Once you decide that your client needs to supplement her income by taking distributions from an investment portfolio, you need to choose a spending policy. A spending policy is the method for determining how much can be withdrawn from the investment portfolio on an annual basis without depleting the principal too quickly.

Spending Policies

There are two kinds of spending policies: the lifestyle spending policy and the endowment spending policy. Two key decisions determine which type of spending policy will be chosen. They are:

• How much will be spent initially, and

• How will the spending amount be increased or decreased?

Lifestyle Spending Policy

A lifestyle spending policy is calculated by identifying a percentage of the portfolio that is withdrawn to cover expenses, increased by a cost of living adjustment typically measured by the Consumer Price Index (CPI). This spending policy is referred to as a “lifestyle” policy because it is intended to provide the investor with a consistent standard of living that is indexed to inflation.

The lifestyle spending policy, although attractive due to its simplicity, is flawed in two important areas.

1. This policy does not tie the spending level of the performance to the value of the underlying investment portfolio. As a result, the lifestyle policy never requires your client to slow or reduce their spending level during extended bear markets when her portfolio may decline.

2. Because the withdrawal rate is driven by the inflation rate, during periods of high inflation, spending amounts may increase too rapidly, placing the portfolio at risk of premature depletion.

To understand how a lifestyle spending policy works, it’s helpful to look at a hypothetical client’s situation. For this example, let’s assume you have a client who has a $1 million portfolio and wants to begin taking distributions of 5 percent from her portfolio on January 1, 1973. During this period of high inflation (which averaged 8.75 percent), your client’s spending amount doubled from $50,000 to $108,632 (figure 1).

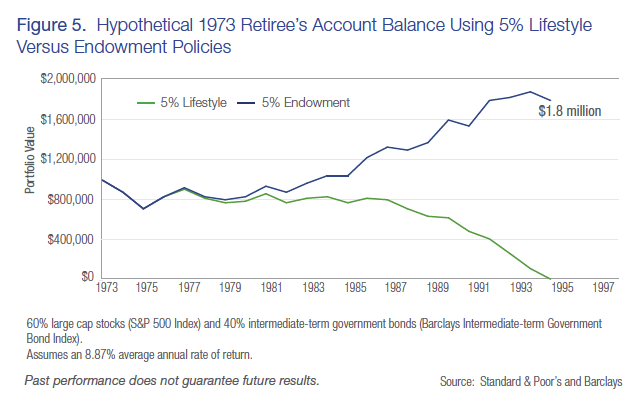

For this client, high inflation was only half the story. During this period stock prices fell dramatically as the S&P 500 declined by approximately 37 percent between 1973 and 1974. The combination of high inflation and the stock market losses caused this client’s investment portfolio to last just 21.5 years (figure 5).

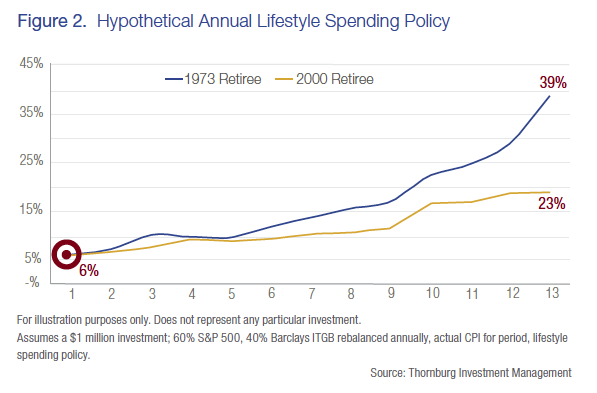

If it seems unfair to begin with the 1973 period, which was arguably one of the toughest investment periods in the last 80 years, let’s look at how the lifestyle spending approach worked during a more moderate investment environment that began in 2000. In figure 2, the blue line shows the lifestyle spending rate from 1973 to 1985, a period during which inflation rose from 6.16 percent in 1973 to a high of 13.58 percent in 1980 and then declined to 3.55 percent in 1985.

The gold line illustrates the spending rate beginning in 2000 when the rate of inflation was 2.19 percent and ending in 2013 when the rate of inflation was 2.07 percent.

As you can see, in this case, the lifestyle spending approach creates a problem because the amount being spent increases every year, because there is no relationship between the value of the underlying portfolio and the spending amount.

The client who began taking portfolio distributions in 2000 doesn’t have the same issue as the client who began taking distributions in 1973, because during the 2000s inflation was lower and grew at a much slower rate than it did during the late 1970s and early 1980s. Still, the downside of the lifestyle spending approach is underscored in figure 2 by the fact that by the end of 14 years, the withdrawals, when expressed as a percentage of the portfolio of your 1973 client, had increased to 39 percent, while the client who began taking portfolio distributions in 2000 was withdrawing 23 percent of their portfolio. Looking at the chart it is obvious that both rates are at odds with the client’s goal of building a sustainable portfolio.

So, if the lifestyle spending policy isn’t the way to go, what approach should you take to help your clients balance their cash flow needs with inflation, market fluctuation and the desire to extend the longevity of their investment portfolios? Consider an Endowment Spending Policy.

Endowment Spending Policy

An endowment spending policy is a spending policy that’s used by many colleges and university endowments. Like individual investors, endowments are interested in preserving the value of their portfolio while spending at a sustainable rate. Because endowments and individuals have similar goals, your clients can learn a great deal from this approach.

The endowment spending policy is a blended approach. Unlike the lifestyle spending policy which relies upon a flat rate that will be withdrawn every year, the endowment spending policy combines a small percentage based on the current portfolio value with the prior year’s spending. When blended together, these two values determine the next year’s spending amount.

Having a percentage of the spending tied to the performance of the portfolio increases or decreases the spending amount in tandem with the value of the investment assets. While the endowment policy is designed to lower the spending amount during bear markets, this is done on a gradual basis, thereby allowing an investor time to adjust spending and stay on plan. Like university endowments, the endowment spending policy provides a balance between funding current operations and preserving assets to cover future operations.

To establish an endowment spending policy, you and your clients must decide on two factors: what spending rate is appropriate and what smoothing rule should be applied, described as follows.

Spending Rate

The spending rate is the percentage of the portfolio value used to determine your client’s annual spending. Much has been written by academics on the subject of sustainable spending rates but today, there seems to be a consensus that a rate somewhere between 4 percent and 5 percent maintains a prudent balance between providing a consistent distribution and giving the investment portfolio the opportunity to grow.

Smoothing Rule

The smoothing rule determines how quickly to increase or decrease your client’s annual spending amounts based on the portfolio’s investment performance. Selecting a 90/10 smoothing rule assumes that 90 percent of the spending amount will be based on the prior year’s spending and the 10 percent will be based on the portfolio’s current valuation.

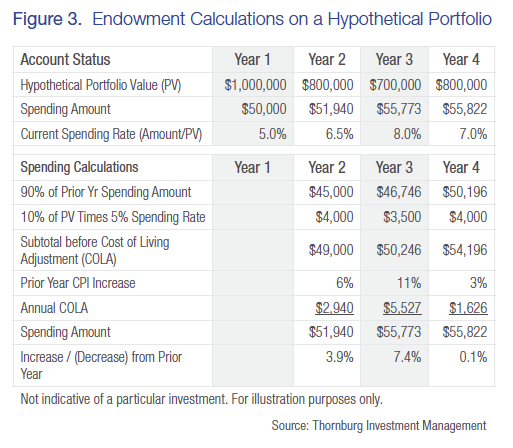

In figure 3, we are using a hypothetical four-year time frame, with high annual inflation. This determines how the endowment spending policy calculates spending, and illustrates how the policy affects the value of a hypothetical investment portfolio.

For the hypothetical we chose 5 percent as the spending rate (a $50,000 distribution from the $1 million portfolio during the first year) and a 90/10 smoothing rule. The hypothetical shows the portfolio value on January 1st of each year and the annual spending calculation.

Note how the spending amount actually increases during the two year bear market, but does not keep pace with inflation since the underlying portfolio value does not warrant it. Your client’s willingness to reduce the spending amount when the investment portfolio is not performing well is the key to having a sustainable investment portfolio. Using an endowment policy assists in maintaining a reasonable current spending amount in both bear and bull markets.

Comparing Spending Policies: Lifestyle vs. Endowment

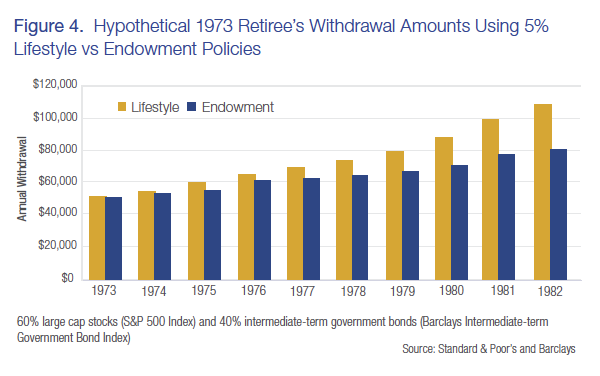

Returning to the hypothetical of the client who began taking investment portfolio distributions on January 1, 1973, it is possible to see the difference an endowment policy can make to the longevity of their retirement portfolio. Illustrated in figure 4 is a hypothetical comparing the annual spending amounts for the first ten years of portfolio distributions from both the endowment and lifestyle policies.

Note how the endowment policy reins in the spending amounts during this high inflationary bear market. In fact, over the 10-year period the spending amount was lowered by almost $102,000 in aggregate (10 percent of the initial portfolio value), allowing this amount to remain invested in the portfolio for future periods. The reduced spending amount gave the portfolio time to grow and as the assets increased in value, the investor could take advantage of improving market conditions.

The net effect of using an endowment policy for the investor who began distributions on January 1, 1973 is quite dramatic. In the hypothetical in figure 5, which compares the impact to the value of the investment portfolio using the lifestyle versus endowment policies, the lifestyle policy portfolio is exhausted in 21.5 years, while the endowment policy portfolio actually grows to $1.8 million during the same time frame.

If you choose an endowment spending policy, you and your client should expect that spending amounts may not keep pace with the cost of living unless the value of the underlying investment portfolio grows sufficiently to support the increases. At the same time, this approach gives the opportunity for two critical factors that contribute to the longevity of long-term investment portfolios: continued growth of assets and a spending policy that supports “belt tightening” during bear markets.

Jan Blakeley Holman is the director of Advisor Education at Thornburg Investment Management. Holman is responsible for identifying and creating advisor education programs that support financial advisors as they work with their clients and prospects. She is also a frequent presenter at broker-dealer and industry conferences where she discusses women and investing; women in transition; and longevity planning. She has also written numerous articles and contributed to several books on these and other financial planning topics.