No. 6. Companies have no obligation to complete announced share buybacks, nor do they say when they have halted buybacks; they just stop buying shares. If asked, the standard response is that market conditions are not favorable.

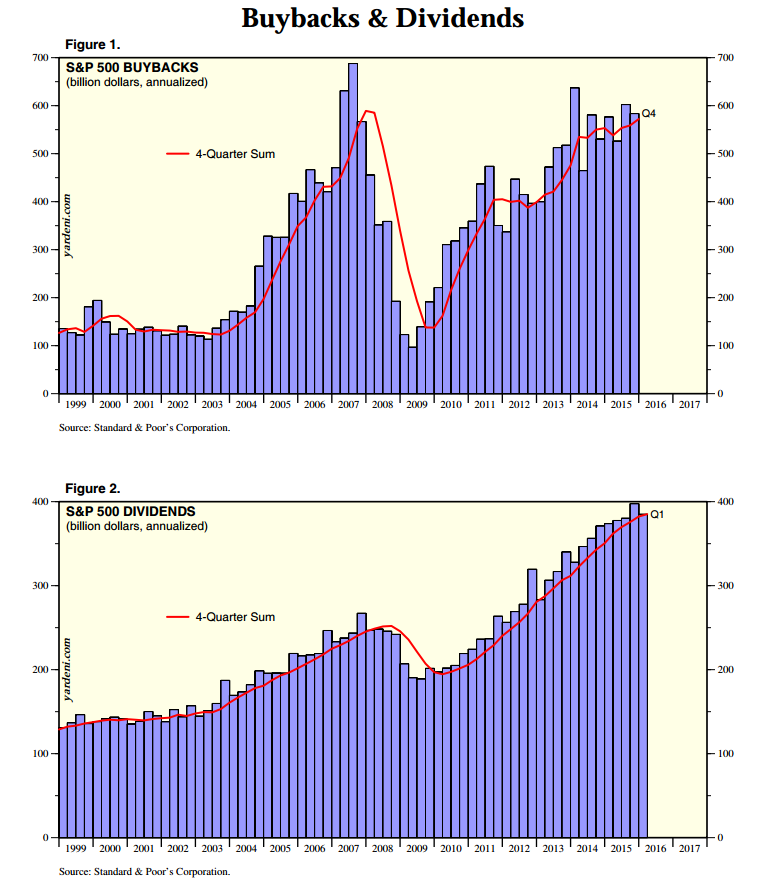

The following chart illustrates how much buybacks fell during the financial crisis compared with reductions in dividends:

As for dividends:

No. 1. Dividends are an actual real return of cash to investors.

No. 2. Companies will not lightly reduce or suspend a dividend. As Michael Masboussin of Credit Suisse wrote in 2014:

Dividends provide a strong signal about management’s commitment to distribute cash to shareholders and its confidence in the future earnings of the business. For this reason, companies are very deliberate about the decision to initiate a dividend. Executives perceive buybacks as being more flexible than dividends and as a lever that can increase earnings per share under the right conditions.

No. 3. Dividends are not typically financed with debt; most of the time they are paid for out of cash flow.

No. 4. The returns of companies that issue dividends have been beating those of companies that buy back shares during the past year, according to Liz Ann Sonders, chief investment strategist of Charles Schwab & Co.No. 5. It is true that dividends can have tax consequences, while buybacks don't.

The bottom line is that buybacks tend to be expensive, poorly timed, pro-cyclical, subject to cancellation without notice, not guaranteed and often serve to offset compensation for company insiders. Dividends represent a real return of cash to shareholders, are carefully considered, counter-cyclical and durable.

A company can't destroy value by returning cash in the form of a dividend. But it can surely waste money on a buyback. In order for a share buyback to return 100 cents on the dollar, a lot of things have to go just right.