|

Sponsored By

|

|

Today women represent more than 50 percent of the U.S. population, make up the majority of college students (undergraduate and graduate) and continue to make progress in earnings and employment. Yet, despite these strides, how to address the financial needs of women remains largely unanswered by the financial services profession and its advisors. In an effort to address the needs and concerns of women, The American College State Farm® Center for Women and Financial Services decided to re-examine the results of our 2012 Women of Color Study from a generational perspective. We analyzed the data for baby boomers, Generation X, and Generation Y — better known as millennials — to determine their unique financial needs and attitudes.

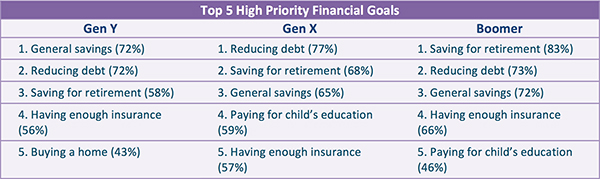

It was no surprise that the top three financial goals for millennial, Gen X and boomer women are increasing savings, paying down debt and saving for retirement, though not in the same order for each group. If financial companies and advisors can work together with women to address and achieve these goals, it will go a long way in establishing and improving relationships. Furthermore, numerous studies have reported that women who work with a financial advisor are more confident about their overall financial situation and retirement preparedness than women who do not.

We have identified financial goals and needs for each of the three generational groups along with specific actions that financial advisors can take to help women accomplish those goals and satisfy their needs.

MILLENNIAL WOMEN

Atop the list of financial priorities for millennial women (born 1981 to 1999) is increasing savings and reducing debts, which factored in at 72 percent each. Many of these young women are in the beginning of their professional careers and are primarily concerned with establishing an emergency cash reserve and managing student loan debt.

Where financial advisors can have the most impact in aiding the progress of this generation of women is providing support in actually accomplishing the goal of saving and paying off debt. This can be in the form of creating a specific savings plan and debt elimination schedule with detailed amounts and dates. Periodic check-ins and email communications offering encouragement and support could also be helpful to keep them on track.

Given the typical millennial’s limited financial resources, another area that can benefit them is having a clearer understanding of the need for and importance of protecting their income with disability insurance. Advisors can help them understand their employer provided benefits and determine how much coverage is needed.

An additional takeaway from the survey was that millennial women revealed they did not believe they could afford a financial advisor. Instead of seeking financial advice from a professional, they are talking with family and friends, who may not always have the most current or correct information. Therefore, it is important that advisors position themselves as an affordable and accessible resource to millennial women. Advisors can work with educational institutions and employers to connect with these young professionals early on and in a non-threatening open environment.

GEN X WOMEN

Reducing debt is the number one financial priority for Gen X women (born 1965 to 1980). Their mortgage represents the greatest source of debt followed by credit cards, auto loans, and student loans, the study revealed. In addition, these women find themselves in the unique and oftentimes precarious position of not only focusing on their long-term retirement savings but also caring for the financial needs of their children and elderly parents. About one-third of the women surveyed indicated that they are currently the primary caregiver for a parent or loved one, or anticipate becoming the primary caregiver. This can create a financial burden given the number of people relying on them for support. It is critically important for Gen X women to have sufficient insurance in place to protect their income and families in the event something happens, such as an unexpected illness, injury or untimely death. This would involve educating them on the proper amounts of insurance coverage needed.

Financial advisors can assist Gen X women by helping them manage these competing goals. Preparing a comprehensive financial plan with a detailed analysis of each area such as retirement planning, education planning and risk management that includes long-term care planning, will provide a clear strategy on how to address each objective and the appropriate product solutions. This process will also highlight areas of deficiency and how those gaps can be addressed.

BOOMER WOMEN

As one would imagine, saving for retirement is the top financial goal for baby boomer women (born 1946 to 1964). One of their main concerns or outright fears is running out of money in their later years and becoming a financial burden on their loved ones, the so-called “bag lady syndrome.” Therefore, it is no surprise that due to their higher asset levels and more complex financial situations, boomer women get the lion’s share of advisors’ attention. Although boomer women are more likely to work with a financial services professional, trust issues still exist, especially among women of color, who are less inclined to seek help from a financial advisor.

Ways that advisors can help boomer women include assisting with managing the many decisions that must be made in retirement such as the best way to spend down their assets and when to collect Social Security. Other important considerations are paying down remaining debt, including mortgage and consumer, and long-term care planning. Advisors should continue to be an educational resource and accessible to these women. This can be accomplished by sponsoring informational seminars and workshops where the advisor invites experts to present on relevant topics like Medicare and estate planning.

Lastly, another key takeaway from the survey was that financial advisors and companies did not come across as relevant to women. This speaks to an overall lack of understanding and misperception about the profession and the services provided. First, let us consider the word “relevant,” which means pertinent or connected with the matter at hand. In other words, women feel that the industry and those associated with it are not applicable to them and their needs. They don’t see the relevance. This is a major disconnect, especially since women are expected to be the beneficiaries of a tremendous transfer of wealth — estimated at $22 trillion — inherited from their spouses by 2020. They will need the advice and support of financial professionals now more than ever before.

Barbara Kay, co-author of “The $14 Trillion Woman,” offers several effective ways of reaching women [link to: http://www.barbarakaycoaching.com/media/publications/fourteen-trillion-opportunity.pdf] that include the following:

- Develop an authentic relationship – It is not enough to manage the money well. In general, women are relationship focused. A strong relationship is the key factor in engaging women clients. Women focus on establishing trust before committing to a provider. That means spending time developing a real relationship and learning about her life.

- Extend the sales cycle – Women want a longer sales dialogue. They frequently confer with peers and consider options before making a decision. Be prepared to talk on several occasions. It will be worth it. Once women bond, they tend to be very loyal and cooperative.

- Provide practical education – Remember that women describe financial information as overwhelming, complicated, foreign and boring. To reach women clients effectively avoid technical jargon. Use everyday language and tie the financial service to everyday life.

- Build a genuine partnership – Women value participation. They want a partner. Ask what level of involvement is important to women clients. Work with them, instead of managing them.

These are just a few examples of the many steps that can be taken to close the gap with women. There is no doubt that financial advisors can be a valued partner for women throughout each stage of their financial lives. In order to develop these relationships advisors and financial companies must do better at reaching women where they are. Once there, the advisor’s goal should be helping them create a financial plan with specific goals and timelines. This will go a long way toward solving the relevancy issue and creating a genuine sense of partnership with female clients.

Financial services professionals need deep expertise in niches such as investments, debt reduction and retirement income planning to best understand the needs of millennial, Gen X and baby boomer women. Pursuing advanced education, such as the Retirement Income Certified Professional® (RICP®), Chartered Financial Consultant® (ChFC®) and CERTIFIED FINANCIAL PLANNER™ (CFP®) designations, is an excellent way for financial professionals to position themselves as trusted advisors to women across generations.

For more information how financial advisors can address the financial needs of women across generations, please read the report, “5 Ways to Help Gen Y, Gen X, and Boomer Women Achieve Their Financial Goals.”