Derek Jeter, undoubtedly soon to be a first-ballot Hall of Famer, never forgot the fundamentals. Regardless of how many records he broke, of how many World Series rings he wore, and of how successful the New York Yankees were under his captaincy, Jeter routinely practiced baseball fundamentals during every spring training. He realized that success was based on mastering basic fundamentals.

It seems as though investors have forgotten about the basic fundamentals of investing. Metaphorically, they seem to be forgetting to cover first base on a grounder to the right side of the infield, to hit the cutoff man on an outfield throw, and to never pitch to a batter’s sweet spot on an 0-and-2 pitch.

The stock market is behaving exactly as fundamentals suggest it should, but investors’ recent range of emotions suggest they have taken their eye off the ball.

Profits Fundamentals

In 1995, I wrote a book called “Style Investing – Unique Insight into Equity Management”, which demonstrated the relationship between corporate profits and style rotation. Several conclusions from the book:

1. Profits cycles, not economic cycles, drive stock markets and style rotation.

2. Investors should focus on GAAP reported earnings because that definition of earnings skews analyses in investors’ favor. Other definitions of earnings hide important information.

3. There is typically a tug-of-war between interest rates and earnings. Rising interest rates are not a death knell for the stock market unless their negative effect is stronger than the positive effect of profits. Similarly, falling rates are not necessarily a boost to the stock market if earnings are too weak.

Twenty years later, investors still seem unaware of the book’s conclusions. Investors pay much more attention to GDP than to profits. A recent New York Times article pointed out the use and pitfalls of “adjusted” earningsі. General consensus is that the current bull market must end if the Fed raises rates.

Investors apparently have not learned the importance of practicing basic fundamentals, and continue to make the same infield errors. “Score that E6 for those of you keeping score at home.”

Earnings And Interest Rates

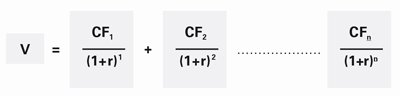

Basic finance says that there are two, and only two, variables that affect equity prices: earnings and interest rates. Consider the basic valuation formula for a stock:

Where,

V = value or price of a stock,

CF = dividends, earnings, or cash flows expected into the future,

r = interest rate used for comparison.

Consider all the variables to which investors pay attention that are not in that formula. Just to name a few, geopolitics, politics, GDP and other macroeconomic variables, and fund holdings may provide more noise and distraction than useful investment information if one doesn’t directly connect them to earnings and interest rates.

Of course, the formula incorporates a risk premium into the interest rate variable (i.e., a hurdle rate or required rate of return), but if one knew the correct risk premium for a security with certainty, then all other analyses would be superfluous because the reassessment of inaccurate risk premiums is basically what drives financial markets.