Key Points

- Weak U.S. profit growth and Fed policy uncertainty have weighed on U.S. stocks, and with the summer season approaching, a breakout doesn’t appear imminent. But there is hope for the second half of the year, and investors should be aware of the less-told story.

- A continued sluggish U.S. economy has kept stocks in a trading range for two years, but there could be a bounce in the second half of the year. Now that the market and the Fed are basically on the same page, the beginning-of-year turmoil which accompanied the initial rate hike may not be repeated.

- Emerging markets can be a solid part of a portfolio for the long-term, but the asset class could face some headwinds in the second half of the year.

U.S. equities can’t get their wheels moving forward

Domestic stocks continue to spin their wheels, remaining in a relatively broad range for a couple of years. The recent weak earnings season didn’t help to resolve the uncertainty. Stocks again pulled back after failing to break out to new highs, but we don’t believe we’ll see a repeat of the recession-fear fueled January-February correction. Additionally, investor sentiment has become less optimistic recently according to the Ned Davis Daily Crowd Sentiment Poll, while longer term skepticism is illustrated by the $61 billion pulled out of equity mutual funds and exchange-traded funds (ETFs) this year (as of May 13, according to ISI Evercore Research). As a typical contrarian indicator, weak investor sentiment can help to support stocks as it often means cash has built “on the sidelines.”

We remain neutral on U.S. stocks and believe we’ll continue to slog along, with summer typically a more sluggish trading season. We urge investors to remain patient and not reach for returns by adding to risk beyond their normal strategic allocations.

Risks abound, but is there an opportunity?

With first quarter earnings season relatively weak, and not a lot of hope for a meaningful improvement in the current quarter, the malaise is understandable. With Fed policy uncertainty, the upcoming “Brexit” vote, a contentious U.S. election season, and geopolitical uneasiness, investors may be asking why they should stick through the traditionally sluggish summer season. But that’s also the story “everyone” is telling; and we are always more intrigued by the story fewer are telling.

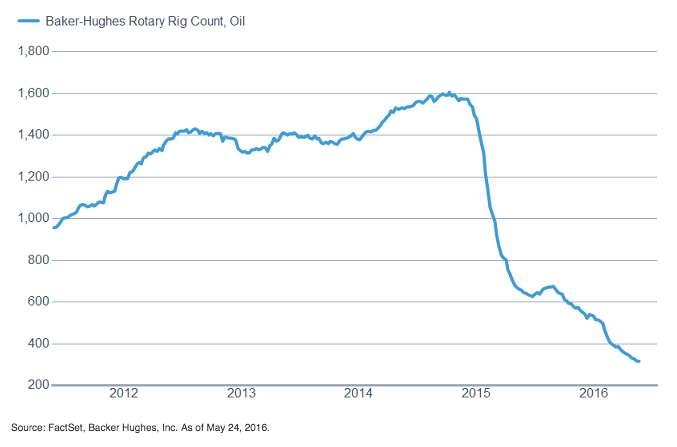

The major drag on earnings from the energy sector should begin to dissipate in the second half of the year, as oil prices have rebounded and year-over-year comparisons become easier. Additionally, the bounce in crude could help to support the fits-and-starts improvement in manufacturing we’ve seen recently. For example, the U.S. rig count has dropped precipitously and may be coming to an end as oil has moved higher over the past couple of months. Although very tentative, the Institute for Supply Management’s Manufacturing Index has been in territory depicting expansion for two consecutive months, while the leading new orders component has been relatively robust.

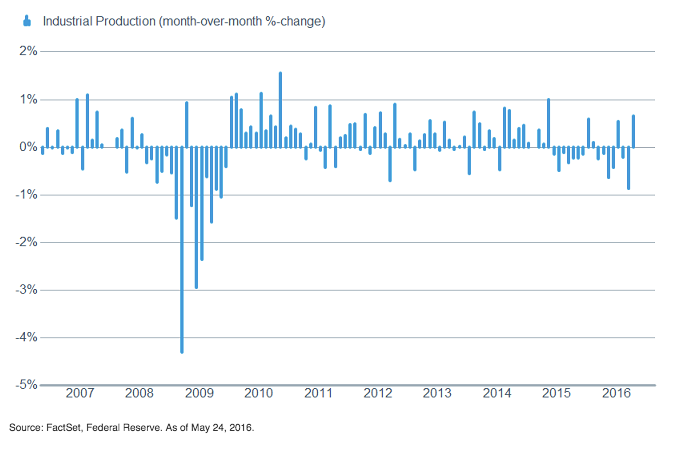

Additionally, industrial production rose 0.7% in April, breaking a string of negative readings. We need to see a few more positive readings in a row to become more convinced, but stocks could begin to sniff out the improvement.

A rise in oil prices

Could help arrest the plunge in rigs

Which could help to support manufacturing

More important for the U.S. economy is that the U.S. consumer may be perking up. Although multiple major traditional retailers reported disappointing results, April’s retail sales rose a robust 1.3%, while ex-autos and gas they gained a solid 0.6%. Additionally, according to the University of Michigan, consumer sentiment rose last month; and revolving consumer credit (which includes credit cards) rose $11.1 billion, the biggest jump since 2001 according to the Federal Reserve. We believe the American consumer may be changing in what and how they are spending money, but it appears they remain in relatively good shape. For more a more detailed look at the consumer, read Brad’s sector piece “The State of the Consumer.”