Key Points

- Weak U.S. profit growth and Fed policy uncertainty have weighed on U.S. stocks, and with the summer season approaching, a breakout doesn’t appear imminent. But there is hope for the second half of the year, and investors should be aware of the less-told story.

- A continued sluggish U.S. economy has kept stocks in a trading range for two years, but there could be a bounce in the second half of the year. Now that the market and the Fed are basically on the same page, the beginning-of-year turmoil which accompanied the initial rate hike may not be repeated.

- Emerging markets can be a solid part of a portfolio for the long-term, but the asset class could face some headwinds in the second half of the year.

U.S. equities can’t get their wheels moving forward

Domestic stocks continue to spin their wheels, remaining in a relatively broad range for a couple of years. The recent weak earnings season didn’t help to resolve the uncertainty. Stocks again pulled back after failing to break out to new highs, but we don’t believe we’ll see a repeat of the recession-fear fueled January-February correction. Additionally, investor sentiment has become less optimistic recently according to the Ned Davis Daily Crowd Sentiment Poll, while longer term skepticism is illustrated by the $61 billion pulled out of equity mutual funds and exchange-traded funds (ETFs) this year (as of May 13, according to ISI Evercore Research). As a typical contrarian indicator, weak investor sentiment can help to support stocks as it often means cash has built “on the sidelines.”

We remain neutral on U.S. stocks and believe we’ll continue to slog along, with summer typically a more sluggish trading season. We urge investors to remain patient and not reach for returns by adding to risk beyond their normal strategic allocations.

Risks abound, but is there an opportunity?

With first quarter earnings season relatively weak, and not a lot of hope for a meaningful improvement in the current quarter, the malaise is understandable. With Fed policy uncertainty, the upcoming “Brexit” vote, a contentious U.S. election season, and geopolitical uneasiness, investors may be asking why they should stick through the traditionally sluggish summer season. But that’s also the story “everyone” is telling; and we are always more intrigued by the story fewer are telling.

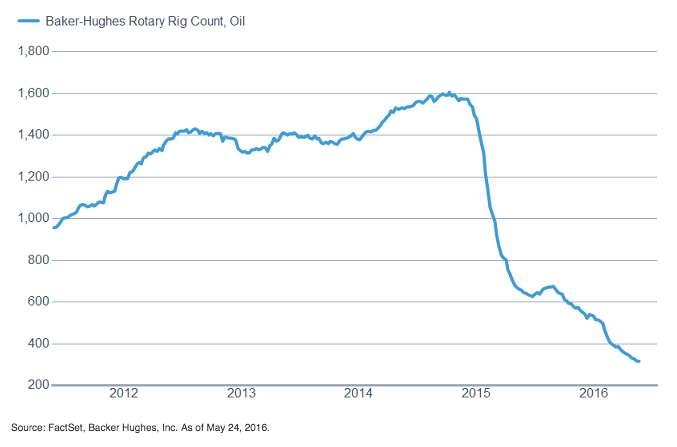

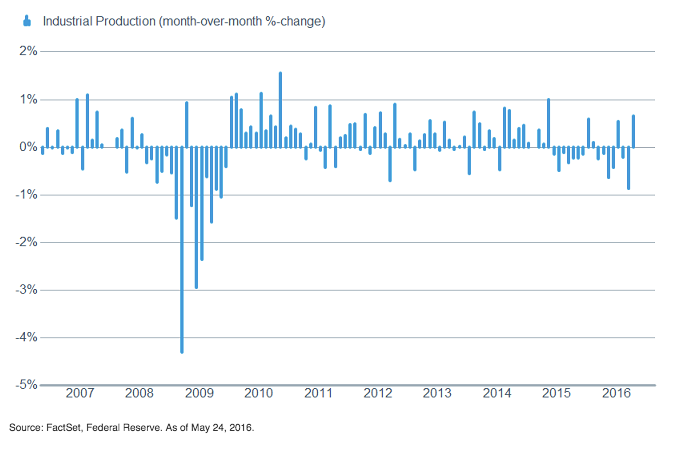

The major drag on earnings from the energy sector should begin to dissipate in the second half of the year, as oil prices have rebounded and year-over-year comparisons become easier. Additionally, the bounce in crude could help to support the fits-and-starts improvement in manufacturing we’ve seen recently. For example, the U.S. rig count has dropped precipitously and may be coming to an end as oil has moved higher over the past couple of months. Although very tentative, the Institute for Supply Management’s Manufacturing Index has been in territory depicting expansion for two consecutive months, while the leading new orders component has been relatively robust.

Additionally, industrial production rose 0.7% in April, breaking a string of negative readings. We need to see a few more positive readings in a row to become more convinced, but stocks could begin to sniff out the improvement.

A rise in oil prices

Could help arrest the plunge in rigs

Which could help to support manufacturing

More important for the U.S. economy is that the U.S. consumer may be perking up. Although multiple major traditional retailers reported disappointing results, April’s retail sales rose a robust 1.3%, while ex-autos and gas they gained a solid 0.6%. Additionally, according to the University of Michigan, consumer sentiment rose last month; and revolving consumer credit (which includes credit cards) rose $11.1 billion, the biggest jump since 2001 according to the Federal Reserve. We believe the American consumer may be changing in what and how they are spending money, but it appears they remain in relatively good shape. For more a more detailed look at the consumer, read Brad’s sector piece “The State of the Consumer.”

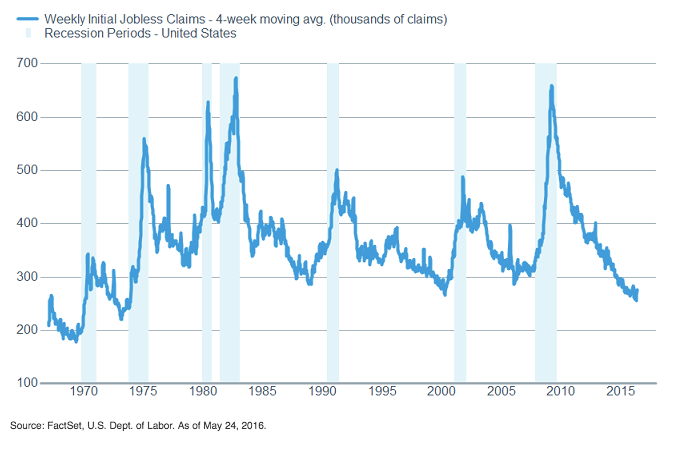

Further potential support for consumer spending comes from the continued improvement in the labor market, with the forward-looking jobless claims falling back after a brief move higher due apparently to some special timing issues, including the ongoing Verizon strike in New York. The improvement is also starting to support wage growth. For a more detailed look at wage growth, read Liz Ann’s latest report.

Claims remain low

Source: FactSet, U.S. Dept. of Labor. As of May 24, 2016.

And wages are starting to benefit

All of this doesn’t mean stocks are going to be off to the races, and we believe near-term volatility will persist, but it does open the possibility for stocks to move higher in the second half of the year as equity investors start to sniff out these potential improvements.

Fed could go from hindrance to help

Another weight on stocks has been Fed policy uncertainty. Throughout much of the first half of this year there had been a mismatch between market expectations and the Fed’s own forecasts in terms of potential interest rate hikes. But both the latest release of the Federal Open Market Committee (FOMC) minutes and commentary from many of its members suggest a rate hike in June or July. As such, the market and the Fed are now essentially aligned. While this process caused some pain in the equity markets recently, it could save pain later should the Fed actually raise rates soon.

We continue to view one or two hikes this year as the most likely scenario, but have our eye on both the rise in wages mentioned above and the bump up in inflation measures such as the Consumer Price Index (CPI), which moved up 0.4% in April, and 0.2% on the core rate. If inflation were to surprise on the upside, the Fed could be forced to be more aggressive, leading to more consternation for investors. But for now, we continue to believe the Fed will be slow and methodical in their quest to return rates to a more “normal” level, which could help to support equities in the second half of the year.

Emerging markets’ wild ride

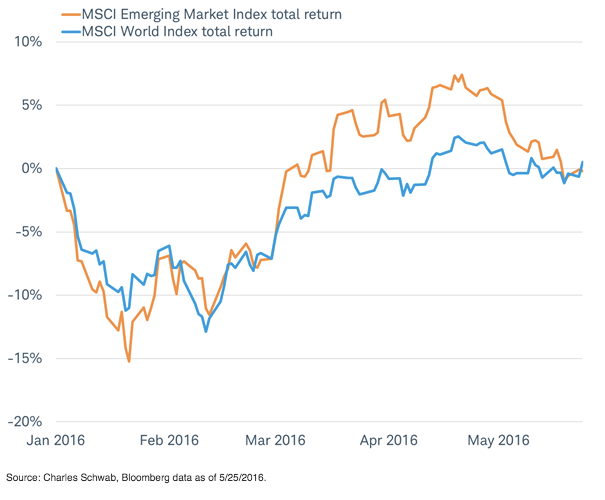

The changing view of the market about the Fed and the resultant moves in the U.S. dollar will likely continue to have an impact internationally as well. Emerging market (EM) stocks had been strong performers for much of this year after bottoming in January. The MSCI Emerging Market Index was up 6% for the year through the end of April. But, in May, the index has seen losses of 6%, and is now even for the year and slightly lagging the performance of developed market stocks, measured by the MSCI World Index, as you can see in the chart below.

MSCI EM performance YTD

The financial media has covered the fact that some well-known investment firms upgraded EM stocks to an overweight in the past couple of months. We did not and remain neutral on the asset class. While we believe EM stocks are an important part of a well-diversified portfolio and attractive for the long-term investor, in our 2016 Outlook we cautioned on EM stock market performance and noted that EM would likely be volatile and a laggard—that is so far proving to be the case. Here are three reasons why:

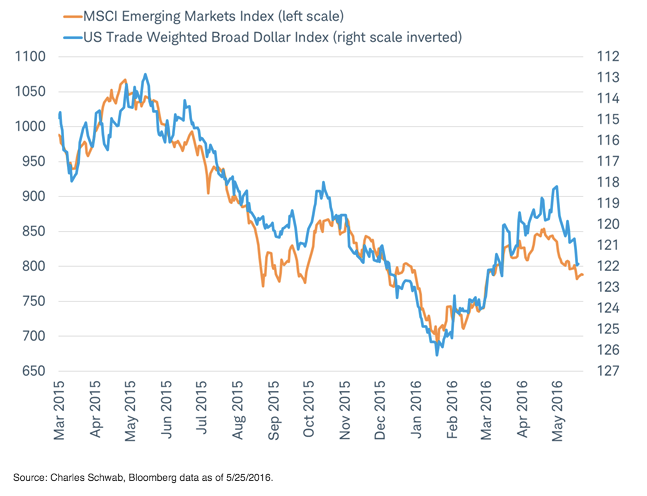

Emerging market performance has been U.S. dollar dependent, as you can see in the chart below. This is due in part to U.S. dollar-denominated debt owed by companies in EMs and also because the currency moves partly reflect capital flows in and out of EMs from the United States. We don’t see the renewed weakness in the U.S. dollar in the second half of the year that would help EM stocks outperform.

Emerging market stock performance has been linked to the dollar

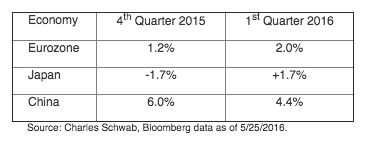

Gross domestic product (GDP) growth in developed markets like Europe and Japan this year has been surprisingly strong. For example, first quarter GDP accelerated from the fourth quarter and widely exceeded expectations with annualized growth of 2.0% in Europe and 1.7% in Japan. Yet, it appears policy makers are pulling back on economic stimulus in China which may weaken the outlook for EM economic growth.

GDP annualized

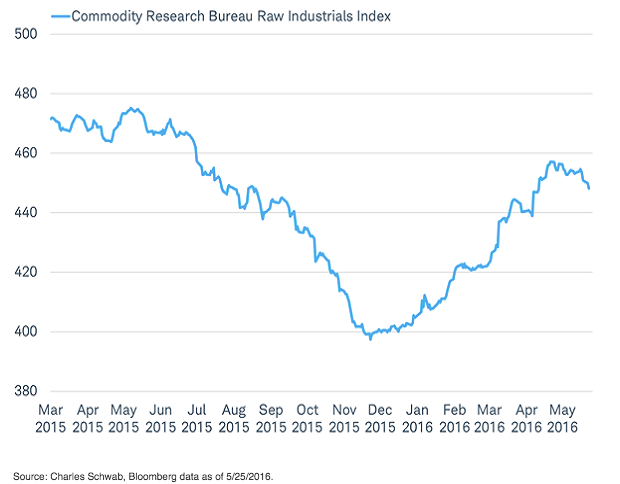

Industrial commodity prices may be due for a pause rather than continue to climb as they did earlier this year. Some EM countries rely on commodities for growth, such as Brazil.

Run up in commodity prices may have paused

EM stocks’ below-average valuations, structural economic reforms, and consumer-driven growth make EM stocks an attractive long-term asset class for portfolios, but they may lag developed markets in 2016. Our view continues to support a neutral allocation to EM stocks in 2016.

So what?

The running-to-stand-still pattern in U.S. equities may continue, with bouts volatility expected. But U.S. economic growth appears to be improving and stocks could start to sniff out a potentially better second half for both the economy and earnings. Investors should remain patient, and use volatility as opportunities to rebalance around normal strategic allocations in both U.S. and international equities.