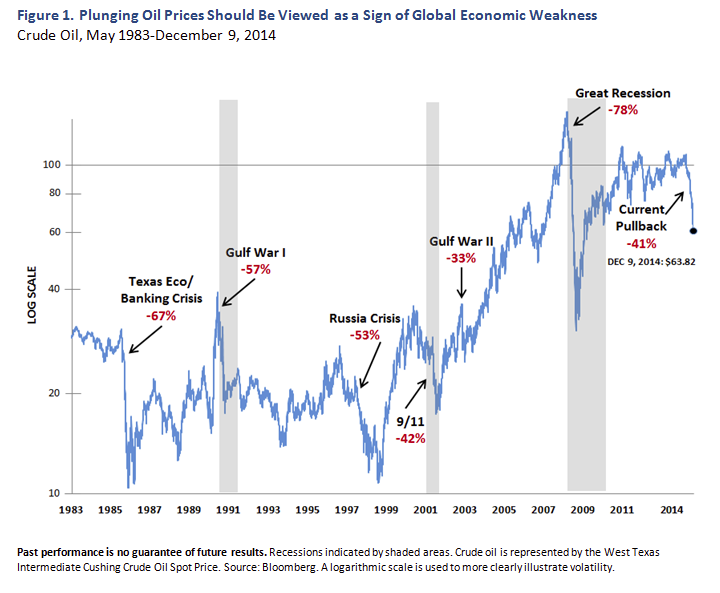

1. A decline in oil prices portending global economic weakness, as in 2000 and 2009 (Figure 1).

2. Anticipation that the Fed will remove its “considerable time” language from its statements about how long it will forestall interest rate increases.

3. The absence of consensus between the European Central Bank (ECB) and German finance ministers about whether the ECB can move forward with true quantitative easing (that is, buying unsecured debt of EU member nations).

As investors grow accustomed to the idea of U.S. short-term rates rising slowly against a backdrop of improving economic growth, we believe the stock market will move to new highs in 2015. Our 12-month price target for the S&P 500 Index is 2250, which would translate into a 13 percent equity return, including dividends.

We maintain the view that we are entering a growth regime similar to 1996–1999. As we have discussed in the past, there are several factors that have historically been indicative of a growth regime, most of which have fallen into place. They include a flattening yield curve, narrow but widening valuation spreads and a declining percent of companies showing margin improvements. The yield of the 10-year Treasury bond is likely to stay in the 2.0 percent to–2.5 percent range for 2015, given economic weakness outside the U.S., a strong U.S. dollar and weak oil prices.

While there are some companies with bubble-like valuations, equity valuations appear reasonable overall, and accretive M&A transactions and highly accretive share buybacks can provide ongoing support to the equity market. In this environment, we continue to identify what we believe are great franchises at attractive valuations. We remain overweight technology, consumer discretionary, health care, and financials, and underweight consumer staples, utilities, energy, and materials.

Gary D. Black is the executive vice president, global co-chief investment officer at Calamos. Black oversees Calamos’ portfolio management, trading, research and risk management in partnership with John P. Calamos Sr., with whom he leads the Investment Committee. He joined Calamos in 2012 and has 22 years of industry experience in a number of executive leadership roles.We see continued upside for U.S. stocks in 2015 but believe the market will struggle through year end, with several factors contributing to near-term volatility:

4. Growing concerns about the bubble-like valuations of some U.S. “momentum” stocks.

Although we view the recent fall in oil prices as indicative of global slowdown, the worst of the decline is likely behind us. We don’t believe another recession is looming. Rather, we still believe we are in the fifth or sixth inning of this economic cycle, where global GDP growth of 2 percent to 3 percent for 2015 is balanced with low inflationary pressures. We expect U.S. corporate earnings growth in the 5 percent to 6 percent range for 2015.

Stocks Likely To Tread Water Through Year End Before Moving Higher In 2015

December 12, 2014

« Previous Article

| Next Article »

Login in order to post a comment