Key Points

• The Fed appears itchy to raise rates again, but concerns about sluggish wage growth remain pervasive.

• Traditional wage growth measures in conflict with newer forms which take mix shifts into consideration.

• Apples-to-apples wage growth measures show a healthier picture.

The Federal Reserve has a dual mandate. Since the U.S. Congress amended the Federal Reserve Act in 1977, the stated monetary policy objectives of the Fed are as follows:

“The Board of Governors of the Federal Reserve System and the Federal Open Market Committee shall maintain long run growth of the monetary and credit aggregates commensurate with the economy’s long run potential to increase production, so as to promote effectively the goals of maximum employment, stable prices and moderate long-term interest rates.” This dual mandate of full employment and stable prices guides the Fed’s decision-making in conducting monetary policy.

There is a linkage between the two mandates in that wage growth and the unemployment rate tend to move inversely. Wage growth tends to slow as the unemployment rate rises, and vice versa. Yet recent trends show some kinks in this long-term relationship.

Fed hawks get vocal

With employment having improved markedly in the current expansion, and inflation beginning to accelerate, the Fed’s hawks are making more noise than the doves. Expectations for another rate hike this summer have unambiguously jumped.

One of the more frustrating aspects of the economic recovery in place since June 2009 has been the sluggish pace of wage growth. Although the unemployment rate has moved from over 10% to slightly under 5% presently, and other measures of employment show similarly healthy improvement, wages have not followed suit … or have they? Let’s dive in.

Sluggish wage growth using traditional measures

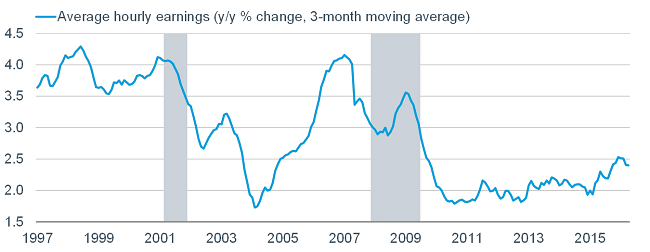

The standard and most popular measure of wages is Average Hourly Earnings (AHE), put out by the Bureau of Labor Statistics (BLS). As you can see in the chart below, wage growth has been notably sluggish since the recession ended.

Source: Department of Labor, Evercore ISI, FactSet, as of April 30, 2016. Gray-shaded areas indicate periods of recession.

Aggregate measures of wage growth, like AHE, are calculated by comparing the average wage in one time period with the average wage in a later period. As such, it includes actual wage changesamong workers who remain employed in both periods; but also reflects wage differencesbetween workers who moved in vs. those who moved out of the workforce. Given the different cyclical patterns, combining the two into a single measure can unsettle the normal and expected inverse correlation between employment and wages.

In fact, as you can see in the chart above, wage growth actually accelerated during much of the 2007-2009 recession due to the mix shift summarized above. Let’s look at that in more detail.

Telling the other side of the story

In a March 2016 Federal Reserve Board of San Francisco (FRBSF) Economic Letter, wage growth—or lack thereof—was dissected. The researchers found that changes in the composition of the workforce propped up wages during the recession from 2007 to 2009, despite a significant increase in labor market slack. Since the recession ended, this pattern has reversed. They found that cyclical components, such as the entrance of lower-wage workers to full-time jobs, have combined with secular components, specifically the exit of higher-wage retirees, and acted as a depressant on overall wage growth.

As noted above, as painful as the 2007-2009 recession was, aggregate wage measures like AHE were actually propped up by the disproportionate firing of low-wage workers. As they exited the workforce, the mix of workers keeping their jobs generally had higher-than-average skills and wages, which moderated the decline in wages. The impact was further distorted because hiring slowed so dramatically (new entrants into the workforce tend to earn lower wages).

Now we have the opposite occurring. As job growth has improved, the contribution to wage growth from continuously full-time employed workers has increased. Many workers are coming back to the workforce; while part-timers are moving to full-time jobs. The majority of these workers earn less than the typical full-time employee, so their entry pushes down the average wage.

As the FRBSF research showed, the main drag on wage growth in recent years has come from flows from part-time to full-time employment, and from not in the workforce to full-time employment. Since about 80% of workers moving from part-time to full-time do so at below-median wages, their entry pulls down median weekly earnings growth.

And then there are demographics

As Baby Boomers have been retiring in increasing numbers, the portion of workforce exits occurring from above-median wages has gotten larger, reflecting the higher earnings of older workers. And this “Silver Tsunami” will be a drag on aggregate wage growth for some time to come. The other side of that coin is Millennials entering the workforce; which given their new entrant status, are coming in, naturally, at lower wage levels.

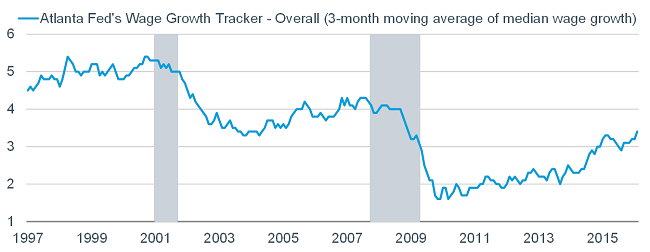

Wage growth measures which focus on the continuously full-time employed are increasingly being monitored as they likely to a better job of gauging labor market strength via wages. One such measure being increasingly cited is the Atlanta Fed’s Wage Growth Tracker. As you can see in the chart below, this measure shows a 3.4% rate of—a full percentage point above the 2.4% rate—for AHE, and a new record for this expansion.

Source: Current Population Survey, Bureau of Labor Statistics, and Federal Reserve Bank of Atlanta calculations, as of April 1, 2016. Gray-shaded areas indicate periods of recession.

In Sum

As the FRBSF research shows, sluggish wage growth may be a relatively poor indicator of labor market slack. In fact, correcting for worker composition changes, wages are consistent with a strong labor market that is drawing low-wage workers into full-time employment. It also may help to explain why the Fed appears itchier than even to raise rates again.

Sympathy For The Devil In The Details Of Wage Growth

May 23, 2016

Liz Ann Sonders is senior vice president and chief investment strategist at Charles Schwab & Co.

« Previous Article

| Next Article »

Login in order to post a comment