Over the last few years, U.S. REITs have been burning rubber, and investors on board for the ride have been well rewarded. Over the three years ended April 30, the Vanguard REIT Index ETF (VNQ) saw average annual returns of 32.5%, almost double the 16.8% return for the S&P 500 SPDR (SPY), which follows the S&P 500 index.

Most of the rebound came in late 2009 and 2010, when a rebound rally sent REITs soaring after they had plunged nearly 65% in the bear market of late 2008 and early 2009. In 2011, when the S&P 500 index stayed flat, investors' appetite for dividend-paying stocks sent REIT indexes up over 8%. So far this year, U.S. REITs are beating the S&P 500 again.

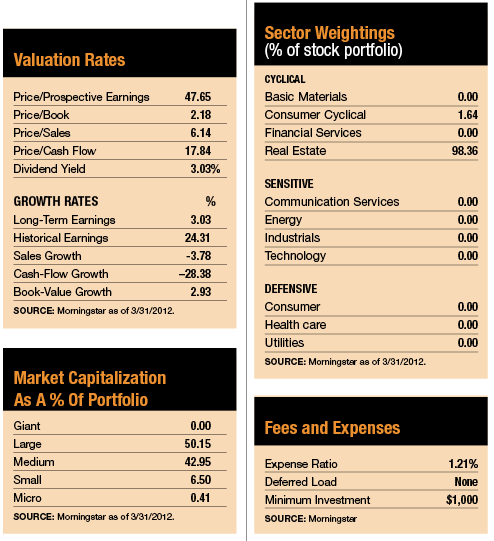

But for new investors looking to jump in, there's a downside to the rapid ascent of REITs-companies that own, and in most cases operate, income-producing real estate. In many cases, the stocks are selling at a big premium to the value of their underlying properties. And because dividend increases haven't kept up with the rapid pace of capital appreciation, dividend yields are much less generous than they used to be.

Over the last 20 years, REIT yields have averaged about 7%. Today, they're generally in the 3% to 3.5% range.

While it's hard to determine what impact lower dividend yields will have on REITs, they've certainly been important in the past. Over the 20 years ending December 2010, a $1,000 investment in the FTSE NAREIT All Equity REIT Index would have grown to $9,948, according to a report from Wilshire Funds Management, and 71% of that total return is attributable to reinvested dividends.

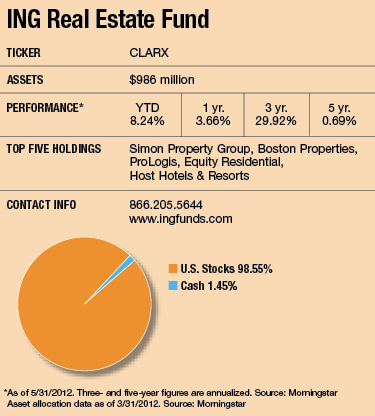

T. Ritson Ferguson, who co-manages the ING Real Estate Fund with Joseph Smith, says that even though REIT dividend yields are at historic lows, the stocks still have a lot of appealing attributes for yield-starved investors, as well as those looking for growth. "Unlike traditional bonds, REITs have the capacity to increase their dividends over time as earnings grow," Ferguson says. "And in a world where 10-year Treasury securities are yielding 2%, a 3.5% dividend yield in stocks that have potential for growth looks pretty appealing."

In 2011, the earnings for U.S. REITs increased by an average of 8%, and Ferguson thinks there will be similar earnings growth in 2012. The group increased dividends by 20% in 2011. That's unusual because increases usually fall in line with underlying earnings growth, he says.

He believes dividend yields will likely remain in the 3.5% area this year, and says capital appreciation will play a more important role than it has in the past. "In the future, dividends will be a much less important component of REIT returns than they used to be," he says. "It's likely that half to three-quarters of returns will come from appreciation, and the rest from dividends."

At the same time, he says, the income component of REITs will still be important to investors. "People should look to these stocks for a balance of current income and potential for earnings growth," he says.

While the run-up in REITs has prompted some analysts to call the group overvalued, Ferguson maintains they're trading at reasonable valuations, according to a number of key measures. For example, REIT earnings yields, which reflect what investors are paying for each dollar of earnings and which are derived by dividing earnings per share by price per share, are in the 6% area. The 400 to 450 basis point spread between earnings yields and the yield on Treasury bonds is "about in line with historic averages."

Volatility has also slowed to its lowest level in over five years, according to a report from CBRE Clarion Securities, the firm co-founded by Ferguson more than 20 years ago that currently advises the fund. During the first three months of 2012, the MSCI U.S. REIT Index had a daily standard deviation of less than 1%, something that hasn't happened since 2006. "Reduced volatility, if sustained, could lead to greater confidence among investors and companies," the report says. "With lower volatility, we also expect correlations with broader equities to move lower over time, also consistent with long-term trends."

Improving Trends

Ferguson, who started in the business evaluating properties for real estate development companies before moving to the securities side in the mid- 1980s, says that his early professional experience allows him to evaluate companies with a broader, deeper understanding than many analysts have. He spends about half his time traveling to visit malls, office buildings, apartments and other income-producing properties to get a handle on which markets and sectors are doing well-and which ones are struggling.

"Notwithstanding the sluggish economy, certain property sectors and regions are seeing strong improvement in cash flow," he says. "We're seeing solid results in the high-quality mall sector. Apartments and office buildings in central business districts such as Boston, New York and San Francisco are also doing well."

Even with sluggish job growth, strong demand has allowed some apartment REITs to continue to increase rents and shore up occupancy. "Things are still unwinding in the housing market," he says. "A lot of people haven't forgotten about the market crash, and renters aren't afraid of losing out on home equity appreciation if they don't jump in and buy. While there is evidence that the worst of the price declines in single-family homes is behind us, it's going to be a slow, uphill climb to appreciation. That's good news for the rental market."

One of the fund's holdings is Avalon Bay Communities, a REIT that focuses on apartments in desirable markets such as Boston and Washington, D.C., as well as on some West Coast areas, benefiting from below-average unemployment rates in those places. Because housing costs are higher, Avalon Bay can command premium rents. The company also has strong management, a great balance sheet and a proven ability to build new complexes on budget.

The fund also has holdings in industrial REITs. Although this part of the FTSE NAREIT U.S. Real Estate Index lost more than 5% last year (while the index as a whole increased 8.3%), an improving economy has helped the group perk up more recently. Through May 10, the sector had a total return of 20%, while the index returned 14%.

Early signs of a recovery in the industrial sector look encouraging, says Ferguson. For the year ending December 2011, the average industrial occupancy rate improved from 88% to 93%, according to data from SNL Financial, a real estate research group.

At 5% of the fund's assets, Prologis represents the fund's largest industrial REIT position. A leading owner, operator and developer of industrial properties, the company leases more than 3,100 industrial facilities. With properties in 22 countries, it also offers exposure to both the U.S. and offshore markets.

Meanwhile, Ferguson has been adding to holdings in the hotel sector over the last 12 months. Historically, hotels have been one of the last real estate sectors to recover after a recession because of their dependence on consumers' fluctuating travel expenditures and the fact that the properties don't have leased tenants. But since last year, he observes, they've been enjoying improved occupancy rates and cash-flow growth.

In this category, fund holding Host Hotels stands out as a company with a top quality portfolio of properties with a diverse mix of brands, including Marriott, Starwood, Hilton and Sheraton. "These hotels are predominantly in the U.S., but there is also some exposure to international markets," he says. "Thankfully, they don't have too many hotels in Europe."

Mall operator Simon Property Group is the fund's largest holding with 11% of its assets. Ferguson first established an overweight position in the mall sector back in 2009, when the stocks got clobbered by a weak economy and were selling at what he considered bargain prices. Despite the economic trouble, Simon Property Group has been able to replace tenants and raise rents, and the stock's dividends increased several times last year.

While he's cautious about prospects for the office market, which has yet to recover from a weak economy, certain companies are showing solid earnings growth, especially those specializing in central business district office properties (rather than suburban holdings), in desirable, stable areas. One such holding, Douglas Emmett, owns a portfolio of high-quality office properties in Los Angeles.

One of the sectors where the fund is underweight relative to its benchmark is health care. Although yields in this group are higher than in other REIT sectors, Ferguson believes the stocks "are trading at values well in excess of the value of their underlying properties. Their dividend yields might be attractive, but relative to their growth in underlying earnings, we believe they are overpriced."

The fund is also underweight in the net lease sector, which focuses on companies that specialize in commercial leases where the tenant pays expenses normally paid by owners, such as repairs and taxes. "These also tend to pay high dividends," he says. "But the shares are overvalued, and the companies have mediocre growth prospects."