To

be exceptionally successful, it is valuable to critically examine the

methods and processes employed by the most successful financial

advisors in the country. Success is a subjective term, so we chose to

use personal income (after all expenses but before personal taxes) as

the barometer. In considering the "best of the best," 1,200 financial

advisors-across all distribution channels-consistently (each year for

at least three years running) pocket a minimum of $1 million per year.

We call them the Elite 1200.

The six traits outlined below are pervasive among nearly all of them. In coaching financial advisors for many years, we've found that most practitioners possess some or all of these traits, but not to the degree that the Elite 1200 do.

The Elite 1200 share six critical traits:

They're strongly financially motivated with excellent work habits. The phrase, "The good is the enemy of the great," is applicable. Their ambition is not softened by their success.

They have a deep understanding of their core clients. They know their best clients exceptionally well, in much the same way many of us know our best friends. The Elite 1200 use a proven profiling methodology-the Whole Client Model-to uncover needs and provide wealth management services. (For more information see "Wealth Mapping" in the June/July 2007 issue of Private Wealth).

They can identify opportunities for financial products and services in real time. This is not to say they're polymaths when it comes to the financial services universe, just that they're able to spot possibilities across seemingly unrelated aspects of a client's financial affairs.

They can source the products and services needed by the affluent. The ability to access and deliver on the financial needs and wants of the wealthy is essential in order to be successful. For instance, they are often wealth managers (not purely investment managers, private bankers or life insurance agents) with a network of professionals and specialists at their disposal.

They take a long-term approach to their practices. As opposed to short-term hits, the Elite 1200 are seeking to build very successful practices and they recognize this takes time. They understand that the incubation period to convert a wealthy prospect into a client takes many months, and in some cases, years.

They're highly adept at garnering new affluent client referrals. While some advisors can reach this level of success by focusing on institutional business, for the overwhelming majority of the Elite 1200, the money is with the moneyed class.

The Secret

For

the purpose of this article, we're going to focus on the predominant

approach used by the Elite 1200 to acquire new affluent clients. While

many top practitioners, and the vast majority of other financial

advisors, employ a wide variety of methods to garner new, Forging

partnerships with professionals who have the loyalty of their wealthy

clients can open a pipeline of new prospects. 42 well-heeled clients,

there is one consistently effective way: building strong relationships

with other noncompeting professionals who provide them with a steady

stream of high-quality, prequalified, wealthy referrals. The principal

noncompeting professionals they partner with are accountants and

attorneys. That's the secret.

Not much of a secret, is it? We all know that accountants and attorneys, as well as other types of professionals, can be excellent referral sources. In fact, we're confident that you caught on to the business-building value of creating relationships with "centers of influence" early in your career. However, we're not talking about creating a strategic alliance, the most common state of relationships between advisors and other professionals. What's needed is a meaningful strategic partnership between you and a carefully chosen select number of professionals, usually attorneys, accountants or a combination. In analyzing the behavior of the Elite 1200, we were able to identify five simple but powerful strategic shifts in their approach. What follows is the road paved by the best in the business.

1. The Professional Is The Client

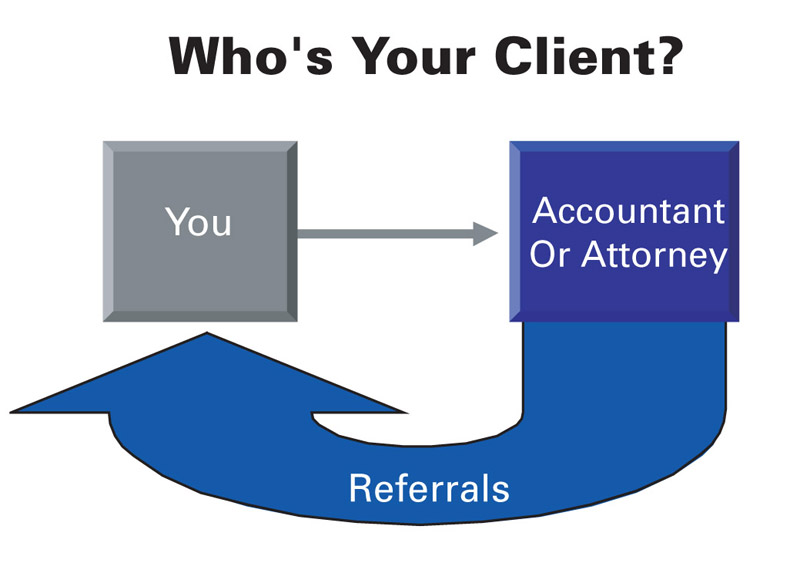

We

run workshops for financial advisors on becoming a rainmaker-someone

who achieves outstanding results in their business. This means helping

advisors forge strategic partnerships with attorneys, accountants and

others. In all the workshops, we use the following graphic and ask the

attendees, "Who is YOUR client?"

If there's any confusion, try the following exercise. Take a piece of paper and fold it in half lengthwise. At the top of the left side, write the initials of one of your better clients. On the other side, write the initials of a professional who has given you a referral in the last 18 months, who you've targeted for a referral or, at a minimum, who you're aware of and has the potential to impact your business. Now answer the following questions for both your client and the professional:

What is the name of their spouse?

What are the names of their children and how old are they?

Where did they go to college?

What are the names of their pets?

What are their interests outside of their jobs?

If you're like most financial advisors, you'll see a pattern. Most financial advisors can easily answer these questions about their investor clients. On the other hand, they seem to fall short on answers when it comes to the professional. In effect, they don't think about the professional as a client and, as a result, probably aren't treating the professional as a client either. And therein lies the rub. Intellectually, most financial advisors readily acknowledge that the attorney or accountant is their client. However, the fact of the matter is that most do not come close to operating that way as evidenced by the erratic levels of knowledge revealed in the exercise. Worse still, professionals have a much greater ability to impact the bottom line of any financial advisor than virtually any client.

2. The End Of Referrals

There are two types of referrals:

The "hand-off" referral is characteristic of a referral from a client. The client is saying: "I trust you, here's somebody, take care of them."

The other type is what we call "Joint Venture Business," which is characteristic of what is received from an attorney or accountant. The professional is saying: "My client has a problem that I need your help with."

Embedded in the definition of a referral is the idea that a client is being given to the financial advisor. This is precisely the case when a new client is referred to you by an existing client-they are handing this person over to a respected professional. However, in the world of strategic partnerships, attorneys and accountants are not giving you a client. From their perspective, the individual remains their client. What they are doing is hiring you for a sleeve of products and services that they do not provide; you are a subcontractor.

One advisor gets to the heart of the matter with the following story. Prior to becoming a full-time advisor, he was an accountant for 15 years. In that time, he gave hundreds of referrals to advisors with whom he had working relationships. Despite the continued one-way support, he NEVER received a call from any advisor asking him for additional insights on the client or his opinion on the product or service being recommended and delivered to the client. (Incidentally, he handles things differently now that he's on the receiving end of referrals.)

3. The Law Of Small Numbers

The

good news is that a relatively small number of strategic partners can

significantly increase your income. In fact, the research on this point

reveals a striking fact: The average number of partners for the Elite

1200 is 3.9.

Perhaps even more interesting is that none of the Elite 1200 work with more than five other professionals. In fact, when advisors tried to work with more than five partners, their success began to falter. Why? It appears that they could not nurture or "feed" all the strategic partnerships adequately, and began to backslide into affiliations, a looser and less effective form of working relationship.

Finding strategic partners is not about selling them on you, your practice or your range of services. Rather, it is about finding someone with whom you click, who has the ability and willingness to impact your business. Only by finding the right strategic partners will you be able to join the ranks of the Elite 1200. To aid you in this process, it is important that you keep a simple word in mind: N.E.X.T.

N.E.X.T. = Never Expend X-tra Time

Our

experience with financial advisors is filled with stories of "good

working relationships" that have gone on for years without producing a

single opportunity for joint business. Similarly, there are those

professionals who spend more time finding fault with a joint venture or

explaining why things can't work the way you envision. If you're not

getting new affluent clients from the partnership after a reasonable

amount of time, use the word: N.E.X.T.

4. "You & I, Inc."

The

goal with a strategic partnership is to create a virtual company with

your strategic partner in which both of you are stakeholding

executives: "You & I, Inc." To do so requires a shift from a sales

approach to a marketing approach. An accepted definition of "sales" is

taking an existing product or service to the marketplace and moving it

"as is." Conversely, "marketing" is defined as a process that begins

with the identification of a prospect and their needs, and then follows

with the development of a solution to meet that need. It's worth noting

that many marketing solutions may incorporate the existing product or

service. Fundamentally, an advisor must adopt a "marketing" mindset

when developing a strategic partnership.

To get started, put yourself in the shoes of an accountant or an attorney as they are pursued by financial advisors seeking referrals. They are regularly besieged by new financial advisors wanting their business; attorneys receive an average of 4.9 visits from new advisors every six months and accountants receive an average of 6.2 visits every six months. This is usually the beginning and the end of the whole process. Why? Because most advisory generalists come by month after month, saying essentially the same thing: "I manage money, do you have any referrals?"

In analyzing the behavior of the Elite 1200, they do three important things to achieve a "You & I, Inc." partnership:

1) Build Rapport

2) Evaluate Potential

3) Find Ways to Add Value

By doing so, they can learn enough to ensure that the partnership has economic viability and is worth cultivating, and can identify ways to make themselves an essential partner to the professional. Interestingly, the majority of financial advisors begin at the same point-building rapport-but they also stop there.

5. The Economic Glue Of Strategic Partnerships

There are two ways you can recompense other professionals; we refer to them as direct and indirect financial incentives.

Direct financial incentives relate to trading clients or fee sharing, both of which have severe limitations. So what do the Elite 1200 do? It turns out that they strongly focus on indirect financial incentives as opposed to direct ones. The following is an example of a successful indirect financial incentive.

One financial advisor was trying to build a partnership with a trusts and estates attorney, and through the preliminary profiling process discovered that the attorney was concerned about growing his income. Through ensuing discussions the advisor learned that the attorney operated on a billable hours arrangement, was sensitive to his clients' concern about costly phone calls, had developed more than 2,000 client relationships during the course of his career (only a few dozen of which were currently active), and did no proactive marketing to grow his business. The advisor carefully evaluated the information he had and proposed the following initiative:

Most trusts and estates attorneys agree that an estate plan is outdated after a period of three to five years has elapsed. Using that logic, a great number of the attorney's 2,000-plus clients needed to update their plans to reflect their current circumstances and wishes. Through proactive communication with clients, the advisor could help the attorney convert the latent billable hours from outdated estate plans into new incremental income. He hired a graphic designer to create 15 customized birthday cards, each commemorating the age of an estate plan, that would be sent annually to clients from the attorney as a gentle reminder of the need to stay current. The total costs to the advisor were a few hours spent thinking outside-the-box and a few hundred dollars on the card design. The results, however, were much greater: The attorney significantly increased his business, his billable hours and his income and has given the advisor preferred status as a referral source.

While a little creative thinking can go a long way and should certainly be part of any working relationship, most professionals will share ideas for the kinds of indirect financial incentives most meaningful to them during the initial profiling process.

The Bottom Line

If

you want to become one of the Elite 1200, you must have a wealthy

client base. The optimal prospecting approach is to access these

affluent clients from "centers of influence."

The five strategic shifts discussed in this article encompass the way you must think about building strategic partnerships. Once you have incorporated these five premises into your thinking and practice, the rest of the process becomes much easier.

In the final analysis, your success in this industry has as much to do with how you invest your time in the expansion of your career as it does with how you invest your clients' money. We challenge you to critically review this system against any other methodology for growing your long-term business. We firmly believe that, through research and experience, you will find it to be the most effective model for garnering additional affluent clients.