With the deadline approaching, taxes are front and center in the minds of investors. No one likes paying taxes, but they are of utmost importance to the financial well-being of state and local governments. Higher tax revenue has been a key driver of improving (in most cases) state and local government credit quality metrics by firming the financial standing of municipal government debt issuers. However, growth in state and local government tax revenue may be poised to slow, lessening the positive impact behind municipal credit quality.

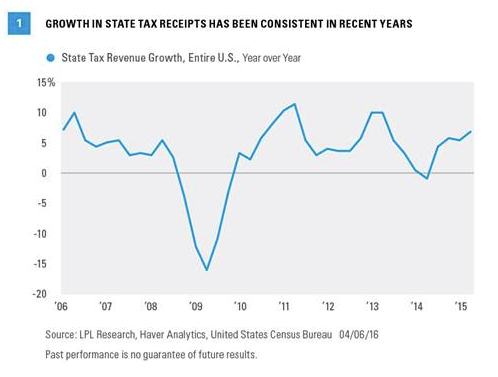

The United States Census Bureau tracks quarterly tax revenue data for each state, and Figure 1 shows the year-over-year growth in tax receipts through the second quarter of 2015 (the most recent data available). Gains have been strong since the Great Recession, with rare exceptions.

However, despite an impressive more than 5% growth rate through the second quarter of 2015, preliminary reports covering more recent quarters indicate slowing growth in tax revenue. States’ own projections have also started to become more pessimistic, with many expecting slower growth for 2016 and extending into 2017. The deceleration isn’t related to one specific revenue source either. The Rockefeller Institute publishes estimates about one quarter ahead of the U.S. Census, and these estimates showed a slowing growth rate in both personal income taxes (4.5% average in 2016 and 2017 versus 8.3% in fiscal year 2015), and sales taxes (3.7% average in 2016 and 2017, versus 4.8% in fiscal year 2015.) Slower revenue growth means less money for states to cover expenses, which include debt service payments. A decrease in tax receipts could lead investors to require more compensation for risk in the form of higher yield spreads for general obligation bonds, which are typically backed by taxing revenue.

STATES RESIST ADDITIONAL DEBT

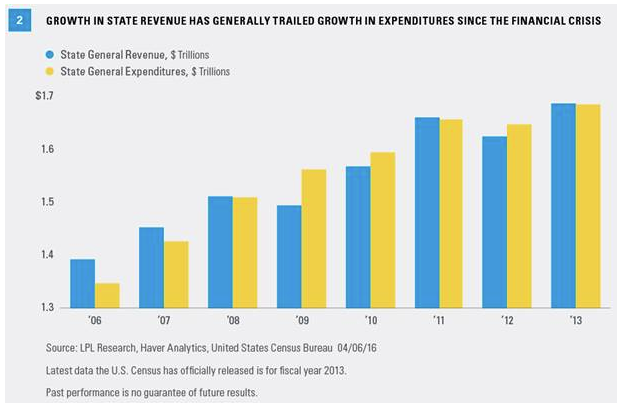

State revenue has generally trailed expenditures in the years since the financial crisis [Figure 2], which is why revenue gains of the past several years have failed to translate into even better financial standing. The reality is that despite revenue gains, budgets remain very tight and have left states with little appetite for taking on additional debt.

The relatively slow rate of growth in debt levels has generally been supportive of the municipal bond market by keeping overall market growth close to zero. This has fostered a favorable supply-demand balance and may have been one factor that helped municipal bonds power through a traditionally weak seasonal period in March 2016, with a positive return of 0.3% for the Barclays Municipal Bond Index, the best March return since 2008.

Over the past year, however, budget battles have intensified in places like Illinois, which still doesn’t have a 2016 budget, and Pennsylvania, which just recently passed its 2016 fiscal budget nearly nine months after the deadline. Pennsylvania’s budget was achieved without tax increases but the state will likely face a tax hike debate in the next budget discussion. The city of Chicago recently passed a large tax increase to help cover pension shortfalls and may be forced to do so again, as an attempt to cut pension costs in order to lower expenses was overturned by the state’s Supreme Court.

The threat of higher tax rates remains despite revenue gains of the past few years. Higher tax rates improve the attractiveness of tax-exempt municipal bonds broadly and may boost their allure. With budgets expected to remain tight, the supply of municipal bonds will likely remain constrained relative to demand, and the potential for tax increases will also likely stay on the table—both of which are longer-term positives for municipal bonds.

DEFAULTS REMAIN LOW

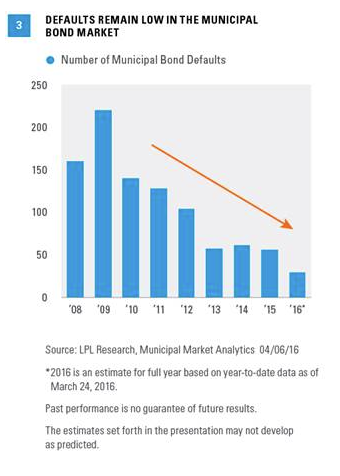

Despite highly publicized budget skirmishes and trouble spots like Puerto Rico, municipal defaults remain isolated. Figure 3 shows the deceleration and continued low number of defaults in the municipal bond market in recent years, giving little evidence that the weakness of these well-known problem areas is spilling over into the broader municipal market.

CONCLUSION

Though growth in state tax receipts may slow, the fundamental picture for municipal bonds remains positive and the prospects of higher taxes in future years may enhance their allure. Valuations also remain attractive with 10- and 30-year municipal bond ratios at 95% and 100%, respectively, meaning investors are able to receive nearly the same yield as similar maturity Treasuries, while also enjoying the tax benefits. Although certain issuers will struggle with the prospects of declining revenue, we believe these issuers may continue to be isolated cases.

Anthony Valeri is investment strategist for LPL Financial.