Clients are increasingly asking their financial advisors to help determine their Social Security retirement strategy, but advisors should also focus on Medicare benefits.

There’s a common misperception among people approaching retirement that Medicare will cover all their health-care costs in retirement. This isn’t the case.

Individuals age 65 and older can anticipate spending about 40 percent of healthcare costs out of their own pocket. Medicare covers about 62 percent of costs for individuals age 65 and older, according to the Employee Benefit Research Institute. So, that’s $40 of every $100 they will spend on their health-care needs.

The variables involved are complex and can be overwhelming to someone delving into these issues, which often is why we hear from financial advisors and their clients. Essentially, you want to embark on a two-phase approach to this process—establishing the big picture or strategic framework and then creating a year-to-year action plan.

First, however, it’s important to understand why Medicare costs are becoming a more pressing issue for clients.

Higher Medicare Premiums To Affect More People

It can be easy to miss the fine print in Medicare legislative proposals that affect individual taxpayers. One bill, known as the “doc fix” bill, was passed April 16 and received a lot of attention for reforming the automatic Medicare payment cuts that doctors faced each year.

The measure, “Medicare Access and CHIP Reauthorization Act of 2015,” also creates a set of new rules for higher-income Medicare beneficiaries:

- Those already paying higher premiums for Medicare (because they have higher incomes) can expect greater costs starting in 2018.

- More individuals will enter higher tiers of Medicare surcharges because of these changes.

- Supplemental coverage, known as Medigap, will no longer pay for Medicare Part B deductibles starting in 2020.

People who earn above a certain threshhold have been paying higher premiums already through income related monthly adjustment amounts (IRMAA).

IRMAA is based on an individual's or a married couple’s modified adjusted gross income (MAGI). The adjustments are applied to Medicare Part B for medical services and prescription drug Part D plans. The “doc fix” bill changes three tiers of this income-based adjustment significantly—particularly the highest tiers.

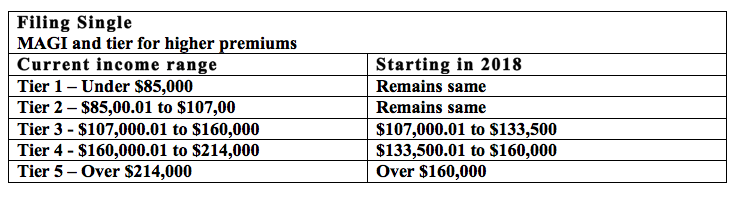

Filing Single – Income Tiers For Higher Medicare Premiums

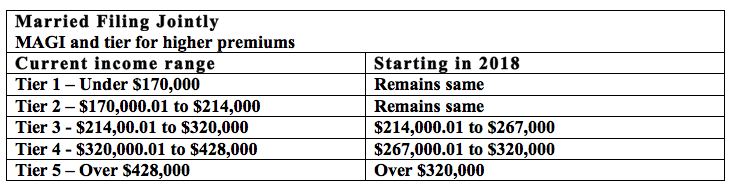

Married Filing Jointly – Income Tiers For Higher Medicare Premiums

As a result of these IRMAA changes, more Medicare beneficiaries will find themselves paying higher premiums.

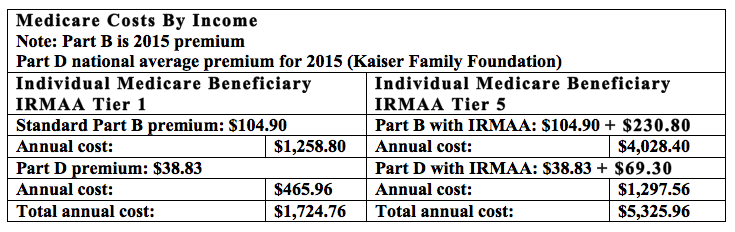

To get a sense for the impact of these costs, consider the following comparison of Medicare premiums for the lowest and highest tier beneficiaries by income based on 2015 costs:

Who falls into this group of higher-income Medicare beneficiaries? In 2015, nearly 3 million Medicare beneficiaries enrolled in Part B will pay higher premiums due to IRMAA regulations, according to the Kaiser Family Foundation.

Clearly, Medicare costs are going to increase for greater numbers of wealthier beneficiaries. When it comes to the latest changes, they only have a couple of years to prepare.

Marketplace Healthcare And Qualifying Income

While we’re on the subject of income levels and health insurance, it’s important to note the implications for the Health Insurance Marketplace. Early retirees who aren’t yet eligible for Medicare also may see some benefits to reducing their income in order to qualify for health insurance subsidies through the Obamacare marketplace.

The highest income that can qualify for subsidies is 400 percent of the federal poverty level. In a household of two people, that amount is $62,920; it's $95,400 for a family of four.

Financial advisors can work with early retirees to find methods for reducing their household income and receive subsidies amounting to hundreds or thousands of dollars a year. This can be especially valuable for retirement planning considering that some financial tools, such as traditional IRAs and health savings account deductions, are not included in the calculation of someone’s adjusted gross income through the marketplace.

Phase 1: Strategic Framework For Healthcare Planning

The first phase of integrating health-care planning with retirement begins with the big picture. Long-term variables that can affect this picture include gender, health conditions and overall life expectancy, as well as plans to relocate.

Increasingly, we’re seeing individuals and families make a move because of the availability of affordable health-care options. For example, maximum costs for prescription drug Part D plans in individual states range from about $12.60 in New Mexico to $171.90 in Florida, according to Kaiser.

Individuals’ employer-provided benefits, such as retiree health care and high-deductible health plans, also can provide cost mitigation as people age. As I explained in a previous column, some advisors are recommending HDHP and the related health savings accounts as methods for saving more money toward Medicare costs in retirement.

Additional factors include how long a spouse plans to keep working, as well as when he or she plans to take Social Security benefits. Many people are not aware that Medicare premiums are typically deducted from Social Security retirement benefits.

This strategic approach also encompasses the financial tools available to manage a client’s income and meet the income-level rules of these federal health-care programs. These tactics include coordinating income and assets among traditional and Roth IRAs, traditional and Roth 401(k) plans, some types of insurance and bond products and HDHPs and HSAs.

Fortunately, examining the potential costs of health care over the course of someone’s senior years has become a more precise process.

Phase 2: Year-To-Year Action Plan

The income-management process doesn’t end with retirement. The same is true for health-care costs and Medicare plan choice. Just like long-term financial plans require course correction, the changing nature of health-care needs creates the same dilemmas and decisions for retirees throughout their retirement.

Medicare specialists can provide critical insights in the strategic planning for Medicare use, especially with first-time enrollment—which is the most significant turning point for new beneficiaries.

Unfortunately, many people don’t take full advantage of their first-time or annual Medicare open enrollment opportunities. Too many end up spending too much and are over insured. A University of Pittsburgh study found that 95 percent of Medicare beneficiaries using prescription drug Part D coverage paid more than required, and more than 20 percent spent at least $500 a year too much.

We frequently assist individuals with their Medicare plan selections on an annual basis because so many plans experience cost increases from year to year, as well as changes to plan features and provisions.

Each year, Medicare beneficiaries gain a new opportunity to evaluate their options and detect new methods for saving money, modify their plan to accommodate a new healthcare condition or adapt to other life changes, such as relocating to be near children or grandchildren.

As federal legislation continues to change Medicare regulations, including income-related monthly adjustment amounts, financial advisors can work with Medicare specialists to track these costs and adjust both income allocation activities and Medicare plan choices.

Financial advisors can provide clients with continuity by working with a service provider that can assist clients moving from employer-based coverage to the health insurance marketplace (prior to age 65), and then to Medicare.

Yes, the health-care transition process has become more complicated. The opportunities and methods, however, are more expansive than ever before. With health-care choices like the marketplace and Medicare, it’s personal. Financial advisors appreciate this aspect of retirement planning and have the opportunity to work closely with health insurance specialists to serve their clients.

The many benefits include helping their clients to understand the impact of the Marketplace and its income-based subsidies, the value of Medicare and methods for reducing those costs and the long-term value of having a strategic and year-to-year plan for addressing healthcare in retirement. Savings on health-care costs can amount to real value that lasts well into the future.

Mary Dale Walters is senior vice president of Allsup Inc., which provides nationwide assistance for individuals and business navigating the complexities of private and public health insurance benefits before and after retirement. Financial advisors may contact (888) 220-9678 or go to FinancialAdvisor.Allsup.com for more information.