Endowment Spending Policy

An endowment spending policy is a spending policy that’s used by many colleges and university endowments. Like individual investors, endowments are interested in preserving the value of their portfolio while spending at a sustainable rate. Because endowments and individuals have similar goals, your clients can learn a great deal from this approach.

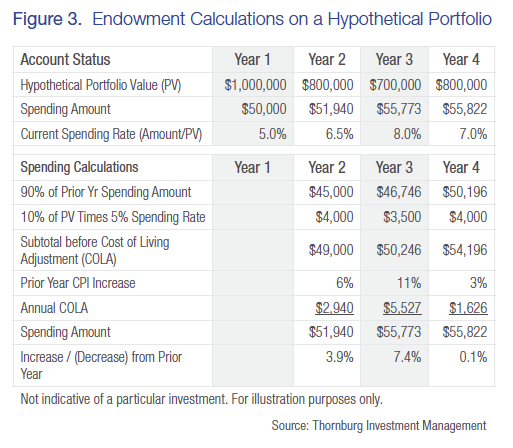

The endowment spending policy is a blended approach. Unlike the lifestyle spending policy which relies upon a flat rate that will be withdrawn every year, the endowment spending policy combines a small percentage based on the current portfolio value with the prior year’s spending. When blended together, these two values determine the next year’s spending amount.

Having a percentage of the spending tied to the performance of the portfolio increases or decreases the spending amount in tandem with the value of the investment assets. While the endowment policy is designed to lower the spending amount during bear markets, this is done on a gradual basis, thereby allowing an investor time to adjust spending and stay on plan. Like university endowments, the endowment spending policy provides a balance between funding current operations and preserving assets to cover future operations.

To establish an endowment spending policy, you and your clients must decide on two factors: what spending rate is appropriate and what smoothing rule should be applied, described as follows.

Spending Rate

The spending rate is the percentage of the portfolio value used to determine your client’s annual spending. Much has been written by academics on the subject of sustainable spending rates but today, there seems to be a consensus that a rate somewhere between 4 percent and 5 percent maintains a prudent balance between providing a consistent distribution and giving the investment portfolio the opportunity to grow.