent of top producers have already done so (as compared with just 4% of all financial representatives).