Recently, I received a pitch from a public relations firm that represents an ETF sponsor titled, "Advisors Fleeing Mutual Funds, Heading Toward ETFs."

This being a press release, it wasn't surprising that the viewpoint was so obviously one-sided. But it also contains an element of truth.

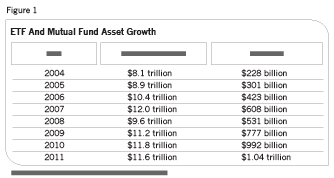

As New Year approaches, ETF sponsors have a lot to celebrate. Since the end of 2004, ETF assets have more than quadrupled, while mutual fund assets are up around 40%. Today, ETFs hold about 9% of the total assets that mutual funds have, compared to 5% at the end of 2007.

At the same time, it may be a bit premature to open the champagne bottle. Despite scattered predictions of their imminent slide into obscurity, mutual funds remain firmly entrenched as the investment vehicle of choice among financial advisors and individual investors. And while ETFs are still collecting assets at a faster clip than mutual funds, the difference in growth rates has recently narrowed. In the first eight months of 2011, mutual fund assets dropped slightly while ETF assets rose only around 5%.

The leveling off could signal the beginning of a stalemate between the two industries next year as each tries to market its advantages to investors. "We've reached a stage where ETF use has reached a saturation point among financial advisors," says Loren Fox, senior research analyst with Strategic Insight. "It's going to take time for those who aren't using them yet to figure out how to transition them into their practice and combine them with mutual funds."

Many advisors new to the ETF world are still getting a handle on the mechanics of an investment that combines elements of the stock and fund worlds, says Beth Flynn, vice president and head of third-party ETF platform management at Charles Schwab & Co. "The most common question we get from advisors revolves around trading issues," she says. "It's an education process. We need to tell them that placing market orders for 50,000 shares isn't the best way to go."

figure 1

The challenge for the ETF industry is finding ways to increase its presence among both new users and seasoned veterans. A survey this year from FA Vision, a service from consulting firm kasina and online advisor community Horsemouth, indicates that over one-fourth of advisors still do not hold ETFs in client portfolios. Those that have adopted ETFs commit an average of 15.6% of their clients' assets to them.

The survey shows that popularity varies widely among distribution channels. Independent RIAs who use ETFs were the most comfortable committing client assets, putting an average of 26.7% of assets under management into them. On average, advisors across all channels who have adopted ETFs commit an average of 15.6% of client assets.

"Although there has been tremendous growth with this product, our survey reveals that there is still a sizable market that has yet to adopt ETFs within their client portfolios," says Hari Krishnaswami, FA Vision product manager. "Even those advisors who have adopted this product have yet to allocate significant assets."

Only time will tell whether ETFs will ever dominate the investment landscape to the extent the mutual fund industry does. In some areas, they will be able to play catch-up and in others, mutual funds still hold the edge. The industry has seen a number of trends, such as the growing number of alternative strategy ETFs.

If any area of the market can catch up with mutual funds, it's alternative strategies such as commodities, hedging, currencies and high yield. ETFs' low costs, their ease of trading and their greater transparency make them particularly suited to alternative "satellite" positions, and allow a new swath of advisors to enter into these investments who might not have considered them before.

"More and more ETF launches encompass those strategies, so we expect them to take a growing share of the ETF market," says Fox.

Smaller players are edging in. While BlackRock iShares, State Street Global Advisors and Vanguard have an 85% share of the ETF market, the growing popularity of alternative strategies is making room for some smaller ETF families to gain traction in the marketplace. Index IQ, a family of alternative asset class ETFs that invest in areas such as hedge fund strategies, commodities and real estate, has doubled in size over the last year and now has more than $700 million in assets.

"We're not trying to compete with iShares," says CEO Adam Patti, who launched the funds in 2009. "But with everyone piling into the same ETFs with a high correlation to each other, we believe there's a niche for a firm that offers something different."

Tom Graves, equity analyst at S&P Capital IQ, sees opportunities for growth among ETF sponsors that have ready-made brand names, such as PIMCO and Schwab. "Although iShares and State Street got a big head start on everyone else, the success of Vanguard ETFs shows it's possible to gain market share if you come in strong with a recognizable name," he says.

Yield-hungry investors are increasingly turning to ETFs for income. Most mutual funds have higher expense ratios than ETFs. That puts them at a yield disadvantage to lower-cost ETFs because those expenses are subtracted directly from dividend yields, leaving investors with less income.

Bond and equity income ETFs are likely gaining ground quickly among advisors because they offer higher yields than most mutual funds. Out of the ten ETFs with the highest inflows this year, two of them-SPDR Utilities and Vanguard Mergent Dividend-are aimed at investors seeking above-average dividend yields. At Schwab, 32% of inflows into ETFs from financial advisors during the first nine months of the year went into equity income products, says Flynn.

Fixed-income ETFs are also doing well industrywide. Through the third quarter, net inflows into fixed-income ETFs totaled $29 billion, compared to $21 billion for U.S. equity products. The most popular fixed-income category among advisors at Schwab is intermediate/long-term, a category that accounts for 28% of the bond ETF assets that the group holds at the firm, followed by short and ultra-short and inflation-protected bonds, each at 19%.

For Many, Active Management Adds Value ...

According to a study this year by Strategic Insight, "How Financial Advisors Use ETFs," most of the recent growth in ETF use has come from newly invested assets, not through advisors selling out of actively managed mutual funds into ETFs. Fox says that many advisors who use ETFs heavily still use actively managed mutual funds, particularly those with a flexible or unique investment strategy.

"Sales of core mutual funds have been down since the financial crisis in 2008," says Fox, the study's author. "Industrywide, we're seeing much more demand for actively managed funds that are able to differentiate themselves."

In the ETF world, active management is still a rarity, and most of the equity products launched thus far have met with tepid demand or been delisted. The requirement that ETFs update and post their holdings daily doesn't sit well with fund managers, who don't want to announce their moves, and regulators have been slow to grant exemptive relief from that requirement. While sponsors have filed more than 800 active ETFs with regulators, these vehicles still account for less than 1% of total ETF assets. With the flash-crash hangover still alive and well in Washington, regulatory approval for new actively managed ETFs will probably be sluggish at best.

There are a couple of corners of the market where trumpeting trades is less of an issue and active management has made some inroads. The most notable success stories in this area have been several PIMCO bond ETFs and a number of currency ETFs offered by WisdomTree.

To some extent, the growing number of rules-based index ETFs are filling the active management gap because their quantitative strategies, which filter stocks based on earnings, dividends or some other criteria, add an element of selectivity to the indexing process. But some feel these new choices are creating confusion as investors try to sort out the differences between the many new offerings in the burgeoning industry. And not all indexing enthusiasts are fans.

Rick Ferri, the president of Portfolio Solutions in Troy, Mich., questions whether these indexes really do perform better over the long term. "Some companies are trying to send a message to investors that their custom index ETFs will generate significantly higher returns than traditional index funds that follow common market indexes," he writes in The ETF Book. "There are many different ways to design the indexes that ETFs follow, but no clearly superior strategy can guarantee consistently higher returns."

The question of whether rules-based indexers have indeed built a better mousetrap will be easier to settle once the funds have established a longer-term track record. If they perform well, they could become more difficult for traditional market-cap-weighted indexing fans like Ferri to ignore.

... But Cost Remains A Factor

Actively managed mutual funds will always have a strong audience, but there will also be a huge segment of investors who like the bargain ETFs represent. A survey from Schwab notes that cost is the number one factor investors consider when choosing an ETF; 59% of respondents say the expense ratio is "extremely important" while 51% say the same about commissions.

With expense ratios on a number of ETFs below ten basis points, can costs get any lower next year?

"That's hard to say," says Graves. "But low cost has been a big selling point for a number of ETFs, and that will almost certainly be true in the future."