In the aftermath of the financial meltdown in 2007-2009 and the lending shenanigans ignored by regulators and politicians prior to 2007, the Federal Reserve Board executes annual stress tests on systematically important financial institutions. The ongoing effort includes running the numbers on economic scenarios as bad as the 1930s and includes high capital requirements dictated by regulators. It is soon followed by regulatory approval for the capital plans of the major banks and insurance companies on the list. These “stress tests” have taken center stage for investors in these companies.

Ironically, we at Smead Capital Management are being run through a “stress test” by a stock market that temporarily ignores our meritorious companies to invest elsewhere. We run all potential company investments through our eight criteria and in the process seek to defend our shareholders against negative scenarios and downside risks faced by our long duration investors. This doesn’t mean that there aren’t times when the stock market shuns our companies while they pursue other agendas.

There is an unusual crossover at the present time between the Federal Reserve’s stress tests and stock market underperformance, because we own four of the companies on the Fed’s “too big to fail” list. What is likely to be the outcome of the Fed’s tests in late June of 2016 and the “stress test” we are getting by virtue of being overweighted in financials and, in particular, banks?

We believe the Fed is doing a classic “close the barn door after the animals have left the yard.” Today’s major financial institutions are bulging with capital at a time when the largest adult population group (Millennials) have been hesitant to borrow to buy homes and cars. Therefore, banks like JPMorgan (JPM), Wells Fargo (WFC), Bank of America (BAC) and American Express (AXP) are drowning in cheap deposits and are prohibited from returning unneeded capital to shareholders. These shareholders have been tortured by the mistakes of a housing and lending boom from 2002-2005 and continue to be punished by populist politicians and socialists who want people to believe that they are holding the “animals in the barn.”

Bank of America CEO, Brian Moynihan, weighed in on this subject in a June 14, 2016 interview with the Wall Street Journal:

“Bank of America Corp. Chief Executive Brian Moynihan, said the Federal Reserve’s annual stress tests may be causing banks to restrict lending. ‘It will make you very safe,’ he said referring to stress tests at The Wall Street Journal’s CFO Network conference in Washington D.C. Monday night. ‘The question is whether it restricts lending.’“1

Economic problems outside the U.S. have exacerbated the decline in long-term Treasury bond interest rates and have combined with regulatory fears to drive down share prices of these systematically important institutions. From a psychological standpoint, it is starting to look like the bad news will never end for these financial companies. Today’s investors, who are gun shy in the first place, are happy to sell and get out of the way of today’s news and stress.

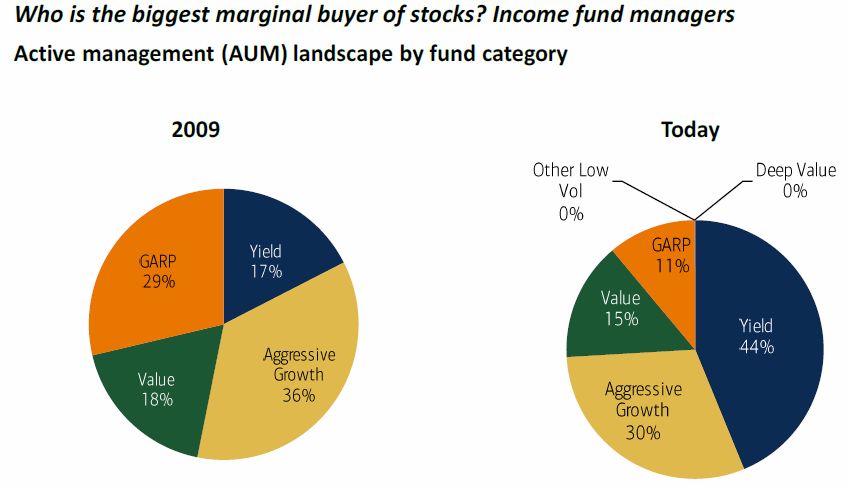

What have investors been pursuing currently? First, they are chasing yield in the least economically sensitive S&P 500 sectors. So far in 2016, utilities, staples and telecoms have received investor favor. This approach also worked in 2011 and coincided with the big banks becoming deeply out of favor. The chart below shows how investors have chased yield in the stock market as a surrogate for yield they have lost in bonds―and because of the mortal fear of economic disaster:2

Second, growth has been hard to come by, partially due to restrictions put on our largest banks. This has driven investors to chase revenue growth stories. For example, Microsoft announced, as I write on June 13, 2016, that they are paying $26.2 billion to buy LinkedIn. Investors bid up Amazon, Tesla and Netflix among glamour revenue growth stories. As long as economic growth is anemic, those that offer a glimmer of hope are purchased in lieu of those who already have profits and free cash flow. It is as if investors only trust abnormally high growth rates and have shortened the duration of their patience.

We would point out that owning yield stocks the last five years underperformed our portfolio and appear overpriced in relation to history. Almost nobody got wealthy from owning utilities and telecoms over the last thirty years and we believe they are unlikely to do it the next thirty. Staples are very good businesses, but at 22 times profits, the other investors can have them.

It is our opinion that the Fed’s stress tests on systematically important financial institutions and the significance of the tests will decline as we get farther away from 2008. We are also convinced that a large number of Millennials will want to borrow, once they have kids, to buy homes and cars. The spooky post-financial meltdown era dominates investors’ thinking. We have learned that there is only one thing we can guarantee in investing―that eventually things change. This means politicians and regulators come and go and demographic/psychological factors must be anticipated in a contrary way. Here is how Moynihan explained why he is not bothered by living through this phase of financial history:

“Mr. Moynihan also dismissed the anti-bank rhetoric in Washington and in the presidential campaign. ‘We made $16 billion last year after tax,’ he said. ‘That’s worth grinning and bearing.’”

Finally, we are more than willing to accept the stress we receive from owning these major financial stocks, as a test of our eight criteria for stock selection. We did so in 2011 and accepted the stress of weak financial stock price performance. This was right before financials ripped the cover off the ball from 2012-2014 and outperformed the market. We accept this performance “stress test” because there could be a huge reward if our economy improves with the aging of our largest adult group and if regulators and politicians find something better to build their reputation on. Remember the old and wonderful quote that originated with Ben Graham, “The stock market was invented to move money from the impatient to those who are patient.”

1Source: The Wall Street Journal

2Past performance is no guarantee of future results. Source: Merrill Lynch report March 30, 2016; What Investor’s Want.

William Smead is CEO and chief investment officer at Smead Capital Management.